Emerging Market spreads are inversely proportional to the US Dollar and recession causes strong US Dollar, not the other way around. These are two basic notions in economics and these two possess the capability of creating a havoc. These notions are driven by many factors which causes skewness in the upside or downside depending on risk taking capability of the investors and this gives central banks globally a huge responsibility to make decisions not only to advance the country domestically but also to analyse how the decision may affect other economies. In today’s scenario, who holds all the cards? US? China?

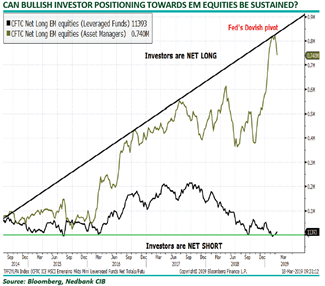

Fed was hawkish in 2018, Europe which is still weak, US Tariffs & US – China trade war sucked global dollar liquidity and already fragile economies went pale. A strong dollar causes damage to external economies, people lose their purchasing power and most affected by are emerging markets. When balance sheet reductions paused, Fed also became dovish, trade war silenced, this change in stance made room for dollar to weaken. A weak dollar saw inflows in EM economies and the stocks rallied. Investors became cautiously bullish in their net positions and have already priced in ‘no change’ decision of Fed in 19-20 March meeting leading to stability in the markets for now.

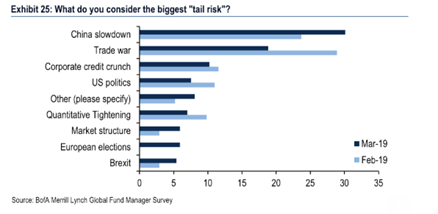

Fed has no option but to shift from being hawkish as higher interest rates causes tight financial conditions and global economic weakness. Hiking further would not only bleed the world but US too. US is currently locked in with China’s economy and inch away from the double edged sword with all the cards which they once held shifting into Chinese hands. In rear view, China seems to be driving the decisions of Fed. A weak dollar makes a strong Yuan, a strong Yuan makes not only Chinese economy healthy but all the neighbouring and emerging market economies. A world where USD and Yuan move together have never existed, the world reap benefits from their negative correlation. Even though China is currently witnessing a slowdown, forex is always to the rescue with Chinese realising gains from strengthening Yuan and falling inflation, boost from imports from its trading partners and also leading a way for Trump in 2020 election. This economic cycle would play in his favour and to extend the cycle, a pause in rate hike, pause in balance sheet reductions is the only way in for him.

There is a downside to this analysis which could cause some investors to remain net short. The point of difference between 2016 rate hike and 2018 rate hike is that in 2016 global central banks were not in tightening mode like Fed but in 2018, Fed when turned dovish, global central banks were also softening. This tandem movement of Fed and central banks have kept emerging markets in a fragile state if not crumbling and the yields provided by short term US treasuries are still more attractive and stable. This fear is keeping some investors from take a long position and they rather prefer holding on to existing portfolio.

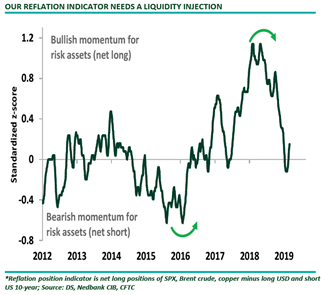

Technical analysis shows us that a golden cross is emerging and higher growth is expected if the economic situation remains unchanged. Equities and commodities like copper and oil are pricing in the positive effect of China stimulus and pressure on commodities caused by rate hikes is lifting. Copper which is seen as an indicator of global growth is moving opposite to 10 year treasury yield.

In late 2018, under pressure from Trump administration and to prevent further domestic slowdown, China implemented tax cuts to increase consumption, reduced the rate of required reserves for lenders to encourage borrowing and stimulated fiscal multiplier to boost demand which along with weaker USD led to strengthening of Yuan and rally in demand dependent commodities. China in effect is navigating this ‘reflation trade’. A weak Yuan hurts US manufacturing sector so to stretch out economic cycle for 2020 election in US, Trump would not mind a weak USD for stronger Yuan out of China which will recover global growth and reverse inflation expectations. China’s (almost) healthy economy keeps all the neighbouring economies in shape and any poking in China destabilize other Asian and EM economies. So, who holds all the cards? Xi Jinping?

(with inputs from Apra Sharma)