Alex Writes for……This is the best explanation I’ve heard as to what’s driving this slow drip selloff in markets. It mirrors what I’ve been hearing from the fund managers I talk with .

The following is from Kuppy’s blog Adventures In Capitalism (emphasis by Alex).

Moving to small caps; I’ve been involved in this sector for nearly two decades. I can only think of two other times where I have seen so much pain and frustration amongst my small cap friends. That would be the 2008 to 2009 period and to a lesser extent during the first few months of 2016. I am stunned at how many high-quality businesses trade for mid-single digit cash flow multiples—despite strong balance sheets. I’m even more stunned at how many slightly leveraged businesses trade at low single digit cash flow multiples. It’s outright insane how many companies trade for massive discounts to NAV. Take a look at shipping for instance—you have dozens of companies where you can liquidate the fleet and double your money based on current vessel values. This is despite the fact that charter rates are up and values are increasing. Of course, this still doesn’t quite compare to anything exposed to the energy sector. These things are being given away as dozens of energy funds liquidate and sell everything they own. You could say that some of these businesses are challenged—they aren’t all challenged. Moreover, they shouldn’t all be declining by a few percent a day—with hardly an up day.

What is going on? You are witnessing a massive culling of the hedge fund industry as hundreds of funds are liquidated and thousands more get sizable redemptions. Many of these funds own the same companies—the outcasts from the indexed world, the cheap, the unloved; the same stocks that many other hedge fund managers own. With the hedge fund industry going in reverse, there is suddenly no natural buyer for what must be sold. As a result, you are seeing waves of forced sell orders and few buyers. It is creating rather insane bargains all around.

Like all trends, this one too will end. If your fund is facing a year-end redemption, you need cash in hand by December 31 and you probably finish selling a few days before then. Therefore, at most, there’s 9 ½ days left to make sales. It may get even uglier—it may not. No one knows how to time this. What I suspect, is that the pain will finally abate in two weeks. Or at least the forced selling pain will be done. If you look at Q4, despite only a small drop in the S&P, it has been one of the most painful that my friends or I can remember. There are lots of guys down 20% to 30% this quarter and suddenly forced to de-lever further, to get their risk ratios in order. This sort of pain and indiscriminate selling creates lots of opportunities.

Hedge funds have been getting slaughtered this year. The back and forth chop of the market has essentially taken a sickle to the bloated money management space. This is a good thing for us active traders and was kind of inevitable. There’s just too many money managers all crowding into the same damn trades.

Anyways, this hedge fund killing field, as Loeb put it, is driving end of year redemptions which means forced selling of positions. The Russell small-cap index is now down -27% on the year, with many good individual names I track down 40, 50, 60%+.

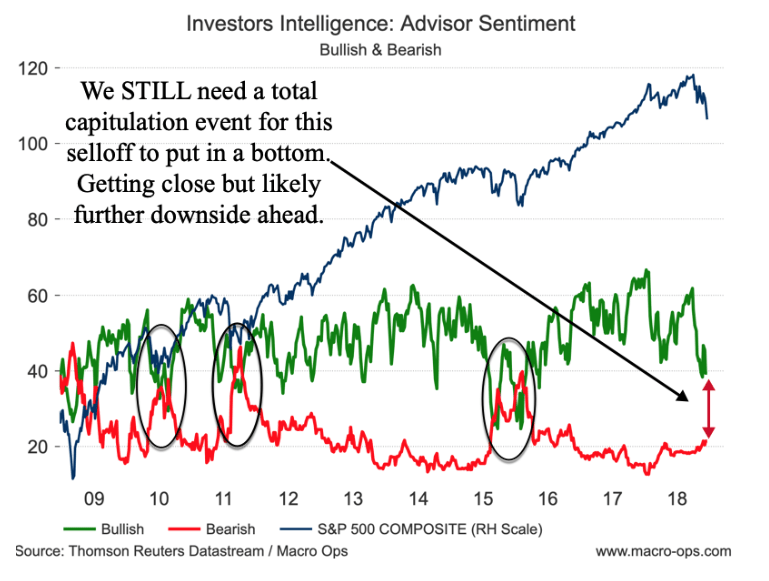

Anytime there is forced selling in the market, opportunities are created. This time is no different. I expect this grinding persistent selloff to abate sometime in the next week or two, as it looks like we’re seeing that total sentiment capitulation event that we’ve been waiting on.

Sentiment is nearing outright ridiculous levels…

The equity risk premium (difference in earnings yield versus treasury yields) via Sentiment Trader is now 4 standard deviations below average. This is extreme…

According to SentimentTrader when the ERP Z-score is below -2, the annualized return shot up to 40.1%.

According to the latest BofAML Fund Manager’s Survey, money managers continue to hold large amounts of cash. This is NOT something you see at the top.

And then here’s how every quarter performed following a 10%+ down quarter post-WWII via Bespoke Investments.

The market is setting up for a MAJOR buying opportunity. There’s likely a bit more pain ahead in the short-term but I think a bottom is near. Our puts in NVDA, BABA, TSLA, as well as our DAX short and long bond / long VIX position is hedging us well. We’ll look to take profits on a number of these trades in the week(s) ahead.

Read Full Post

https://macro-ops.com/a-special-announcement-and-market-update/