There is nothing that a human mind can’t conceive. It can shoot for the stars or dive in the ocean which twinkles in the shadows of stars and ascend back with sparkling mind bearing uncanny ambition only to float contended.

Today, we live in fear of losing wealth, we worry what economic consequences would do to our cash, we look through a microscope and scrutinize every word, every policy, every regulation or find something to put above ‘every’ and list out the glaring negatives with a slight trace of approval. If only one could notice the lens of the microscope, would then one could tell reel and real apart.

Such is the case of negative interest rates. It is dealt differently by different flock of loaded individuals, generally in ways which would not only prevent losses but essentially gain cash. This flock stands on one side of the transaction contemplating means to win regardless of the loss that still deliberating other doomed flock endures. Well, this is how the world works. It is a Bernoulli trial. But there exists a splash of humble wit folks floating beneath the starry sky delighted by the victory of each one and beaten down none.

Theory? Without thinking too much, negative rates indicate that the economy is unable to generate sufficient income to service its debt. Almost always, all roads leads us back to debt sustainability levels. In order for an economic system to reduce debt, it requires growth or inflation or currency devaluation. For an economic system to exercise one of the two (growth not included), capital transfer is to be facilitated. This capital movement in negative rates environment is from the savers to the borrowers. Your invested value, the money you gave to borrowers would have a value lower than the face value. Barbaric! Savers should be the winners not the borrowers!

So each flock as per their liking would act in a way that makes them the gaining side. In real world scenario, one flock could be investors who when yields falls even deeper into negative territory scoop a profit through capital gain. Flock of foreign investors may try to earn through currency appreciation. Another flock would focus on real rates even though they are negative as that would preserve their capital under deflationary conditions when nominal yields would decrease their capital. Who would want that!

Investopedia gave an example, “In 2014, the European Central Bank (ECB) instituted a negative interest rate that only applied to bank deposits intended to prevent the Eurozone from falling into a deflationary spiral.”

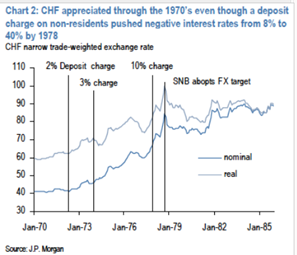

Let’s recall a real practical example. The case of Switzerland. Paul Meggyesi of JP Morgan said, “The defacto negative interest rate regime lasted until October 1973. The negative interest rate was re-introduced in November 1973 at 3% per quarter and then increased to 10% per quarter in February 1978. All though this period capital inflows were being sustained by the global monetary turmoil/inflation that characterized the first years of floating exchange rates, not to mention the SNB’s singular focus on promoting monetary and price stability through money supply targeting. Ultimately the SNB abandoned these purely technical attempts to curb capital inflows and embraced a much more effective policy of currency debasement, namely it abandoned money supply targeting in favor of an explicit exchange rate target that required huge amounts of unsterilized intervention, money supply expansion and ultimately inflation. (Suffice to say this policy lasted only until 1982, when the Swiss realized that inflation was too high a price to pay for a weak currency).”

He continued “Negative interest rates will only deter capital inflows if they are sufficiently large to offset the capital gain an investor expects to earn through capital appreciation. CHF rose by 8% in nominal and real terms in 1972-1973. Appreciation in 1973 – 1978 was 62% in nominal and 29% in real terms.”

In fact, during global financial crisis many central banks reduced their policy interest rates to zero. A decade later, today, still many countries are recovering and have kept interest rates low. Severe recessions in the past have required 3 – 6 percent point cuts in interest rates to revive the economy. If any crisis were to happen today, only a few countries could respond to the monetary policy. For countries with already prevailing low or negative interest rates, this would be a catastrophe.

Today, around $10 trillion of bonds are trading at negative yields mainly in Europe and Japan as per Bloomberg.

Poisons have antidotes, and sometimes one need to gulp down the poison to witness the mystique surrounding the life and glide with accidental possibilities, the possibilities which one wouldn’t seek if they remain wary of novel minted cure.

Here enters a splash of humble wit folks! They want a win – win. So these folks came up with an idea, an idea with legal and operational complication but they have swamped themselves with research to find ways to not stumble in future and yes they do have a long way to go but we have a start. These folks are our very adored IMF Staff.!

They are exploring an option that would help central banks make ‘deeply negative interest rates’ feasible option.

Excerpt from their article ‘Cashing In: How to make Negative Interest Rates Work’:

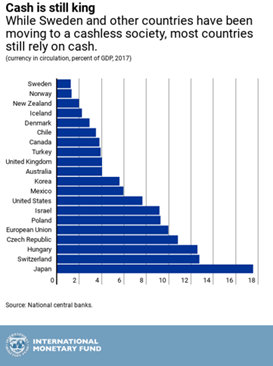

“In a cashless world, there would be no lower bound on interest rates. A central bank could reduce the policy rate from, say, 2 percent to minus 4 percent to counter a severe recession. When cash is available, however, cutting rates significantly into negative territory becomes impossible.”

“…Cash has the same purchasing power as bank deposits, but at zero nominal interest. Moreover, it can be obtained in unlimited quantities in exchange for bank money. Therefore, instead of paying negative interest, one can simply hold cash at zero interest. Cash is a free option on zero interest, and acts as an interest rate floor.

Because of this floor, central banks have resorted to unconventional monetary policy measures. The euro area, Switzerland, Denmark, Sweden, and other economies have allowed interest rates to go slightly below zero, which has been possible because taking out cash in large quantities is inconvenient and costly (for example, storage and insurance fees). These policies have helped boost demand, but they cannot fully make up for lost policy space when interest rates are very low.”

“… in a recent IMF staff study and previous research, we examine a proposal for central banks to make cash as costly as bank deposits with negative interest rates, thereby making deeply negative interest rates feasible while preserving the role of cash.

The proposal is for a central bank to divide the monetary base into two separate local currencies—cash and electronic money (e-money).

E-money would be issued only electronically and would pay the policy rate of interest, and cash would have an exchange rate—the conversion rate—against e-money. This conversion rate is key to the proposal. When setting a negative interest rate on e-money, the central bank would let the conversion rate of cash in terms of e-money depreciate at the same rate as the negative interest rate on e-money. The value of cash would thereby fall in terms of e-money.

To illustrate, suppose your bank announced a negative 3 percent interest rate on your bank deposit of 100 dollars today. Suppose also that the central bank announced that cash-dollars would now become a separate currency that would depreciate against e-dollars by 3 percent per year. The conversion rate of cash-dollars into e-dollars would hence change from 1 to 0.97 over the year. After a year, there would be 97 e-dollars left in your bank account. If you instead took out 100 cash-dollars today and kept it safe at home for a year, exchanging it into e-money after that year would also yield 97 e-dollars.

At the same time, shops would start advertising prices in e-money and cash separately, just as shops in some small open economies already advertise prices both in domestic and in bordering foreign currencies. Cash would thereby be losing value both in terms of goods and in terms of e-money, and there would be no benefit to holding cash relative to bank deposits. This dual local currency system would allow the central bank to implement as negative an interest rate as necessary for countering a recession, without triggering any large-scale substitutions into cash.”

Negative rates are coming whether we like it or not. There is only so much growth we can get in steady state among rising debt levels. The only hurdle to implementing negative rates is currency in circulation and that’s why more and more countries are trying to outlaw cash. Interesting and profitable times ahead for those who understand the brave new world

( with inputs from Apra Sharma)

Obviously you are aware that the C.B. is the market you want to sterilize the individual with E-money and nirp while rewarding the debt maker banks.Without cash there is no freedom.Your article should be how to destroy freedoms.We will not consent!!