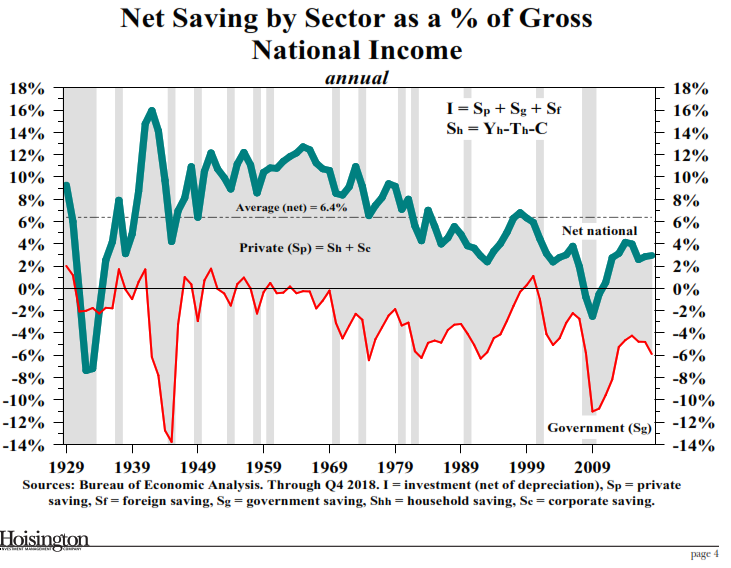

Lacy said he has never shown the next chart before. Adding, there are certain things in economics that “hold true.” This is one of the most important charts in economics:

- The green line shows the national savings rate. It is currently at 3%. It is historically 6%. We are running half of normal. The shaded area shows the private sector, which is running at 9%. That’s pretty good. The red line shows the government sector and it is running at -6% and dragging down national savings. That is where the problem lies.

- But it is not going to stay there – the government deficit is moving even lower into negative territory.

- The government deficit will continue to grow. Tax cuts and the bipartisan agreed-upon increase in spending do not lead to deficit reduction.

- Bottom line: What it says is there is an insufficiency of savings to absorb ever-larger budget deficits. National savings is not staying at 3%, it is going to decline. Real investment is going to decline. It is possible the private sector will save more but that means there will be less consumption.

- In other words, the public sector is going to constrain the private sector and the economy. (SB: Debt acts as a noose around the economy’s neck.)… and guess which sector provides the basis for better growth, the private sector or the public sector?

- In other words, the government sector’s budget deficits are too large for the level of savings

Given the political structure of our country, it is unlikely the situation will change. Lacy added, “impossible.”

Bottom line: We simply have an insufficiency of savings and it cannot be corrected.

The Production Function – it is dependent upon technology and the three factors of production: land, labor and capital.

- The production function states that if you overuse one of the three factors of production, output will initially rise and will then flatten out and then turn down.

- In other words, there is a non-linear relationship between debt and economic activity.

- The simple-minded solution that if a $3 trillion program doesn’t work you try a $6 trillion program… that doesn’t work when diminishing returns takes effect.

- The evidence here is increasingly dire.

Latest Evidence of Diminishing Returns:

Read Full post below