By Jeffrey Snider

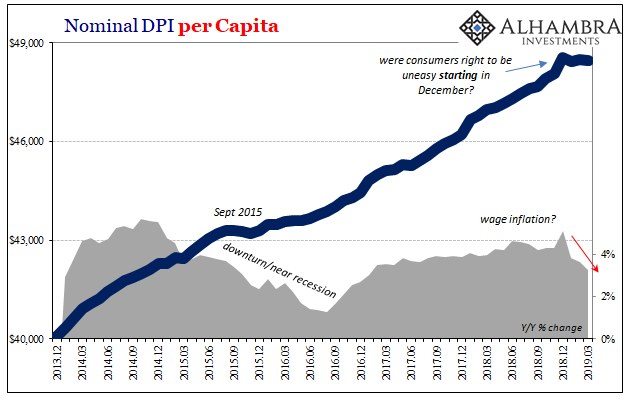

Ever since the first major outbreaks of Euro$ #4 last year, the balance of data has tipped further and further toward the minuses. Yesterday was a big one. US income growth in 2019 is no longer growth. Not huge declines, but minus signs where, if the prior boom narrative had been valid, large plus signs should rule unchallenged.

The business cycle used to be relatively easy and intuitive. A recession shows up, the economy quickly, violently plunges, and then just as fast back to normal. The whole thing wrapped up in a year, maybe a year and a half for the nastier ones. It isn’t fun, but everyone knows the score.

What we’ve witnessed since Euro$ #1, what people still call the Great “Recession”, is an elongation of not business but these monetary cycles and what they do to the global economy. There had always been a transition period before, these today are now almost phases unto themselves. Extended periods of economic gray.

Canada provides us with another good example. Today, that country’s government reports GDP in February 2019 was just slightly less than it was in January. According to StatCan, real output declined 0.1%. By itself, no big deal. Certainly not outright recession.

The rate was +0.3% growth in GDP during January. But there were also minus signs in three of the prior four months. February makes four negatives out of the last six. Definitely not boom, maybe not recession though perhaps an elongated transition toward one. Very much gray.

Read More