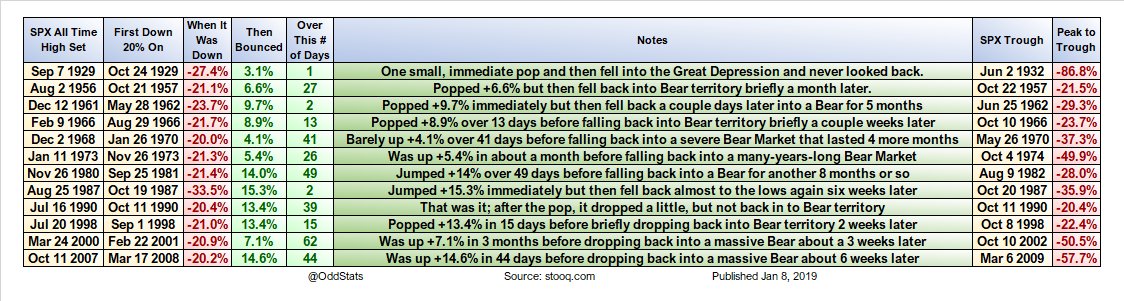

Here is every prior Bear Market in SPX history (-20% drop from a unique All Time High) with dates/notes on the initial bounce after first entering Bear territory and then what it did next. The NOTES column is the most important.

Goldman writes….Equity prices have tracked negative earnings revisions, but earnings season will represent an important litmus test for the near-term path of the S&P 500. FY2 EPS revisions sentiment, defined as the number of positive EPS revisions less the number of negative EPS as a share of total revisions, has slipped into negative territory. The path of S&P 500 returns has generally tracked this revision sentiment. Earnings revisions briefly stabilized at the end of 2018, but AAPL’s guidance set in motion further negative revisions, with sentiment declining from –14% to –23% in the past week. With no nascent signs of slowing negative revisions, the strength of 4Q results and management commentary around the outlook for 2019 will take on heightened importance for whether earnings estimates (and returns) stabilize in the near term.

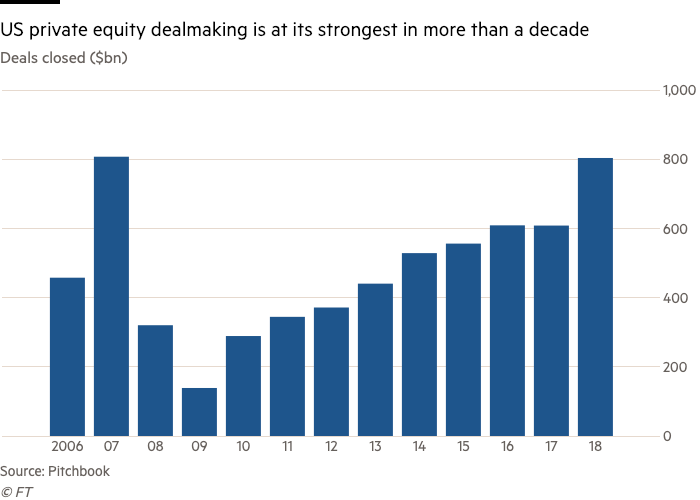

Private equity dealmaking in America last year reached the highest level since 2007, with investors buying $800bn of companies and a record proportion of deals involving richer-than-usual valuations.More than three-fifths of the transactions were struck at a purchase price that was at least 10 times higher than the acquired company’s annual profits, according to an analysis by data provider Pitchbook. That was the highest rate on record, showing that dealmakers showed increasing appetite for expensive acquisitions even in a year when stock market valuations fell sharply.

The relationship between currency and assets is key. This is what Powell referred to when he said that the level of assets “would depend really on the public’s appetite for our liabilities, specifically currency.”

And so, he said, the balance sheet “will be substantially smaller than it is now,” but given the surge in currency in circulation, it will be “nowhere near what it was before.”

At the demand rate for currency over the past 10 years, there will be about $2.2 trillion of currency in circulation in 5 years. That means that the balance sheet, if it is going to be just 10% larger than currency (see the chart) in circulation, would need to be near $2.4 trillion in order for the old pre-QE relationship to be re-established. This means, the Fed would have to shed an additional $1.6 trillion in assets over the next five years.