By Apra Sharma

From January 1927 to December 2018, U.S. value stocks have posted an annualized return of 12.6% vs 9.9% for U.S. growth, according to research from Gernstein Fisher.

Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management commented, slowing global growth and declining earnings estimates are precisely the reason to steer clear of growth stocks. No one would be spared during this slowdown, making these darlings particularly vulnerable, she says.

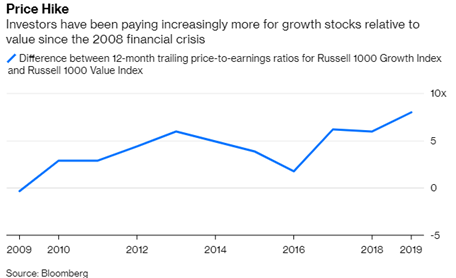

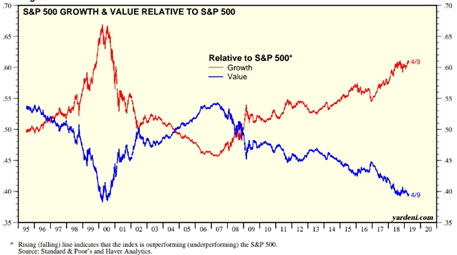

You see where this is going. Investors have had little trouble choosing between highflying technology companies and boring banks over the last decade. As a result, the growth index is now more expensive than the value index by the widest margin since the dot-com era, as measured by 12-month trailing price-to-earnings ratios.

The investment price calibre may not change over a long span but risk characteristics of its stock depends on what happens to it in stock market. The more enthusiastic public grows, faster it advances as compared with actual growth in earnings, the riskier proposition it becomes.

Ritesh Jain said, “Growth has outperformed value for last few years and the valuation difference is becoming extreme. Investors should add more value oriented stocks to their portfolio.”

Notice that successful fund managers keep a blend of growth and value stocks in their portfolio. Pure Growth is proven to give negative returns in financial crisis and that’s when value outperformed.

As Burton Malkiel says, “The key to investing is not how much an industry will affect society or even how much it will grow, but rather its ability to make and sustain profits.” South sea bubble, Tulip bulb craze or Great Depression are shouting at us but we are busy enjoying speculative gains.

He continues, “An investor who simply buys and holds a broad based portfolio of stocks can make reasonably generous returns. What is hard to avoid is the alluring temptation to throw your money away on short, get – rich – quick speculative binges. It was irrational speculative enthusiasm that drove the prices of these funds far above the value at which their individual security holdings could be purchased.”

In South Sea Bubble, the verse by eight of spades applies to every bubble that punctured thereon:

“A rare invention to destroy the crowd,

Of fools at home instead of foes abroad:

Fear not my friends, this terrible machine,

They’re only wounded that have shares therein.”

It applies aptly even to tulip bulb craze, Great Depression, conglomerate boom of sixties, dot com bubble, U.S. Housing bubble and crash in early 2000s.

In 1959, “growth” companies IBM and Texas Instruments were selling at price earnings multiple of more than 80. A year later they were sold at 20s and 30s. Investors research on the basis of Firm Foundations Theory but they buy on the basis of Castle in the Air theory. And soon yesterday’s hot issue becomes today’s cold turkey. The urge to get on the bandwagon even in high growth industries produced a profitless prosperity for investors.

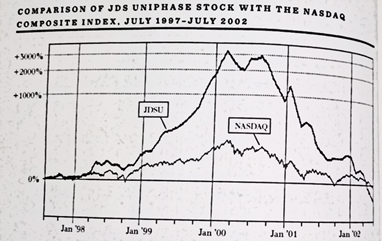

The growth stocks in the High Tech bubble such as Cisco and JDS Uniphase, the backbone of internet, lost 90 percent of its market value when the bubble burst and the “forecasted growth” never happened. JDS Uniphase, see for yourself!

JDS Uniphase from a high of 297.34 in year 2000 fell 99.5% to 2.24 during 2001-02! Amazon.com had a 98.7% decline from 75.25 in ’00 to 5.51 during 2001-02!

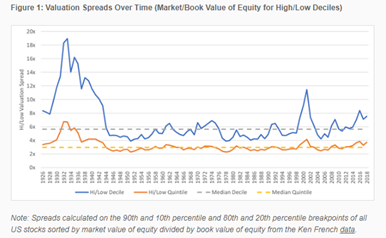

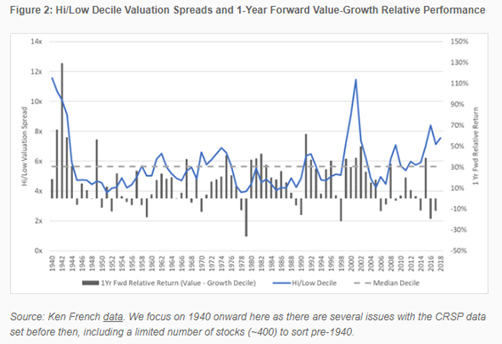

“The lesson” as Malkiel puts, “is not that markets occasionally can be irrational and we should therefore abandon the firm foundation theory of pricing financial assets. Rather, the market corrects itself. The market eventually corrects any irrationality – albeit in its own slow, inexorable fashion. Anomalies can crop up, markets can be irrationally optimistic and often they attract unwary investors. But eventually, true value is recognized by the market. Over the last decade, valuation spread have gone from being below their historical median to being the highest in U.S. market history. The most expensive stocks in the market have traded around 5.6x the valuation multiple of the least expensive stocks in the markets over long periods.

The valuation spread between the cheapest and most expensive stocks in Russell 1000 index hit its widest point in about 20 years, says Nomura Instinet.

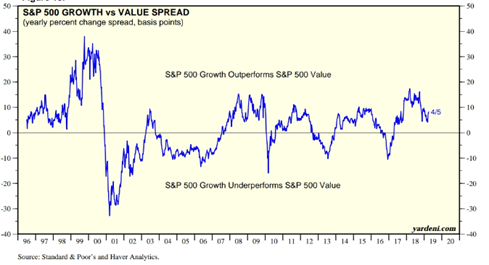

After beating growth for the first time in two years in the fourth quarter, value stocks have dropped back again in 2019, rising about 10 percent versus their counterparts’ almost 13 percent rally, indexes compiled by Russell show.

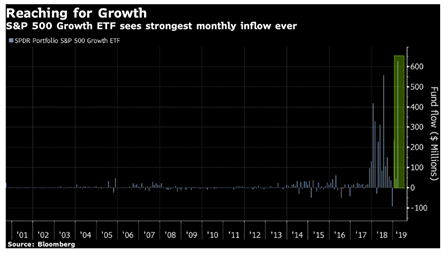

The $4.54 billion SPDR Portfolio 500 Growth ETF, ticker SPYG, took in nearly $630 million in March — the largest monthly inflow on record for the almost 19-year-old fund. That happened as the S&P 500 Index rounded out its strongest start to a year since 1998, with SPYG outperforming its value counterpart by more than two percentage points.

This quarter, growth stocks outperformed value stocks by a margin of 4% globally. Over the past decade, large cap growth funds tracked by Morningstar have returned 15.6% a year on average vs. 13.2% for large cap value funds.

The question remains, is this outperformance the result of superior returns from growth stocks because they have incredible business or a wish to not settle for lower safer returns from value investing. When the hottest stock which is reported to grow tremendously become the new ‘tulip bulb’ craze is inevitable. Those desirable companies are sold at higher price-earnings multiple and investors become wilfully blind to the fundamentals and buy those stocks at higher prices. Had they taken a moment and looked at the numbers, the rapid buying makes a stock overpriced and stocks are bought at higher prices from investors expecting increase in growth forever and a slight turbulence sends their portfolio value spiralling down.

A fast growing industry doesn’t imply companies in the industry will be fast growing. One should pick up industries whose potential is untapped and growth of multiples will gradually increase. Consistent growth not only increase earnings and dividends but also multiples. If a company has reached saturation, multiples will fall and the investor who entered during its peak phase will have a double whammy of not only losing out earnings but also see the multiples falling. It is therefore necessary to value a company no matter when you are entering, if you have luck on your side and you made an investment with low price earning multiple evaluating growth in coming years, then you will have double benefits of owning a stock at lower multiple when it currently would be trading at higher multiple and enjoy higher earnings.

An intelligent investor gets interest in growth stock not only when it is unpopular but also when something goes wrong. In July 2002, Johnson and Johnson announced that Federal regulators were investigating accusations of false record keeping at one of the drug factories, and the stock lost 16% in a single day. That took J & J’s share price down from 24 times the previous 12 months’ earnings to just 20 times. At that lower level, Johnson & Johnson might once again have become a growth stock with room to grow-making it an example of what Graham calls “the relatively unpopular large company”. This kind of temporary unpopularity can create lasting wealthy enabling you to buy a great company at a good price. Johnson and Johnson is one company that is present in both growth stocks and value stocks list of S&P500.

For a fundamentalist, primary goal is to derive what the stock is worth. They are immune to optimism and pessimism of the crowd and makes a sharp distinction between the current stock price and its true value.

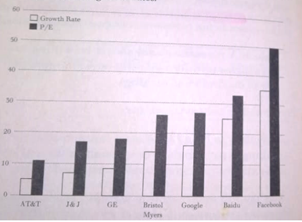

A question arises here, “Are actual price earnings multiples higher for stocks for which a high growth rate is anticipated?” A study by John Cragg gives us the answer, yes.

The actual growth rate has been lower than the pumped up P/E ratio. Growth rates are general rather than gospel truths. An investor should be willing to pay a higher price for a share not for larger growth rate of dividends and earnings but for a share longer extraordinary growth rate is expected to last.

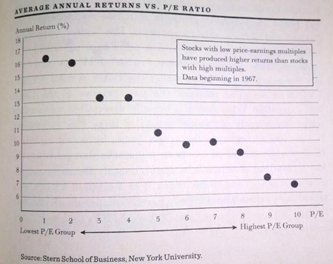

In 1934, Benjamin Graham, David L. Dodd and Warren Buffet emphasized on finding value by finding low P/E ratio and low price to book value. Value should be based on current realities rather than projections of future growth. Value always wins. Some select their stocks by looking for companies with good growth prospects which are untapped by market and sell at relatively low earnings multiple. This is called GARP (Growth at reasonable price). A portfolio of stocks with low earnings multiple produces above average rates of return even after risk adjustment. (Beta is not a reliable risk measure as Fama and French study shows, the relationship between return and beta is flat. You could rely on conclusions you draw from Porter’s Five Forces Model).

But do note here that companies with some degree of financial distress also sell at low earnings multiple and low prices relative to book value. In 2009, Citigroup and Bank of America were at prices below their book values when speculation was that government would take over and shareholder equity would be wiped out. The striking thing about growth stocks as a class is their tendency towards wide swings in market prices. At some point, growth curve flattens out and in many cases it turns downward.

The current economic expansion will be the longest on record in a few months, and yet growth has easily beaten value during the period. The Russell 1000 Growth Index has outpaced the Russell 1000 Value Index by 3.14 percentage points a year since July 2009 through March, including dividends.

U.S. growth stocks have been among the best performers over the last decade. The Russell 1000 Growth Index beat the Russell 1000 Value Index by 2.8 percentage points a year through February.

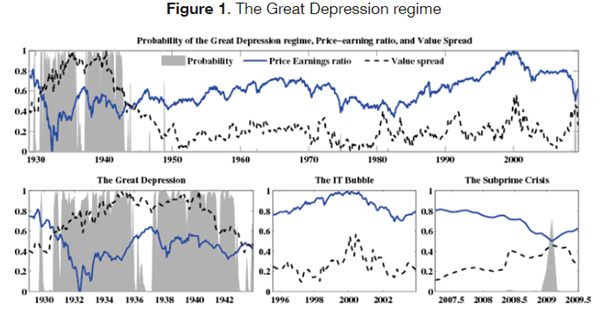

Over the last decade, valuation spread have gone from being below their historical median to being the highest in U.S. market history. The most expensive stocks in the market have traded around 5.6x the valuation multiple of the least expensive stocks in the markets over long periods.

In 2018, valuation spreads between growth and value stocks were 7.6x according to Fama – French data. This is 34% above the historical median of 5.6x since 1926 and 47% above the median since 1940. In 2019, the spreads are about widest they have been since the Great Depression and dot com bubble.

The price of a stock is directly related to a company’s earning potential. Whether a company is smallcap, midcap or largecap is a secondary consideration, the focus should be on the company, its business, financial health and scope for growth. As Benjamin Graham said, “If you buy a stock purely because its price has been going up instead of asking whether the underlying company’s value is increasing, then sooner or later you will be extremely sorry.”

Investors almost always ends up giving more weightage to growth and relate it to company’s earning potential. They take for granted that the company and its business will thrive and give them handsome returns. Many investment Gurus emphasize on importance of the evaluation of business, knowing the story of the company, yet many analyse their pickings through growth forecasts. One classic Buffet proverb should serve them as a reminder, “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”