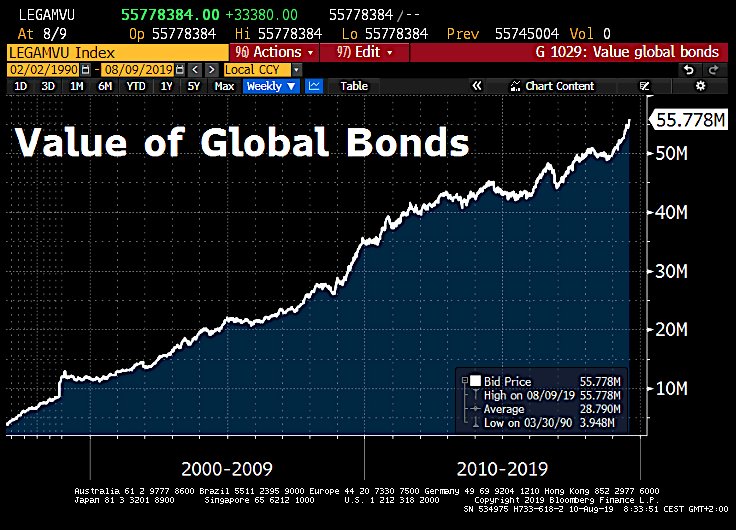

The one ingredient missing for a major bond price top is the blowup of a big firm like LTCM, Bear Stearns, Lehman, Orange Co., MF Global, etc. Maybe it has already happened, and we just have not heard yet.(Tom McClellan)

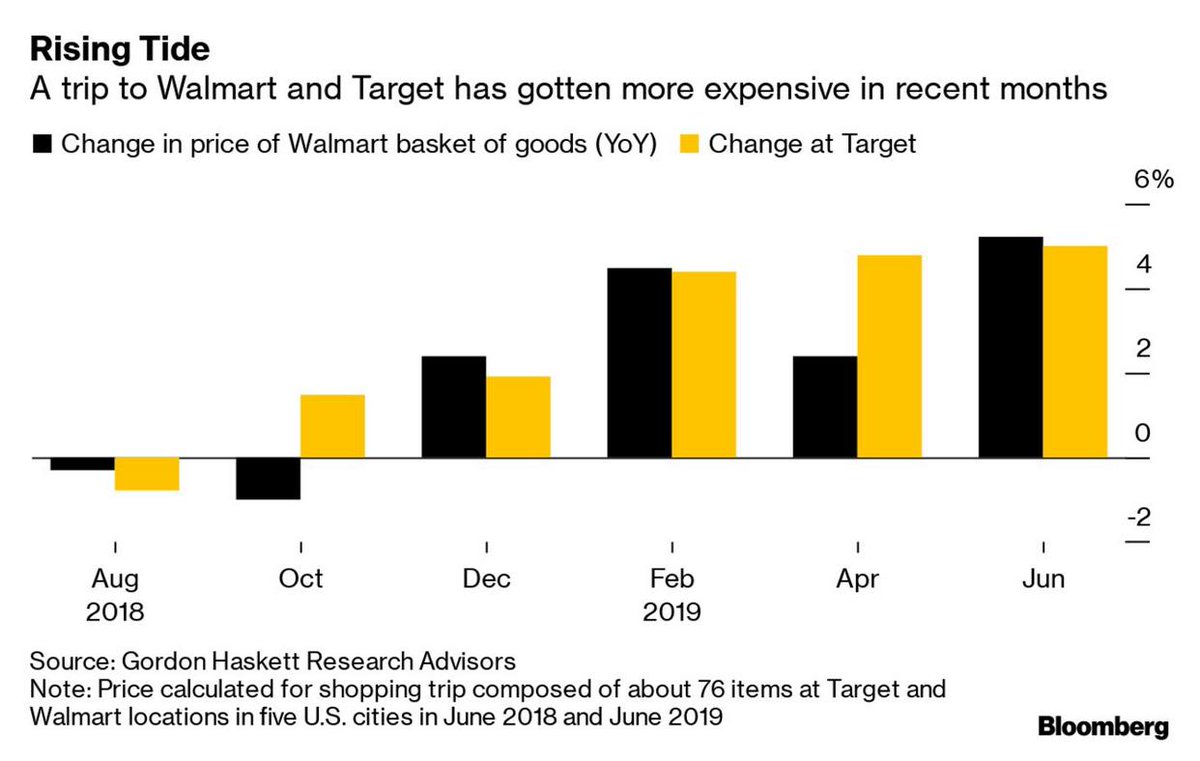

The inflation is back

Walmart said it saw “modest” inflation in the first quarter, but it has heated up lately, and a Walmart shopping trip was 5.2% more expensive in June compared with a year earlier. For thrifty Walmart shoppers, that matters.’ (link: https://www.bloomberg.com/news/articles/2019-08-10/walmart-feels-inflation-sting-prices-and-something-s-gotta-give) bloomberg.com/news/articles/…

Borrowing doesn’t mean what it used to mean

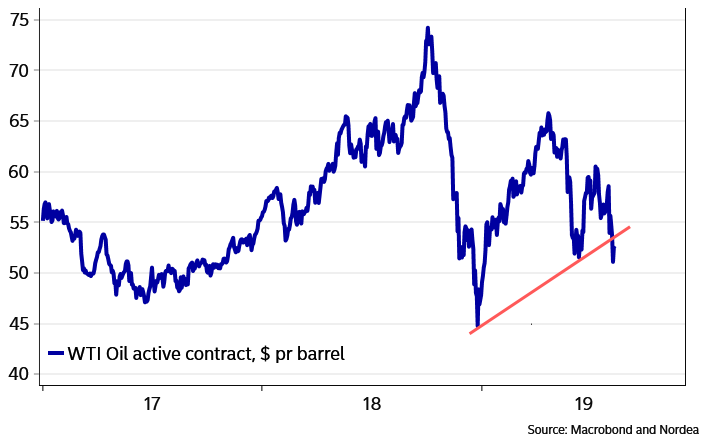

While precious metals seem to prosper, commodities linked to the business cycle seem to falter. It seems as if WTI oil prices have broken lower. This story could have legs for real, if the Chinese started buying more Iranian oil. Will they dare? It will not only piss off the US, but also Saudi Arabia.

Value of global bonds has hit a fresh high of $55.8tn as investors rushed into safe-haven bonds amid US-China tit-for-tat escalation and further central bank easing abroad.

Global stocks have lost $1.5tn in mkt cap this wk as investors navigated through another round of US-China trade war escalation. Yuan breached 7 per Dollar while US Treasury labelled China currency manipulator. Tit-for-Tat escalation seen as downside risk to growth & risk assets.(Holger)