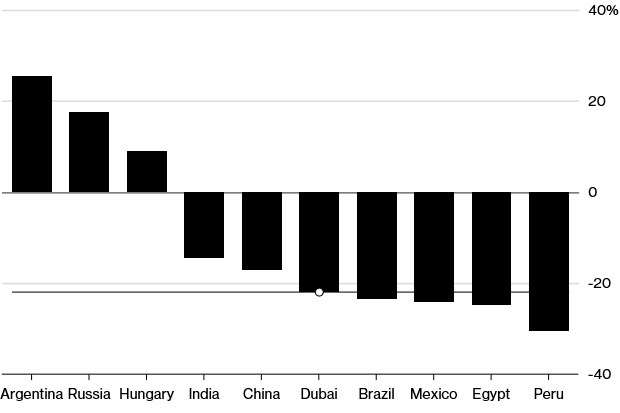

Profit expectations are unraveling. India, perhaps the biggest emerging-market favorite of global money managers, is missing earnings projections by almost 15 percent. China, the world’s second-biggest economy, is trailing by 17 percent. Six other markets including South Korea and Mexico are falling short by more than 20 percent.

There are handful of outperformers, but they’re countries where analysts typically give cautious projections, such as Russia and Argentina, because a seemingly endless stream of trouble makes predicting earnings difficult.

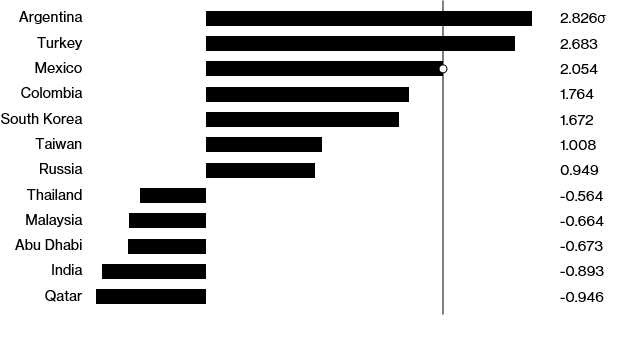

Among 30 emerging markets, 16 trade at a standard deviation above the 10-year mean. In other words, companies are earning more profit for each dollar of their share price. Returns from Argentina are almost three standard deviations above normal, the best value-for-money across the emerging world. India stands at Bottom

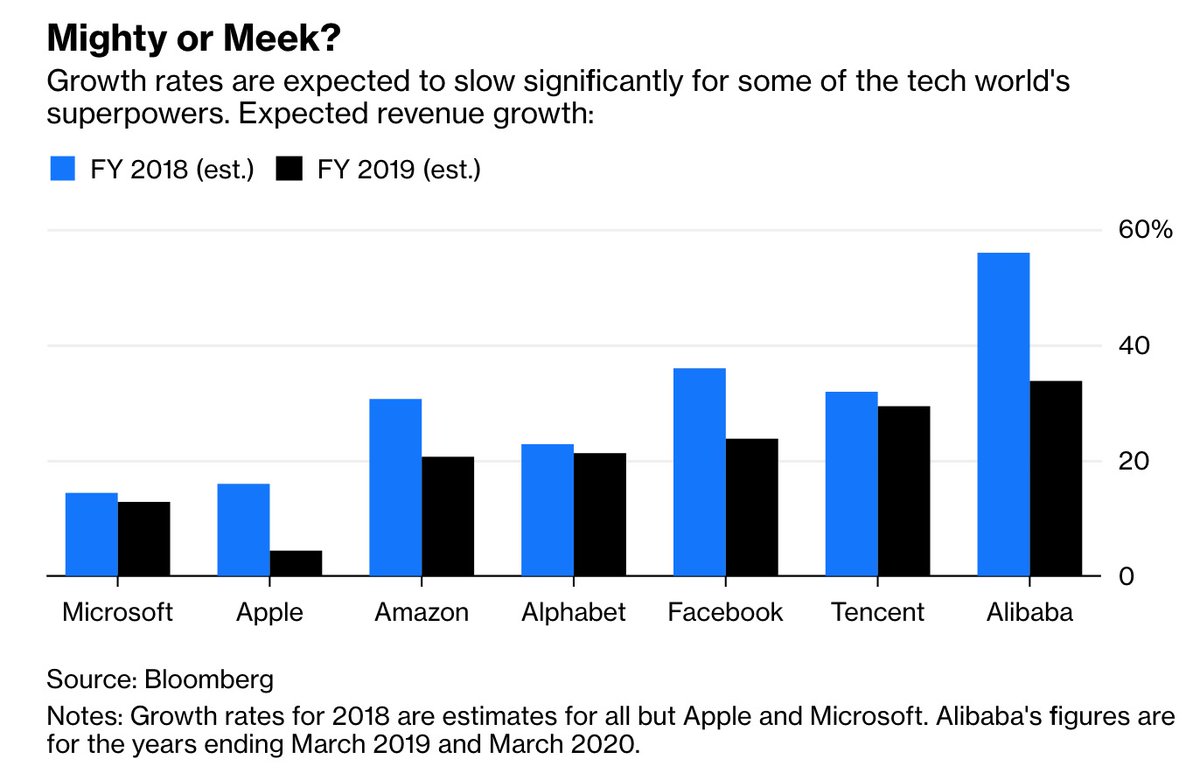

Growth rates are expected to slow significantly for some of the tech world’s superpowers. Disillusionment and promise in a whirlwind year.

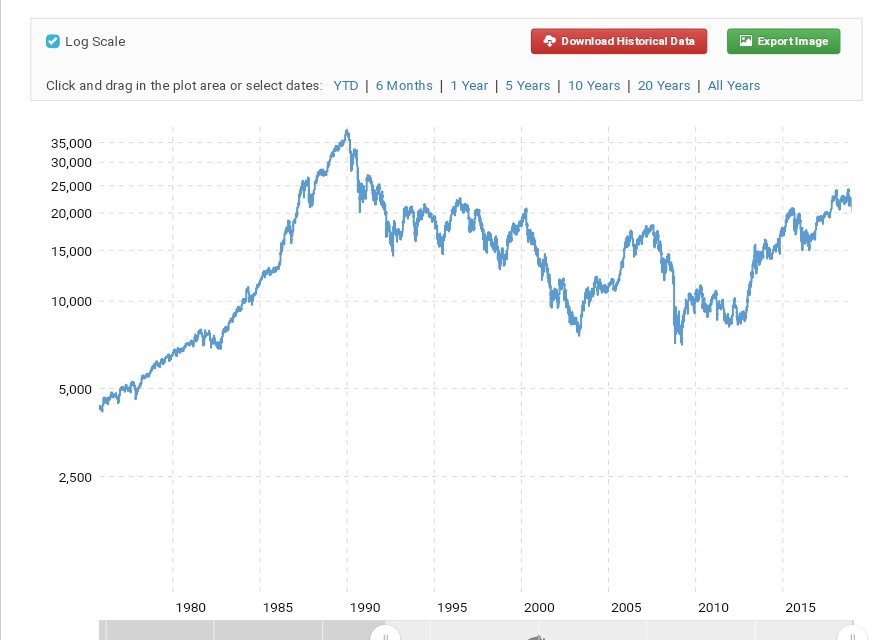

Time In Market More Important Than Timing The Market…..ask Japanese investors

The Japanese Index (Nikkei 225) chart is terrifying.This is 50 years. It’s been 30 years since a new high.

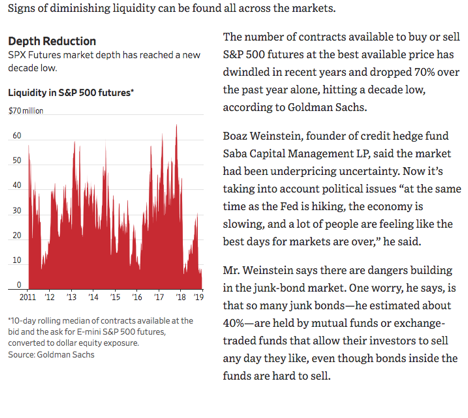

The impact cost is going up and if you are in large AUM funds then it you, investor who is paying for it.