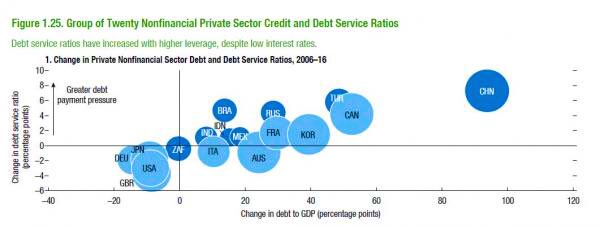

The USD shortage + higher short term rates + stronger USD has put (especially) Chinese firms with significant dollar-denominated debts in a fragile position (because 2+ trillion in debts matures over next 24months) . The more USD rally the more difficult is USD loan rollover

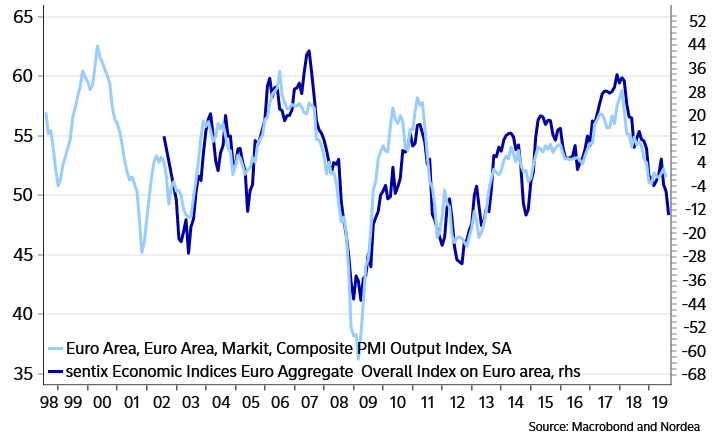

The Bundesbank warns of a technical recession in Germany. Nordea warn of the risks of a Euro area wide technical recession then. The Euro area composite PMI could drop below 50 over the next 2-3 months.

FX weekly -> ndea.mk/33HxWYs

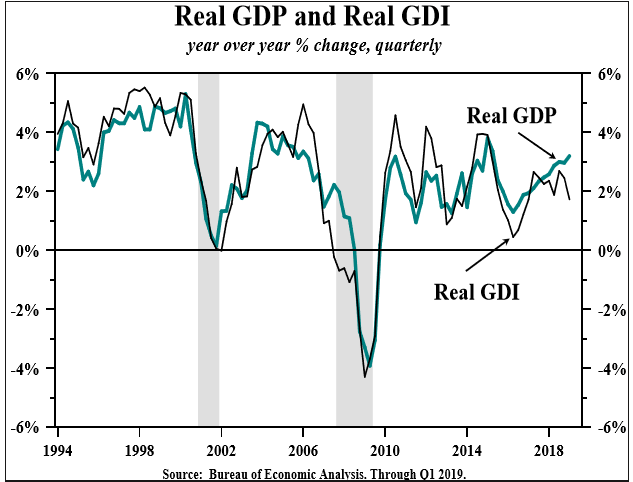

US Real gross domestic income (GDI) gained at a very meager 0.76% annual rate in Q4 2018 and Q1 2019, well below the 2.65% growth in real GDP (Chart 2). Over the past year, real GDP growth was 3.2%, versus 1.7% for GDI, hardly ebullient growth. Normally, GDI and GDP have moved together going into recessions but prior to the severe recession in 2008, GDI led GDP, just as presently, a clear warning sign. Dr Lacy Hunt

why is it never different

Ben Bernanke, on subject of inverted yield curve, in 2007. That turned out well.