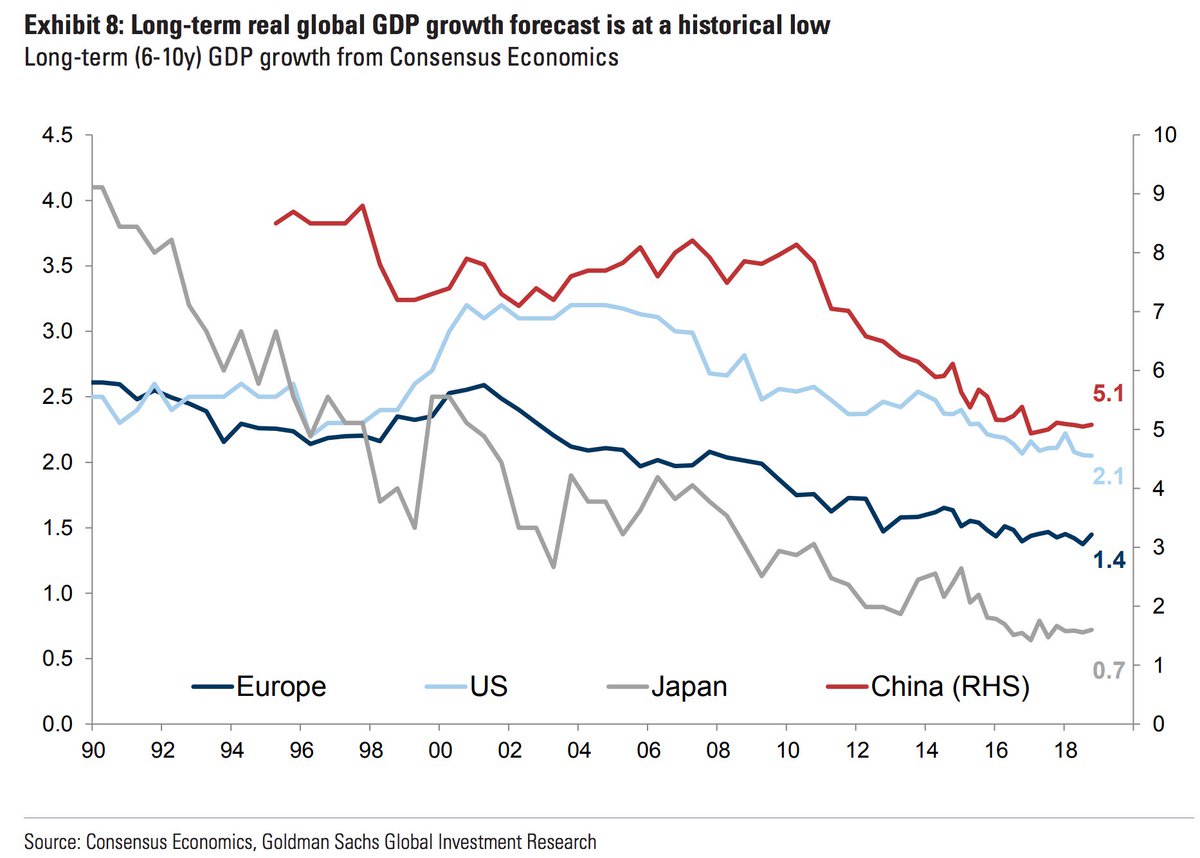

Long-term real global GDP growth forecast is at a historical low despite the move towards zero interest rates, the large expansion of central banks’ balance sheets and the substantial fiscal expansion in the US, Goldman shows. Trend growth has been slowing everywhere since GFC.

China’s biggest weakness is its dependence on semiconductor imports, primarily from US companies. China manufactures only 16% of the semiconductors it uses locally. Last year, the country spent $260 billion on chip imports, a value exceeding its oil imports. By interfering in the supply of semiconductors, America could choke China’s technological ambitions. Given that China will rely on US technology imports for the foreseeable future, Beijing may have little choice but to play by US rules in 2019. The corollary is political risks are diminishing rather than intensifying, as is widely perceived. Nearly half of economists surveyed by The Wall Street Journal said they viewed the US dispute with China as the biggest risk this year.(Stray Reflections)

The global fiscal impulse, which measures how much governments’ fiscal policy adds to or subtracts from overall economic growth, is set to turn even more positive this year. Fiscal deficits in four of the world’s biggest economies—the US, Europe, Japan and the UK—will rise to 3% of GDP in 2019, from 2.8% last year. The IMF expects the US fiscal impulse to reach almost 1% this year. Investors are making a huge mistake in their forward-looking evaluations by focusing exclusively on monetary policy. Central banks do not matter as much now that fiscal policy is taking over.

The foundations on which the shale boom was built is coming undone: cheap money, lower costs, rising productivity, and risk appetite. All-inclusive break-evens are about $51 in the Permian, $57 in the Eagle Ford and $64 in the Bakken. Oil prices at current levels will therefore start to drag on business investment in the coming year. Three aggressive independent Permian upstream operators have cut capital budgets by at least 12% to 15%. Shareholders are pushing companies to conservative capital spending plans and focus on free cash flow generation. The rig count is no longer increasing. There are signs oil productivity is also peaking as drillers have burned through their best assets. If the increase in shale oil production this year is more tepid than what many people are predicting, oil prices will move higher. Almost all other forms of oil supply have declined over the past few years. We see a drawdown in global oil inventories in 2019.(Stray Reflections)

Electronics exports from Singapore – the global hub of fabrication – plunge 15.9%, worst in 5 years. This is not just China – global trade has fallen off a cliff