Kripa Mahalingan writes “

“Playtime is up for asset management companies, who have been designing imaginative schemes, as SEBI steps in with new regulations. Now it is time for fund managers to colour within the lines “

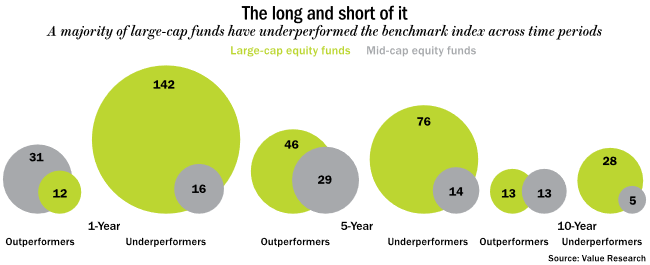

Outlook money presents us with the following chart:

Indian Portfolio managers will obviously want to defend their turf but the advancement is technology has taken away the asymmetry in information and democratized the information which is slowly getting priced at or moving quickly to ZERO.

This is quite evident in the performance of actively managed large cap funds where underperformance percentage in both short term and long term is quite stark.

Even among midcaps funds,almost 30% of funds are not beating the benchmarks over 5 year period and most of the this underperformance has come about due to change in regulations and narrowness of this rally during last three years.

This is no different than US where 5 stocks have contributed to 30% of S&P returns over last 3 years.

Investing environment

The world is slowly moving towards oligopoly and this market concentration among few players is also leading to concentration in market share and profitability. This is quite evident in US and as Jonathan Tepper writes in The Myth of Capitalism “tells the story of how America has gone from an open, competitive marketplace to an economy where a few very powerful companies dominate key industries that affect our daily lives. Digital monopolies like Google, Facebook and Amazon act as gatekeepers to the digital world. Amazon is capturing almost all online shopping dollars. We have the illusion of choice, but for most critical decisions, we have only one or two companies, when it comes to high speed Internet, health insurance, medical care, mortgage title insurance, social networks, Internet searches, or even consumer goods like toothpaste. Every day, the average American transfers a little of their pay check to monopolists and oligopolists”.

India is also following the same path of capitalism and it would be reasonable to assume this will lead to profit and market concentration. This environment of ” WINNERS TAKE ALL ” requires a paradigm shift in thinking by fund managers if they hope to beat the benchmarks. The other headache is Value vs Growth with growth outperforming value for so long that most active fund managers have become growth fund managers and do not hesitate to justify the overvalued growth stocks.

I think a combination of market concentration and growth investing mentality is going to make life tough (and not easy) for most active fund managers and although nobody can predict the future, I will hazard a guess that active portfolio managers underperformance is going to get more stark in this brave new world of oligopolies and tricky economic environment.