Macro data surprises have remained negative compared to consensus estimates, in line with our longstanding scenario, but equity markets have disregarded this and seem to be driven by a blind trust in central bankers’ abilities to turn the trend around before a more severe earnings recession takes hold. Falling bond yields have also renewed the push for higher valuation multiples, hence profit neutral valuations are back at multi-year highs. Falling interest rates have challenged our value bias and triggered a further valuation divergence between the expensive and cheap ends of the equity market. We still believe there will be a marked earnings recession and view analysts‘ V-shaped earnings expectations into 2020 as very unlikely. There is a risk, however, that central bankers could manage to create a larger asset bubble before a more severe crash takes place in some distant future, but we see too many dark clouds on the horizon in the short term to dare play that scenario.

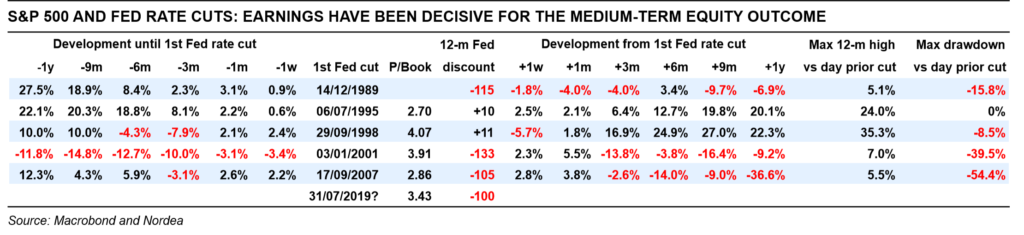

Macro strategy: Bubble or trouble? Our models, particularly for the US, point to much lower growth than consensus expects, as well as rising wage costs, which should trigger a marked earnings recession. How have previous Fed easing cycles played out for equities in such a scenario? In four of five cycles, equities have performed well from one month before the first cut up to one month after. In all easing cycles, the S&P 500 has at some point been higher within twelve months than the day before the first cut. In the medium term, two easing cycles have appeared hand in hand with bull markets and three have accompanied bear markets. The difference seems to depend on the presence of a marked earnings recession or not. It has not been enough that the Fed has eased to get an all-clear for equities. We still expect global manufacturing to improve in 2020, but the number of detrimental trends in the fundamentals still bothers us in risk/reward terms, and represent a warning signal in our view.

Equities: Valuation and estimate risks remain We see a clear risk that we will enter an earnings recession and that analysts have not moderated expectations enough on top lines and profitability estimates. Long-term tailwinds for profit margins are gradually disappearing and in some areas turning to headwinds. With valuation levels on profit-neutral multiples once again approaching new highs, we doubt that the market will withstand the estimate cuts that we foresee. Given that we remain confident in our macro outlook and that believe earnings estimates will need to come down for 2019-20, we find support for our defensive positioning. Where we could go wrong could be an underestimation of market participants’ willingness to push the expected return even lower (in other words, buoying valuations even higher). We are very reluctant, however, to recommend playing such a scenario.

Equity styles: Double down on value With interest rates falling and central banks turning more dovish, some wonder if we should abandon our value bias and accept that valuations do not matter in a low interest rate environment. We do not accept this view and advise doubling down on the value factor. First, the valuation discrepancy between the cheap and the expensive end of the market is unprecedented. Second, slower global growth in a low cost-of-capital environment should theoretically reduce valuation differences, not increase them. Third, we can demonstrate that expensive stocks tend to struggle as uncertainty rises (eg the VIX index). Finally, the cheap end of the equity market has become so much smaller given its abysmal relative performance of late that a much smaller capital allocation to the style is enough to turn the tide. For those not daring to take the full value plunge, we advise combining value with solid quality and cash-conversion traits

read full report below