The cycle is turning from consolidation to diffusion.

For more than a decade, the consolidation of economic power — both on the corporate and individual level — has been the key dynamic determining the returns of nearly every asset class. It has shaped the dominant trends in equity markets, whether growth’s outperformance versus value, passive investing’s meteoric rise, the low-volatility regime, or the concentration of capital in U.S. stocks. It has defined the tech-venture capital ecosystem, with funds concentrating in a small number of firms believed to have blitzscaling potential. It has determined global real estate values, with high-end jobs and wealth clustering in “superstar” cities. Even luxury collectables reflect the dynamic, with extreme wealth driving the top-end of the art, car, wine, and whiskey markets to extreme values.

In WILTW March 7, 2019, we penned an article titled: “Market participants still don’t understand the power of the cycle that turns from wealth accumulation to wealth distribution. But they will.” Week after week, we see evidence of intensification on all three key fronts driving the cycle shift — political, technological, and cultural. Consider only a few recent developments:

- Facebook co-founder Chris Hughes wrote an op-ed for The New York Times with the declarative headline: “It’s time to break up Facebook”.

- The Supreme Court ruled against Apple, allowing iPhone users to move forward with an antitrust suit against the company.

- Forty-four U.S. states have filed suit against 20 drug companies for scheming to fix drug prices and suppress competition.

- Bayer’s C-suite is facing a shareholder revolt for failing to see the risks of its biggest acquisition ever, Monsanto.

- Recently-released data revealed California’s population growth rate slipped to 0.47% in 2018, the slowest since data collection began in 1900.

- Disney-heiress Abigail Disney spoke publicly against Bob Iger’s salary, telling CNBC: “Jesus Christ himself isn’t worth 500 times his median workers’ pay.”

- Bitcoin spiked more than $1,200 in a single day on Monday, pushing the token’s price above $8,000 for the first time since last July.

From the Gilded Age to the post-Depression heyday of U.S. antitrust action, history attests that the cycle from wealth accumulation to wealth distribution turns in stages. Consolidation and inequality will be gradually chipped-away by regulation, innovation, and consumer tastes. Economic benefit will diffuse slowly and incrementally. Yet, even in the transition’s nascent phase, investment implications are already manifesting:

- On the downside: Real estate prices in megacities around the globe are falling — in some cases, sharply. Key megamergers are backfiring. Uber’s IPO floundered as its private valuation exceeded the public market’s estimation of its worth. And regulatory and legal actions are threatening the business models of behemoths in several sectors.

- Meanwhile, on the upside: Decentralizing technologies like the “edge cloud”, blockchain and software-as-a-service (SaaS) are gaining power. Gen Z and millennials are pushing consumption away from mass-market brands and to smaller, niche producers. And we are beginning to see the economic rejuvenation of cheaper, smaller cities throughout the U.S.

It may not yet be time to entirely abandon consolidation as an investment theme. However, to our mind, it is increasingly clear the cycle shift is gaining momentum.

Last week (WILTW May 9, 2019), we dissected why the SaaS boom has only begun and the market is likely to be defined by diffusion rather than monopolism (unlike the consumer-data-dominated era). 5G combined with the IoT will dramatically spike the volume of data generated by enterprises. And SaaS companies with best-in-class products and sector-by-sector and region-by-region expertise will see the greatest upside. It is unlikely mass-market, legacy-cloud giants like Microsoft, Salesforce, or even Amazon will alone be able to service those idiosyncratic challenges. Meaning, niche SaaS providers will be able to carve out lean, highly-profitable businesses.

As an example of this dynamic already in action, we referenced freight-forwarding startup Flexport, which saw its annual revenue spike 95% in 2018 to $441 million. We quoted its founder, Ryan Peterson, who made an essential point to Forbes earlier this year: “Of the top 100 freight forwarders, we are the only one founded after Netscape.”

In these pages, we have explored why the shipping industry has lagged in its digital transformation, and in turn, underperformed. As we wrote in WILTW March 21, 2019: “The [maritime transport] group is now at ‘maximum pessimism’ with stocks down 90% and in many cases trading at less than half of NAV.” SaaS firms like Flexport that can offer shipping an on-ramp to digital transformation will not only see significant upside themselves, but could rejuvenate profit growth — and equity sentiment — for the entire sector.

And the shipping industry is by no means the only old-line industry that is ripe for digital transformation. In WILTW April 6, 2017, we cited calculations from McKinsey Global Institute (MGI) measuring value seized from big data by sector, finding retail had captured only 30% to 40% of potential estimated value; manufacturing just 20% to 30%; and the public and healthcare sectors a mere 10% to 20%.

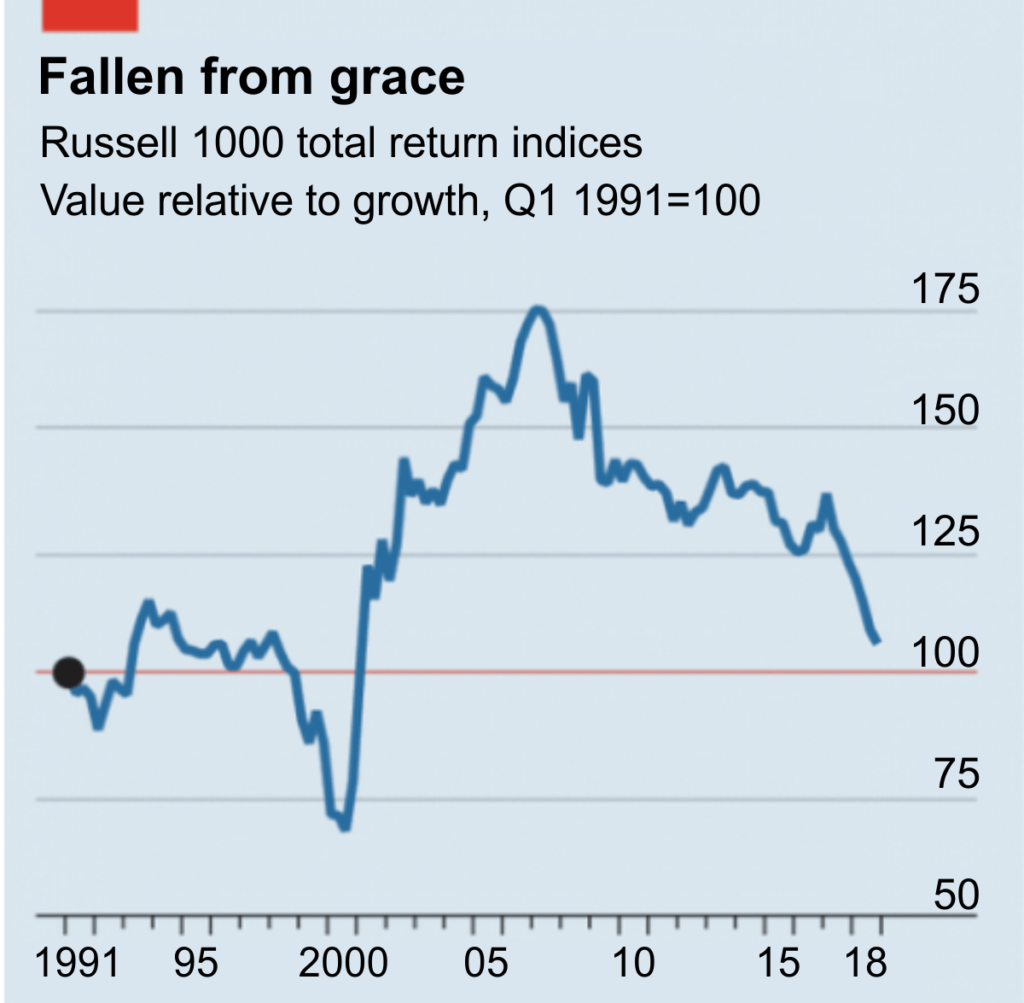

If old-line industries effectively digitize, it would have seismic implications for the investment ecosystem’s status quo. Just consider the underperformance of value versus growth over the past decade. As The Irish Times pointed out last month, value stocks, by one valuation metric, outperformed growth stocks by an average of four percentage points a year between 1926 and 2008 and in 90% of 10-year periods. However, since the market bottomed in early 2009, growth stocks have been on their longest run of dominance on record.

Source: The Economist

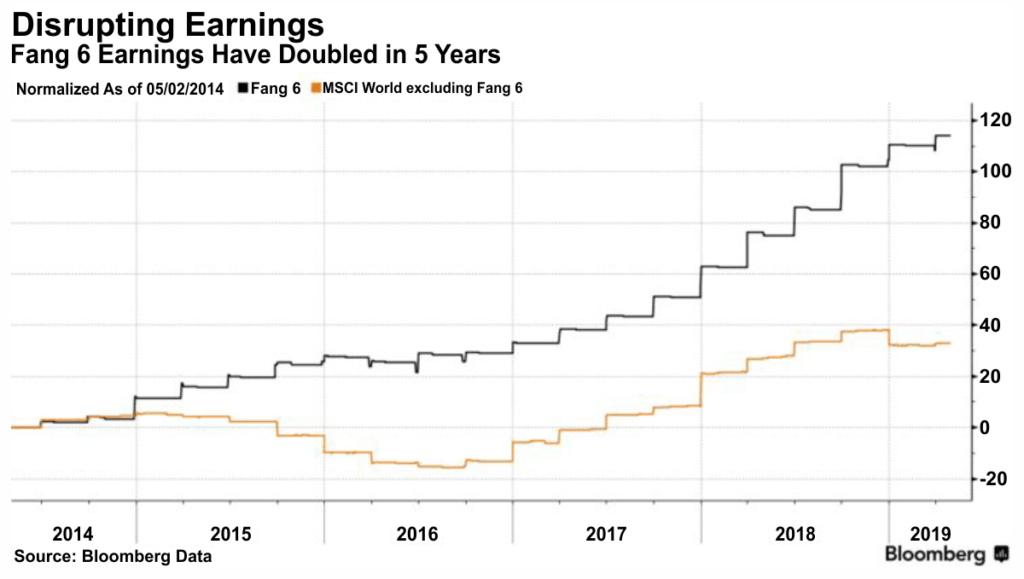

While there is much debate about why this has happened — with some even claiming “value investing is dead” — one contributing factor is clear: growth’s dominance has been highly dependent on the ever-consolidating power of tech giants. Just consider the not-surprising, but still-shocking, chart below. Published earlier this month by Bloomberg’s John Authers, it shows FANG 6 earnings — Facebook, Amazon, Apple, Netflix, Google and Microsoft — relative to the rest of the MSCI world index over the past five years:

As Authers writes: “the Fang 6 are not so much disrupting the rest of the world’s corporate sector as eating it alive.” If SaaS providers expedite the digital transformation of laggard industries while regulation restrains the vulturous profit-taking of tech giants, it could end growth’s outperformance versus value.

The passive revolution has also been highly dependent on the reliable outperformance of a small number of firms. As MGI determined in a recent report on “superstar” dynamics in the global economy: Between 2014 and 2016, the best-performing decile of firms seized roughly 80% of all economic profit globally, up from 75% a decade ago.

A handful of firms seizing the vast majority of profit growth globally year-after-year has deprived active investors of the ability to identify undervalued growth opportunities and outperform passive indexes. When diffusion supplants consolidation as the dominant market dynamic, it will be a headwind for passive and a major tailwind for active investing.

The pace at which the shift from wealth accumulation to wealth distribution occurs will depend on several factors. To name three: Will a pro-antitrust democrat win the White House in 2020? Will Gen Z and millennial tastes and politics solidify or change as they age and gain spending power? How quickly can innovators solve blockchain’s scalability questions?

Yet, regardless of the speed of the transition, the progression away from consolidation and towards diffusion has begun. We will continue to dissect the risks and opportunities in these pages every week. However, the broad implications already appear clear: Bet on decentralizing innovations. Bet on specialization over scale. Bet on the neglected and undervalued over assets where wealth has concentrated. And prepare for volatility as most market participants will be caught flat footed by this seismic shift.

This article was originally published in “What I Learned This Week” on May 16, 2019. To subscribe to their weekly newsletter, visit 13D.com or on Twitter @WhatILearnedTW.