Quoting Vaughan and Finch from The Fix, “LIBOR has confirmed people’s worst suspicions about financial system: That behind closed doors, shrouded in complexity and protected by weak and complicit regulators, armies of bankers are gleefully spending their days screwing us over.”

Zombanakis barely expected that their arrangement for first ever syndicated loan would become ‘World’s most important number’. Journey of evolution of LIBOR was no less than a miracle. From 1969, birth of concept by Zombanakis, to 1986 its adoption by British Bankers’ Association, to 1997 when CME accepted LIBOR for Eurodollar futures, LIBOR was finally at par with the brains of conniving traders who added fuel (manipulation of LIBOR) to fire (already distressed financial system in 2007).

Jessie Romero wrote that “At least 11 financial institutions faced fines and criminal charges from multiple international agencies, including CFTC and the Justice Department in US. Separately, in 2014 the FDIC sued 16 global banks for manipulating LIBOR, alleging their actions had caused “substantial losses” for nearly 40 banks that went bankrupt during financial crisis.”

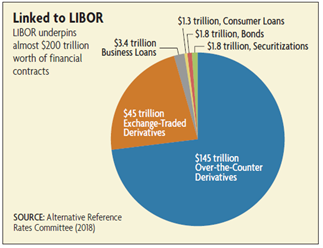

In view of this, FSB issued a report in 2013 stating the criteria an effective reference rate should meet: it should minimize the opportunity for market manipulation, it should be anchored in observable transactions wherever feasible and that it should command confidence that it will remain resilient in times of financial distress. In order to restore market confidence, Federal Reserve Bank of New York recently made public the three reference rates in consideration for succession in US: Secured Overnight Financing Rate (SOFR), Tri – Party General Collateral Rate (TGCR) and Broad General Collateral Rate (BGCR). The most adopted has been SOFR, CME launched SOFR futures in May 2018 and the clearing house LCH cleared the first SOFR swaps in July. Banks are required to submit the rates at the beginning of the day, as the scandal unfolded, market for LIBOR became thinner, most banks today chip in rates only when they are urged by UK’s FCA. In 2021, they would not be forced and most expect it to be the end of LIBOR. However, it may not be completely eradicated as currently reported $200 trillion worth of financial contracts are referenced to USD LIBOR. In April 2018 report, BlackRock estimates total gross notional USD LIBOR exposure of $35.8 trillion in 2021, $15.90 trillion in 2025 and $8.00 trillion beyond 2030. Without adequate fallback provisions in the contracts, washing away LIBOR is not possible.

The presence of active underlying market threatens LIBOR’s sustainability and transition to SOFR in US may not be visibly smooth. Amy Poster writes, “SOFR reflects an overnight risk free rate based on secured transactions, with Treasuries as collateral in contrast to LIBOR which provides a term rate with different tenors on an unsecured basis. LIBOR has largely been a proxy for banks’ cost of funds. This difference limits SOFR as a benchmark for unsecured term transactions with longer tenors that carry higher borrowing costs. To resolve this difference, market participants have called for a dynamic credit spread to be incorporated into SOFR”. ARRC also warned, “Permanent cessation without viable fallback language in contracts would cause considerable disruption to financial markets and would also impair the normal functioning of a variety of markets, including business and consumer lending.”

In USD chosen benchmark is SOFR and in UK Sterling overnight Financing Rate (SONIA). Bloomberg stated that, “U.K. homeowners have more than 5.1 billion pounds of mortgages that reference LIBOR and as of March 2018, $1.2 trillion of U.S. retail mortgages are estimated to be tied to LIBOR.”

With increasing market hesitation to get roped in with LIBOR and search of alternatives, provided a platform for SOFR to grow but ultimately it would boil down to how much liquidity SOFR could provide and rate of acceptance of SOFR derivatives.

(with inputs from Apra Sharma)