By Apra Sharma

Risk appetite of investors is a major driver of returns that financial markets provide. Thinking about US, the rate hikes of which big beneficiaries were Emerging Market Countries, might be taking a toll on US itself with equities crashing relatively and a weaker USD. For Fed, waiting time is coming to an end and they have only one way to go, get dovish. If they hike rates further, it would be a disaster for US as $62T GDP is on the outside and $18T on the inside.

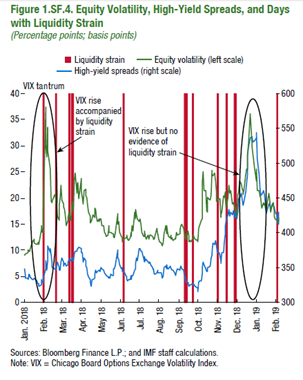

In a liquid market, an adjustment in prices in response to a news shock would happen rapidly. However, if the market is not very liquid, the jumps are sluggish. Big Price movements in bond markets tends to be more reflective of liquidity strain. Recent events like flash rally in US Treasuries in 2018, Sharp drop of S&P500 futures in December 2018 or yen spike in January 2019 have raised concerns about fragility of market liquidity.

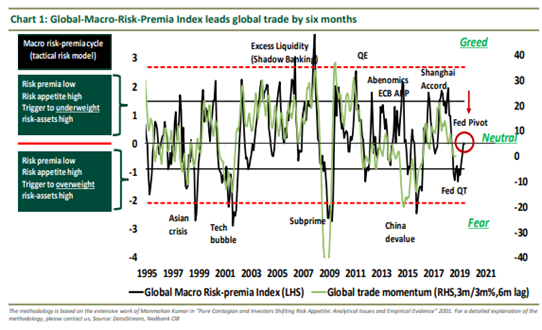

‘Global USD liquidity is vulnerable to the downside’, says Nedbank’s Global Macro Insight. In our history, investor sentiments have played a crucial role whenever crisis occurred.

‘All of the elements of our theory of animal spirits are essential to understanding the depression of 1890s: a crash of confidence associated with remembered stories of economic failure, including stories of growth of corruption in years that preceded the depression; a heightened sense of unfairness of economic policy; and money illusion in the failure to comprehend the consequences of the drop in consumer prices’, said Akerlof and Shiller in Animal Spirits.

Alfred Noyes, a then financial editor of New York Times pointed out, “…the first act of frightened bank depositors was to withdraw these very legal tenders from their banks. Experience has taught these depositors that in a general collapse of credit the banks would probably be the first mark of disaster.”

When Fed was founded in 1913 and subsequently FDIC was the answer to liquidity problems then. In 1998 with LTCM, 2008 Bear Sterns rescue (to name a few), Fed was the banker of last resort to prevent liquidity crisis. The powers of central banks and their actions decide the impact on the economy and investors hope that they always proceed with best interests.

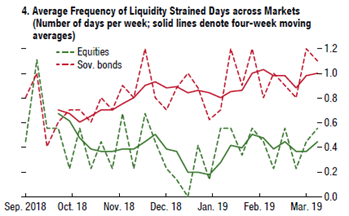

The most recent spike could be attributed to investors readjusting to monetary policy normalization and change in outlook of growth. The effects of structural change in the provision of liquidity is more pronounced in sovereign bond markets than equity or cash segments.

An escalation in US – China trade war or Fed’s no cut stand has left liquidity of in particular, USD vulnerable. Trading volumes has clearly decreased post financial crisis which is a function of investor sentiment ,may not the only factor affecting market liquidity but has always been the key factor which cannot be ignored.