By Apra Sharma

“Every brand, typically on the premium side, has to justify its value to the customer every day. As soon as you’re not the big brand, you’re a niche player”, says Jim Weber who runs Brooks Sports (Bloomberg).

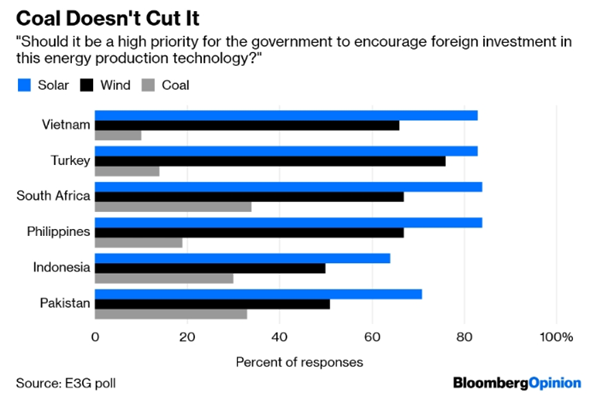

As per Nat Bullard, “As per study by E3G, polled citizens of the above countries voted for increased foreign investment in renewable energy followed by fossil fuels. Public views investment in solar and wind energy as high priority compared to coal. In economic terms, coal fared poorly w.r.t countries in the survey as coal trails far behind wind and solar energy in terms of being good for the economy. Since the beginning of the year, four Asian banks have announced restrictions on financing new coal plants. Don’t ask leaders or lenders about coal’s future. Ask the people.”

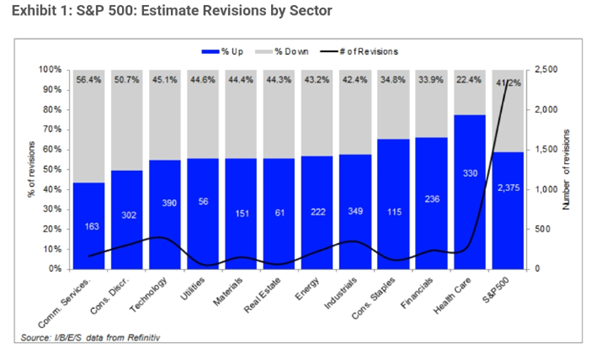

“The energy sector has the lowest earnings growth rate (-26.2%) of any sector. It is expected to earn $11.3B in 19Q1, compared to earnings of $15.3B in 18Q1. The oil & gas refining & marketing (-57.4%) and integrated oil & gas (-38.1%) sub – industries have the lowest earnings growth in this sector.”

“Nine of 11 sectors anticipate revenue growth for the quarter with energy sector having the weakest anticipated growth compared to 18Q1. The energy sector has the lowest revenue growth rate (-0.8%) of any sector. It is expected to earn $238.0B in 19Q1, compared to revenue of $240.0B in 18Q1.” (Lipper Alpha Insight)

As per Investopedia, energy infrastructure is a relatively under followed sub – sector of the broader energy sector. Here is one opportunity if you wish to diversify your portfolio as buy and sell levels are in well-defined range.

In this regard, as renewable energy is becoming more affordable, wind energy stocks, solar energy stocks are placed to give enormous returns in coming years.

Hindustan Unilever (HUVR) has been trading at 60x earnings multiple. As per Sanjiv Mehta, Chairman and MD, HUL on Bloomberg, “You must accept that FMCG sector is recession resistant but not recession proof. At the end of the day, it depends on money in the hands of consumers.”

When consumer stocks were trading at 35 times their earnings, S Naren, executive director and chief investment officer at ICICI Prudential Asset Management Company, considered them expensive. But the valuations rose to 50-60 times. Interest-rate arbitrage helped consumer stocks in 2008 and the valuations are so expensive now that there could be a time correction, Naren said on BQ Edge, BloombergQuint’s on-ground initiative. There is no clarity that the products made by consumer goods companies can be replaced because the pace of change is lower in this sector, he said.

S Naren adds, “When you have zero percent interest rates and you know that in India soap, toothpaste and detergent demand will go up then it is very easy to bet that this will grow, and you are getting funding at zero percent. So, you are getting money at zero percent and you are investing in Indian consumer stocks, you are taking zero percent money to invest in something which will surely grow.

If you look at power as a sector, do I see in any country’s electricity being replaced then the answer is no. For the last 10 years, there has been no returns in most of the power stocks.” But “in the last 10 years, the demand has gone up 50 percent.”

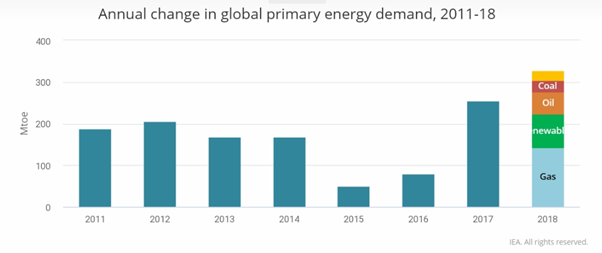

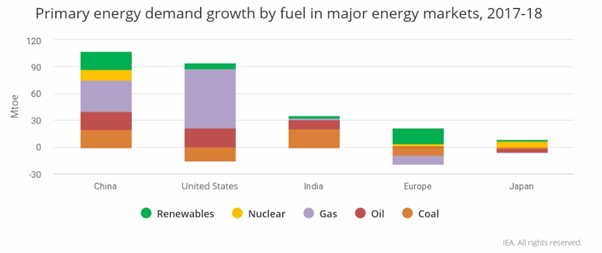

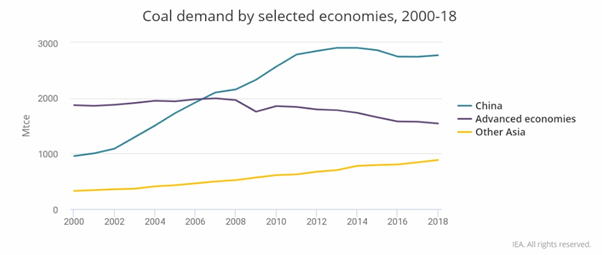

As per IEA, global energy consumption in 2018 increased at nearly twice the average rate of growth since 2010, driven by a robust global economy and higher heating and cooling needs in some parts of the world. Demand for all fuels increased, led by natural gas, even solar and wind posted double digit growth. High electricity demand was responsible for over half of the growth in energy needs.

The demand for all fuels rose, with fossil fuels meeting nearly 70% of the growth for the second year running. Renewables grew at double digit pace, but still not fast enough to meet the increase in demand for electricity around the world, as per IEA.

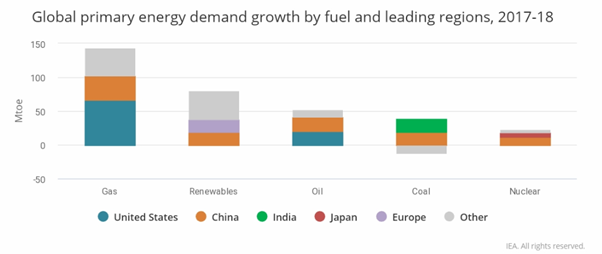

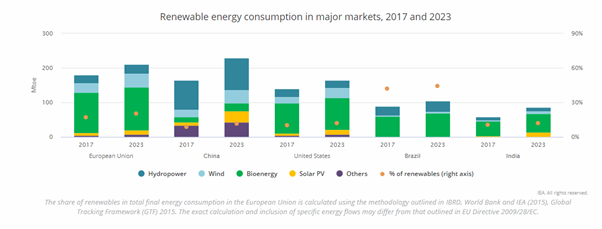

Quoting them further, higher energy demand was propelled by a global economy that expanded by 3.7% in 2018, a higher pace than the average annual growth of 3.5% seen since 2010. China, United States and India together accounted for nearly 70% of the rise in energy demand.

Inputs to the power sector accounted for 95% of China’s growth in energy demand, as generation from all technologies, especially coal, expanded to meet an 8.5% jump in demand for electricity. In 2018, China also had the world’s largest increase in solar and wind generation.

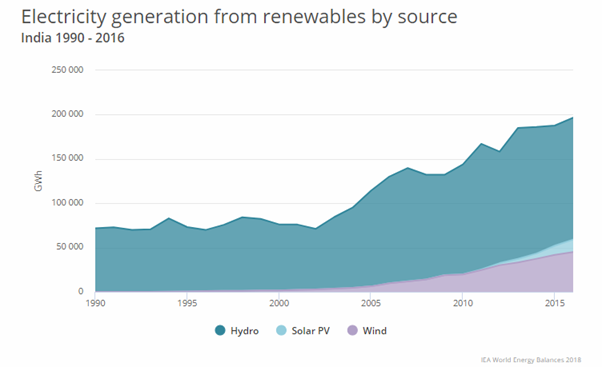

India saw primary energy demand increase 4% or over 35Mtoe, accounting for 11% of global growth, the third largest share. Growth in India was led by coal (for power generation) and oil (for transportation), the first and second biggest contributors to energy demand growth, respectively.

India’s 7% economic growth, the highest among large economies, created strong demand for coal, especially for electricity generation and steel production as India surpassed Japan to become world’s second largest steel producer behind China. New solar and wind capacity met less than a third of the growth in electricity demand, while coal supplied the bulk of additional electricity generation. As a result, coal demand in India grew by around 5%, as per IEA.

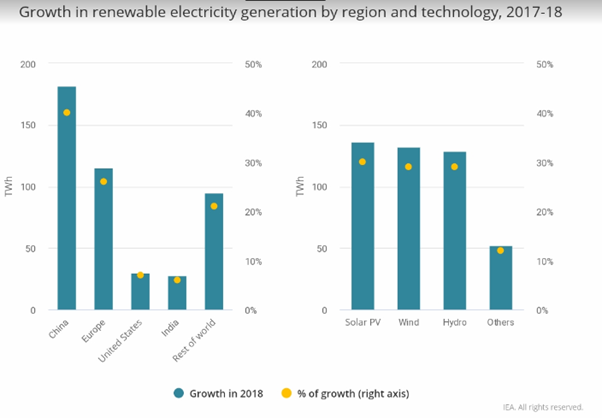

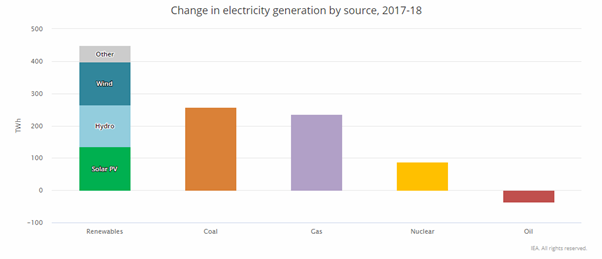

Renewables increased 4% in 2018, the power sector led the growth with renewables based electricity generation increasing by 7% compared to 6% average annual growth rate since 2010. Solar, PV, hydropower and wind each accounted for about a third of the growth with bioenergy accounting for majority of the rest. Together, renewables were responsible for almost 45% of the world’s increase in electricity generation. They account for almost 25% of global power output, second after coal, as per IEA.

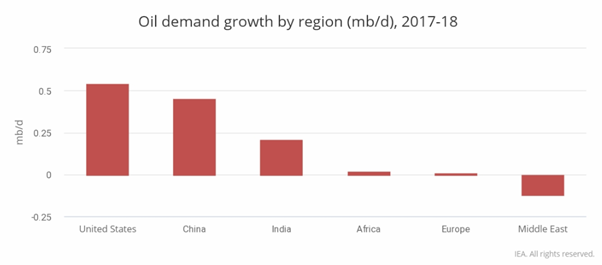

Global oil demand growth slowed down in 2018 as higher oil prices partially offset robust economic activity around the world. Indian oil demand grew 5% in 2018 compared to 2017, a year when demand was lower due to implementation of GST and demonetisation. However, the sharp increase in oil prices in 2018, amplified by currency deterioration, contributed to slowing growth in second half of the year. Rapid industrialisation and fast pace of growth in vehicle fleets have caused severe air quality problems and policies are being put in place to try to tackle the problem, as per IEA.

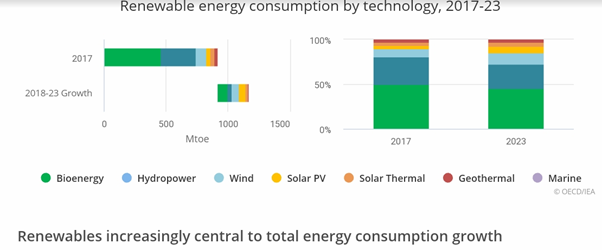

The share of renewables in meeting global energy demand is expected to grow by one-fifth in the next five years to reach 12.4% in 2023. Renewables will have the fastest growth in the electricity sector, providing almost 30% of power demand in 2023, up from 24% in 2017. During this period, renewables are forecast to meet more than 70% of global electricity generation growth, led by solar PV and followed by wind, hydropower, and bioenergy. Hydropower remains the largest renewable source, meeting 16% of global electricity demand by 2023, followed by wind (6%), solar PV (4%), and bioenergy (3%), as per IEA.

Solar PV alone represents half of the additional growth in the accelerated case forecast. Driven by faster cost reductions that make the technology more competitive globally, annual additions are expected to reach 140 GW by 2023. Commercial, residential, and off-grid PV applications together account for most of the extra growth, which indicates untapped potential in these segments, especially in China, India, Europe and Latin America.

As per IEA, renewables and nuclear power met a majority of the increase in power demand.

India’s power demand increased by around 65 TWh, or 5.4%, a slower rate than the previous year. The increase was driven by higher demand in buildings, especially coming from air conditioning, as well as higher access to electricity. Last year, India completed the electrification of all its villages, with electricity connections extended to around 30 million people in the last 2 years, as per IEA.

However, this expansion is not all rosy.

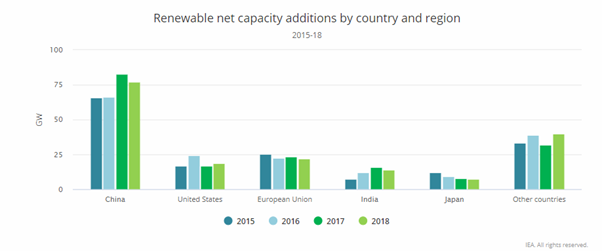

As per IEA, After nearly two decades of strong annual growth, renewables around the world added as much net capacity in 2018 as they did in 2017, an unexpected flattening of growth trends that raises concerns about meeting long-term climate goals.

Last year was the first time since 2001 that growth in renewable power capacity failed to increase year on year. New net capacity from solar PV, wind, hydro, bioenergy, and other renewable power sources increased by about 180 Gigawatts (GW) in 2018, the same as the previous year, according to the International Energy Agency’s latest data.

“The world cannot afford to press “pause” on the expansion of renewables and governments need to act quickly to correct this situation and enable a faster flow of new projects,” said Dr Fatih Birol, the IEA’s Executive Director. “Thanks to rapidly declining costs, the competitiveness of renewables is no longer heavily tied to financial incentives. What they mainly need are stable policies supported by a long-term vision but also a focus on integrating renewables into power systems in a cost-effective and optimal way. Stop-and-go policies are particularly harmful to markets and jobs.”

Since 2015, global solar PV’s exponential growth had been compensating for slower increases in wind and hydropower. But solar PV’s growth flattened in 2018. The main reason was a sudden change in China’s solar PV incentives to curb costs and address grid integration challenges to achieve more sustainable PV expansion. Moreover, lower wind additions in the European Union and India also contributed to stalling renewable capacity growth in 2018, as per IEA.

“These 2018 data are deeply worrying, but smart and determined policies can get renewable capacity back on an upward trend. We are helping all 38 members of the IEA Family, and all other countries around the world, in their energy transitions with targeted policy advice aimed at accelerating investment in a global portfolio of renewable energy technologies, as well as energy efficiency, carbon capture, utilisation and storage, and all other clean-energy technologies,” said Dr Birol.

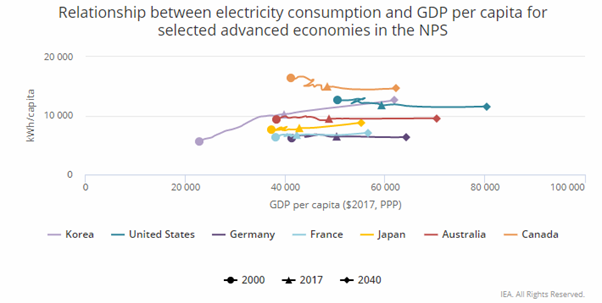

Population growth in many advanced economies is barely exceeded by electricity demand growth, meaning that further growth in GDP per capita does not lead to an increase in electricity demand per capita (as an exception, the industry sector in Korea accounts for a large share of electricity demand, and so it is one of the few advanced economies that sees industry contribute to overall electricity demand growth on a per capita basis), as per IEA.

Investors should be cautious when it comes to purchasing a stock to reap dual benefits of capital appreciation and growth in value of the company hence high multiples. Exposure of a portfolio should be diverse and a constant scan of the market is essential to enter at budding stage and exit when the growth is over expanding. Those who are value investors and want to remain invested for a long time should also search for opportunities when they could enter a segment so as to witness a sectors’ complete growth.

Conclusion in simple words , it is high time Indians diversify out of their comfort zone and start looking into other places!