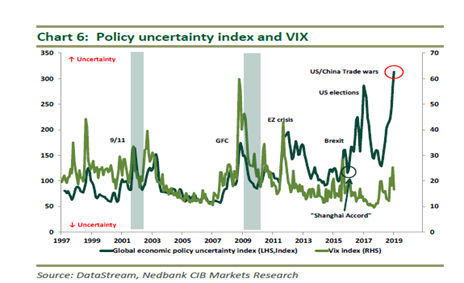

When crisis hits you, you learn a lesson, lesson everyone makes sure you never forget. They get written down in history and teach you forever. When it comes to financial crisis, from Tulip Bulb craze to The Great Depression to 1987 crash to 1997 Asian crisis to 2007-08 Financial crisis, all events taught us a moral & financial lesson and prepared us for the next crisis. With top risk management practices in place for corporates, they diligently manage the firm and social responsibilities. But what if the next crisis is not the result of irrationality of mob or fraud by corporates but by the Government itself consciously (or it seems so).

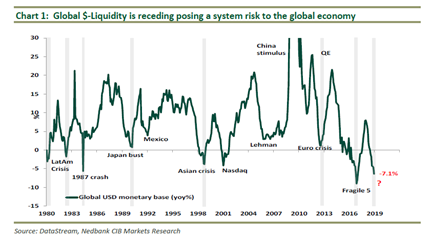

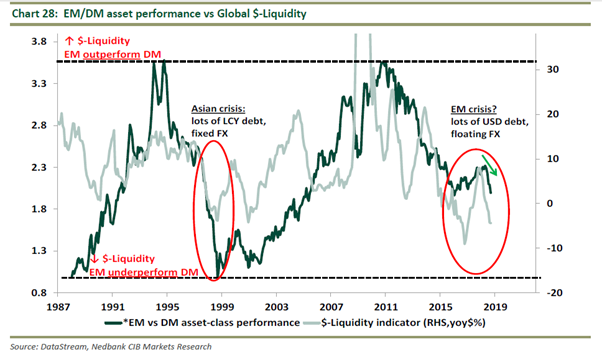

Such has happened recently when Fed hiked the rates and reduced its Balance Sheet in chorus knowing the beats would resonate and destabilize the global economy. Both actions of Federal Reserve in combination sucked up the global US Dollar liquidity.

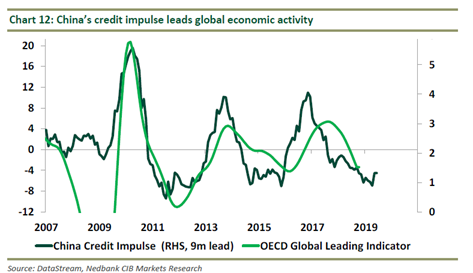

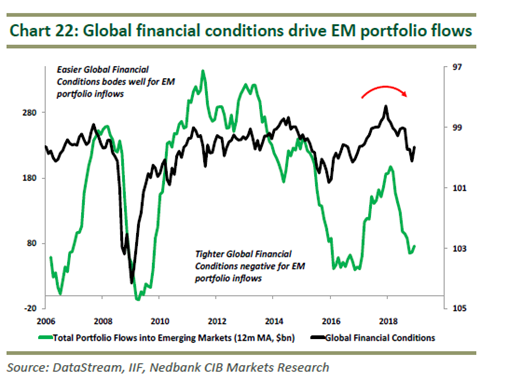

With US – China trade war, the dollar became strong, their exports were less attractive but again did Fed’s policies had a direct impact on liquidity? China being the significant contributor to credit growth, growth in China’s economy leads to growth in global trade. With growing global trade and 90% settlement in USD, there is excess supply of USD in system, which eased financial condition globally causing weaker USD. Thus, Fed’s policies might not be the only driver of global liquidity. The global trade wars are a potential source and risk factor affecting global liquidity negatively.

Chinese bank’s foreign exchange sales have been steadily increasing showing a considerable amount of outflows from country. Despite this, strangely their currency reserves remain stable!

Emerging market equities were 20 – 30% lower from February to October, credit markets (bonds) didn’t fare much either. Along with this, the tariffs placed by US government on manufacturing turned things slow. After all, over $60T of global GDP is outside US.

The impact on market sentiment is much larger than meets the eye. When liquidity is being removed, investors sell assets and avoid buying risk assets during weeks when Fed is actively reducing size.

JP Morgan Strategy Research, 17th January, 2019.

Where does this leaves us then? Are the charts which were developed to prevent crisis indicating that one is anyway near us and this time the fault isn’t of institutions and of the mass but of ‘You – Know – Who’ and this wrecking ball is hitting everyone.

Good point! Lesser trade is resulting in lesser creation of US$.