World’s most famous investor had one of his worst years ever in 2018. Buffett’s Kraft Heinz bet dragged down Berkshire Hathaway in 2018: Conglomerate swung to a $25.4bn loss in Q4 due to an unexpected write-down at Heinz & unrealized investment losses. He also said

“Prices are sky-high for businesses possessing decent long-term prospects,”

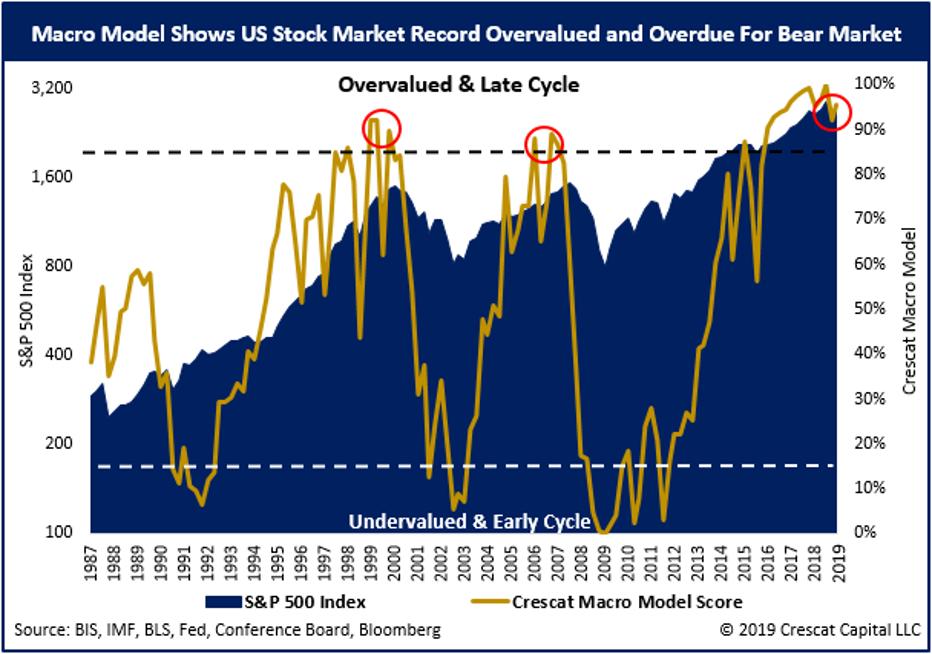

Crescat Capital ( one of the best performing hedge funds of 2018 with a return of 45%) is tactically positioned to capitalize on a downturn in the global economic cycle. Most investors remain oblivious to valuation facts as well as the coincident business cycle timing signals they outlined in the link below: https://www.crescat.net/wp-content/uploads/Bear-Market-Rally-Sets-Up-Opportunity-For-Crescat-Strategies.pdf … …

If stock investors are celebrating the Jerome-the-Hawk to Jay-the-Dove conversion, while ignoring the deteriorating economic backdrop, they are likely falling into a trap much as they did in late 2007 and early 2008.’ https://blog.evergreengavekal.com/bubble-3-0-no-way-out/ …

QE3 and QE2 will likely both be rolled back, but QE1 will never be rolled back. The “new normal” of Feds balance sheet in Nordea FX weekly -> https://ndea.mk/2EaE4w2