NECESSARY, NORMAL, AND INEVITABLE

Dear Investors:

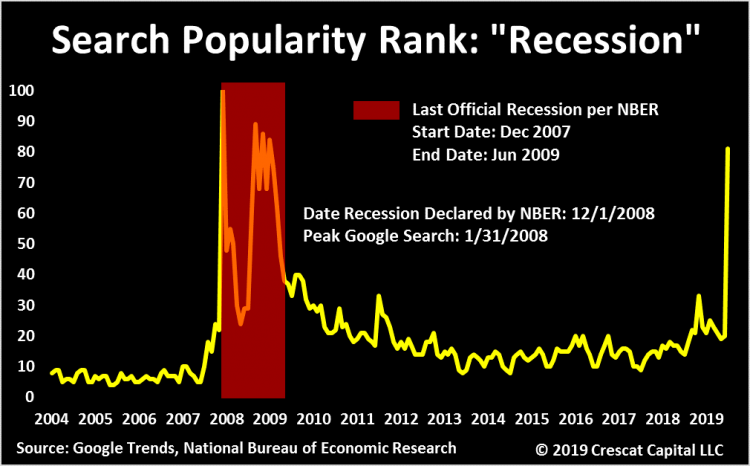

Recessions become self-fulfilling prophesies late in an economic expansion at a point when people finally start believing and acting like one is imminent. It is particularly true when asset bubbles are present. A huge spike in concerns about the economy as measured by Google Trends analysis of the search word “recession” was not a contrary indicator at all at the very beginning of 2008. Indeed, it proved to be the start of the economic contraction. NBER, the official recession-calling body of economics PhDs, did not declare it until twelve months later as typical. We believe the current late-cycle spike in Google recession searches will prove prescient once again.

US and Global Macro Indicators

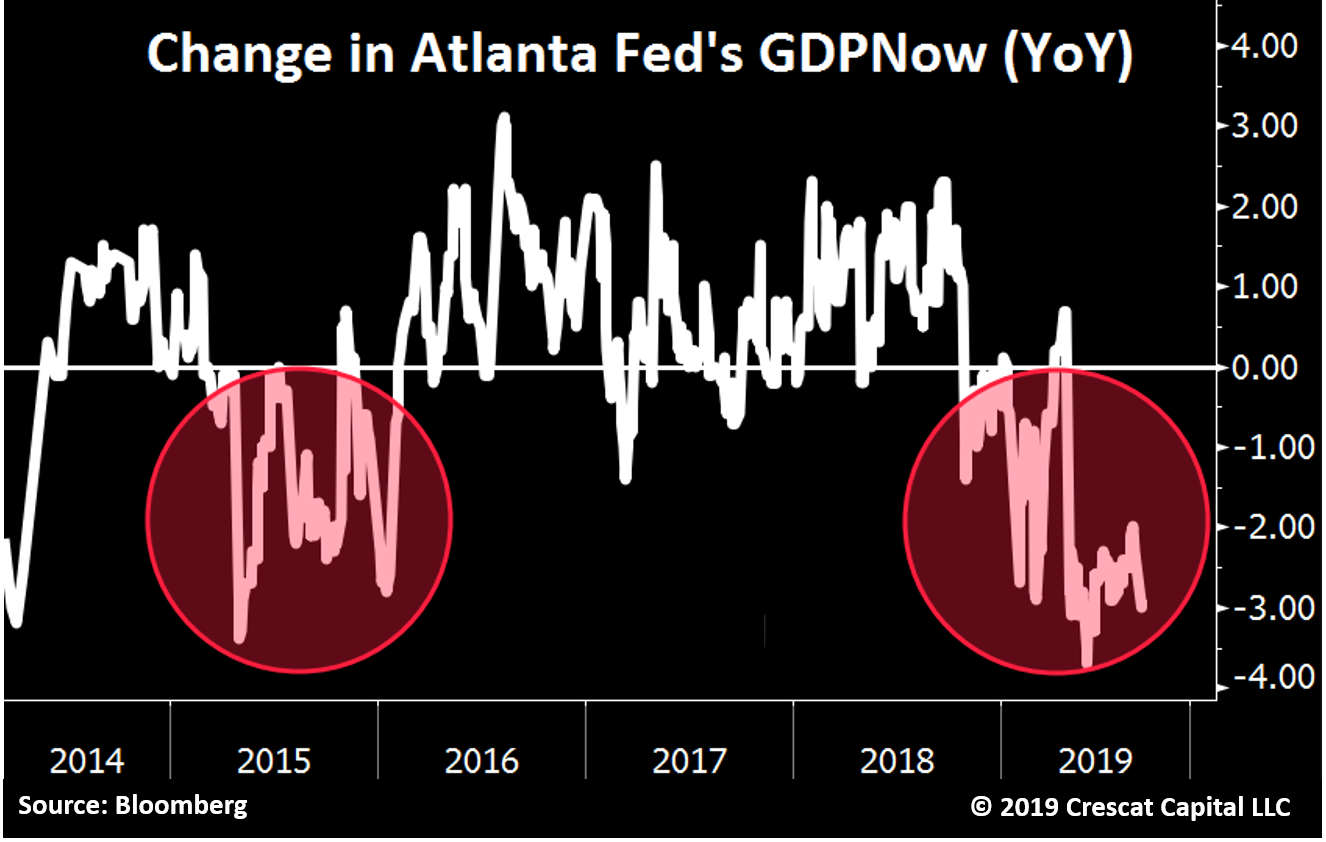

Beware the narrative that the US economy is still strong when it is being spun by conflicted central bankers, politicians, and investment professionals. The truth is that the macro indicators have been turning down materially all year as we can see by the year-over-year change in the Atlanta Fed’s GDPNow macro model.

It’s like in early 2018, when the predominant storyline was “synchronized global growth”. That narrative persisted throughout the year, but global stocks (ex-US) peaked in January. Surveys of global manufacturing purchasing managers have been in decline ever since and have gone into recessionary territory over the last three months.

But the US stock market is still near an all-time high. And today, hand-holding market pundits still cling to the dying notion that the US economy is strong, kept alive by hopes that a new round of Fed easing, the so-called “mid-cycle adjustment” can reverse the deteriorating conditions. Bulls are ignoring deteriorating material macro indicators like the US Bureau of Labor Statistic’s “preliminary” 500,000 jobs reduction for early 2019, the dismal August ISM manufacturing report, and the big drop in last month’s Michigan Consumer Sentiment Index.

The last time US macro data was deteriorating this badly, it was 2015 and several emerging markets went into recession at the same time as the Chinese stock market crashed and its currency began to devalue. US recession was averted after the Fed hiked just once at the end of 2015 then paused for a year. The Fed executed a rare soft landing and the business cycle was extended for more than three years now to what is the longest expansion in US history. But the Fed hiked rates eight more times from December 2016 to December 2018 and engaged in $650 billion of quantitative tightening through May of this year. The economic outlook today is much more foreboding than it was in late 2015, particularly as China is now facing much bigger recessionary pressures of its own.

In the history of the federal funds rate, 1995, 1984, and 1966 were the only mid-cycle adjustments (cuts after hikes) that led to soft landings and extensions of the business cycle. The 2016 pause mentioned above was arguably another. It’s too late in the expansion to work now. Asset bubbles are too big.

We are record late in an expansion in the US with several inversions in the Treasury yield curve having breached levels that historically have a perfect track record of predicting an oncoming recession. These include the 3-month versus 5-year and 10-yr spreads as well as Crescat’s own percentage of inversions indicator. More than 70% of the US yield curve has inverted already in this cycle, a level that has preceded every economic downturn since the 1970s.

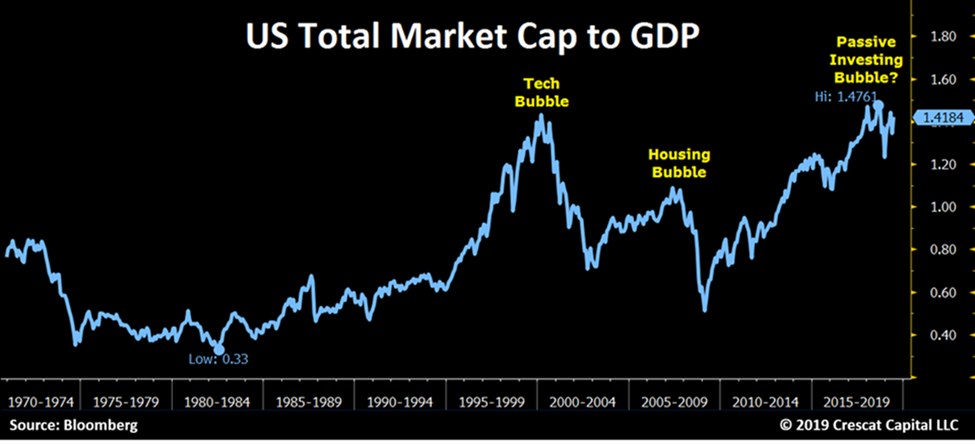

Asset bubbles are much bigger today than they were in late 2015, particularly the US stock market. Michael Burry of Michael Lewis’ Big Short notoriety recently made a call in a Bloomberg interview that we are in a passive indexing bubble that will end like the subprime CDO debacle that led to the global financial crisis. In the history of the Wilshire 5000, the total US stock market index, stocks recently reached their most expensive ever relative to the underlying economy, higher than the peak of the tech bubble in 2000.

We believe based on our macro modeling that 2019 is the downturn that is highly likely to continue into a hard landing. It’s too late for a Fed mid-cycle adjustment to keep the expansion going. That ship sailed post 2015. With the latest excesses in passive investing, the world has reached a level of gross valuation ignorance that could make the coming bear market particularly brutal.

Our composite of macro indicators says that the crash window is open. Recessions are necessary, normal, and inevitable. The longer they are postponed through government intervention, the greater the mal investment, the bigger the speculative bubbles, and the more violent the downturn.

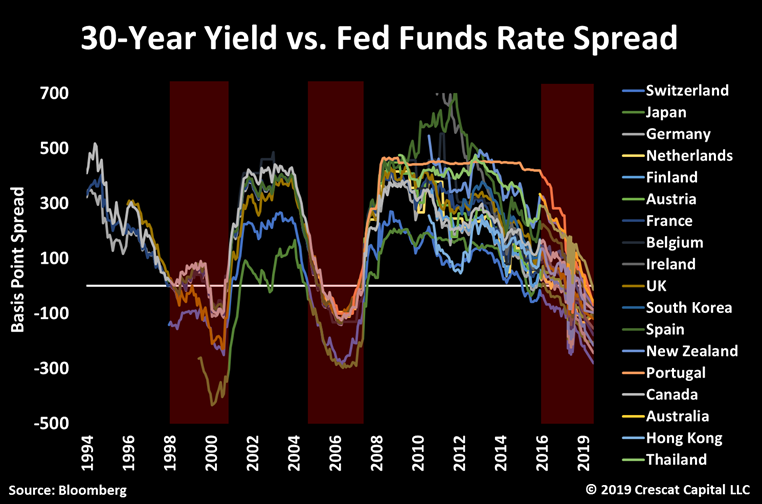

The global yield curve continues to be as inverted as other market peak times. The chart below is just an update of these 18 economies that now have their 30-year yields below the Fed funds rate. Thailand just recently joined the pack. These distortions are just another ominous sign for the global economy.

As history has shown us repeatedly, when the South Korean won breaks down, global stocks tend to follow. The chart below is another macro timing indicator at a critical level today. South Korea heavily relies on exports and its currency is a barometer for financial conditions worldwide. The won is now re-testing a major support line and further depreciation could be detrimental for equity markets globally.

China & Hong Kong

The Chinese economy is at the outset of a debt and currency crisis. No other country has grown debt so aggressively for so long and in such an extreme manner. China built an oversized banking system that now undergoes a rising nonperforming loan problem, a precarious housing bubble, and a political leadership that remarkably resembles a crony-kleptocracy. China’s declining current account problem imperils its entire mercantilist approach, while its push towards a consumer-driven growth model never seemed so far-fetched. Rising social unrest, trade tensions, and food inflation are just icing on the cake for these macro inconsistencies.

The yuan just had its worst month since 1994, even bigger than the 2015 devaluation. We expect much further currency dilution as the PBOC continues to mobilize aid for its failing banking system. We are at the early stages of all these issues. Just this year, the Chinese government was forced to engineer three bailouts: Baoshang Bank, Bank of Jinzhou, and Hengfeng Bank. In aggregate these banks hold close to $420 billion in total assets. Although accounting for a small portion of China’s $42 trillion colossus on-balance-sheet banking system, it’s a sign that the economy is under severe pressure. We expect much larger loan losses to soon surface. According to Bloomberg, China’s central bank recently concluded its first review into industry risk and 420 firms, all rural financial institutions, were considered “extremely risky” and just two received a top rating. China’s debt levels are overwhelming, and a significant currency devaluation is likely on the way.

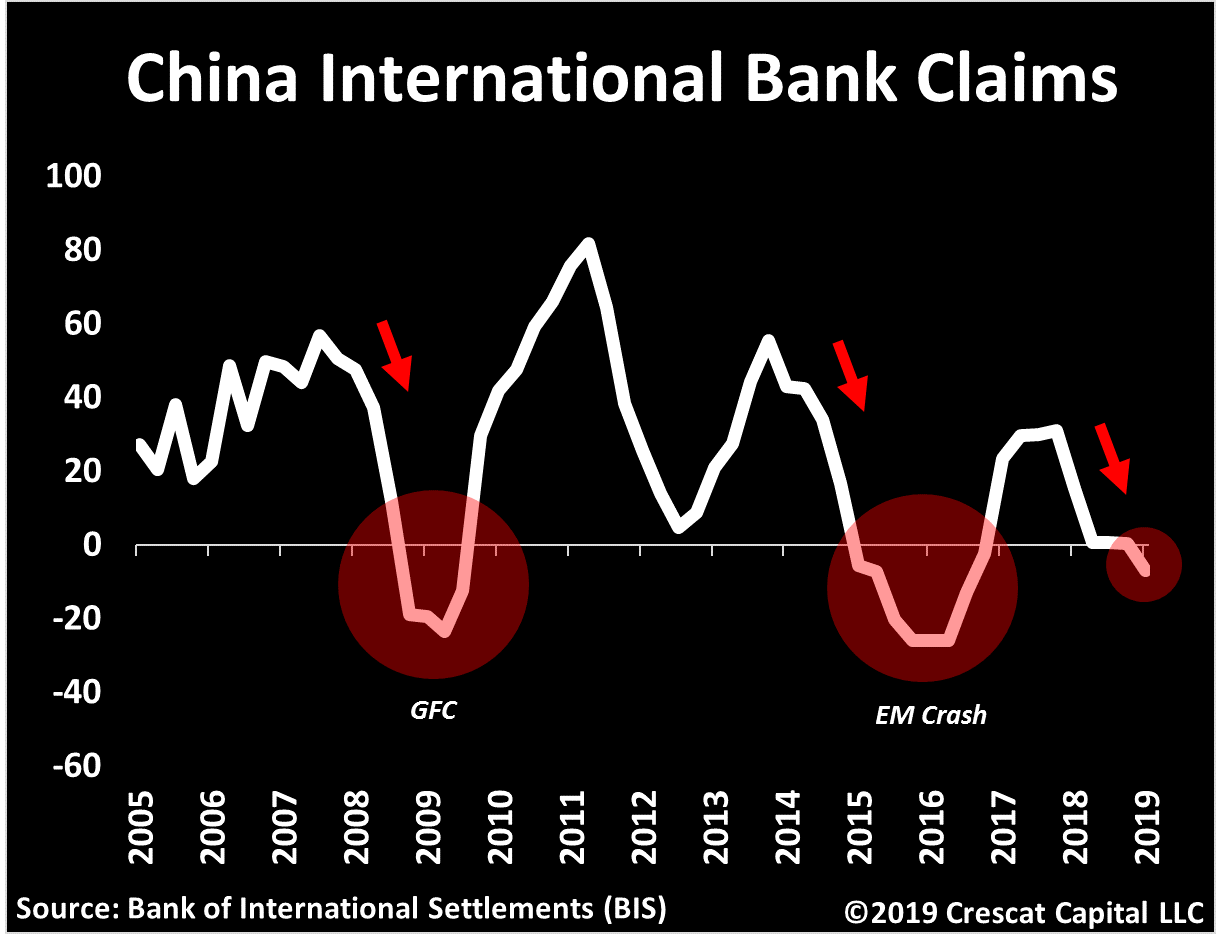

Per the Bank of International Settlements (BIS), China’s total international bank claims have just contracted for the first time in three years reflecting an early warning sign of financial stress. These claims, valued at $920 billion, comprise cross-border transactions in any currency plus local claims of foreign affiliates denominated in non-local currencies. Chinese banking activity similarly faltered during the emerging market crisis in 2015 and the global financial crisis.

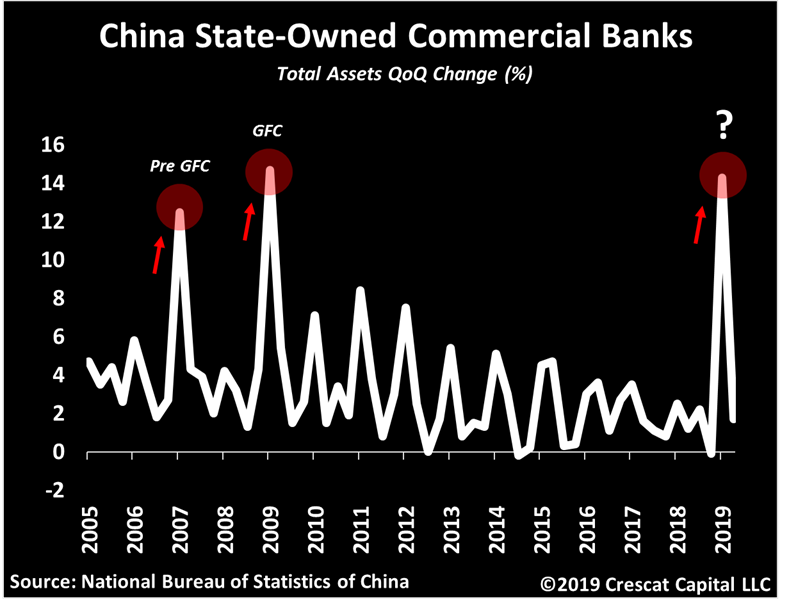

In our previous letters we noted that the median Chinese stock had fallen close to 40% during the 4th quarter of 2018. Since then, the PBOC has attempted to revive its economy through aggressive monetary policies that continue to put downward pressure on its currency to depreciate against the dollar. The Chinese central bank targeted specific forms of liquidity injection, one of them being through its state-owned commercial banks. Their quarterly rate of change in total assets just surged as much as it did times prior to and during the global financial crisis.

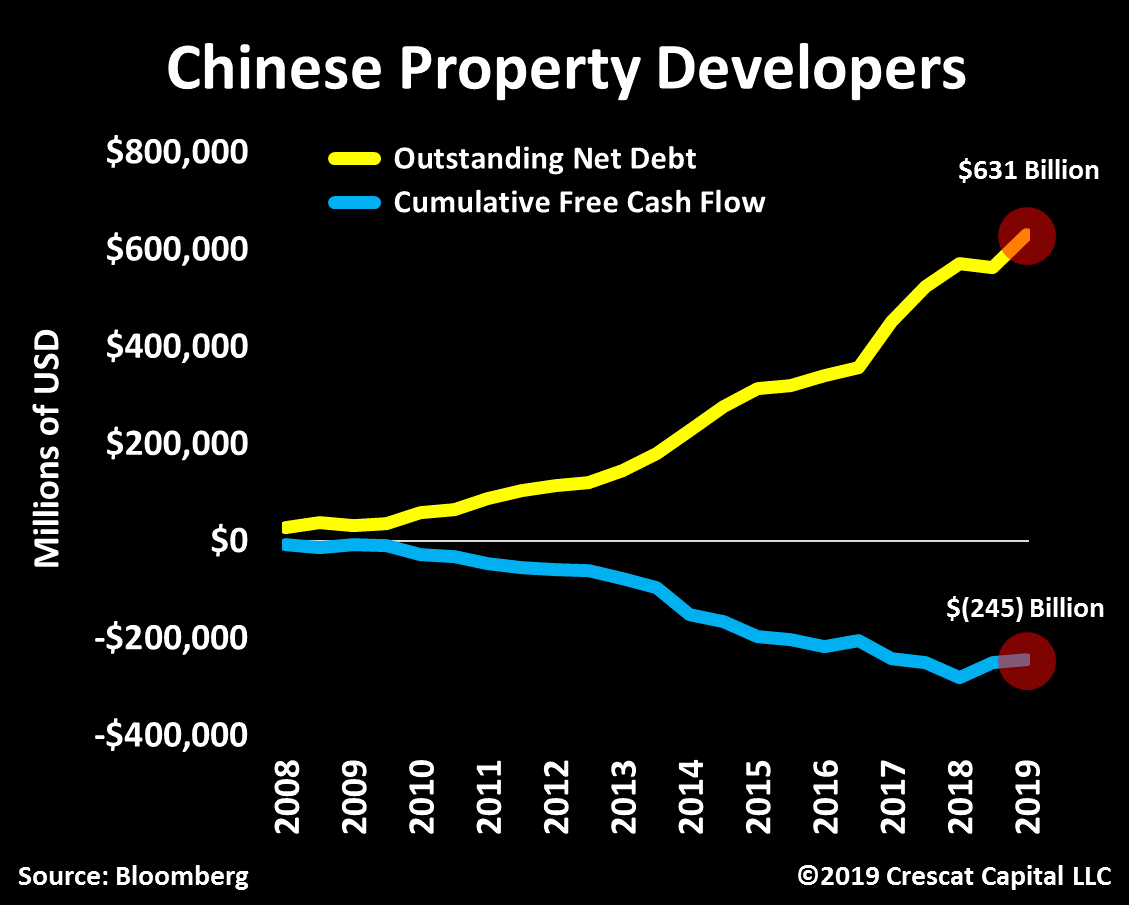

Large sums of investment into non-productive assets, that’s China’s real estate conundrum. Across publicly traded companies, the industry of Chinese property developers and homebuilders is now worth over $1.25 trillion in enterprise value. In contrast however, these businesses only generated about $1.5 billion of free cash flow in the last 12 months, in aggregated terms. Also, close to 55% of Chinese property developers aren’t even profitable on a free cash flow basis, according to their latest report. These companies have now accumulated close to $631 billion in outstanding net debt while total equity value accounts for $585 billion – or equivalent to 108% net debt-to-equity ratio. To put into perspective, that’s the exact same proportion US homebuilders had right at the peak of the housing bubble.

Since 2008, Chinese property developers have accumulated close to $245 billion in free cash flow losses while debt levels continue reaching record levels!

Just recently, we noted China Evergrande, a heavily indebted property developer, reporting that its profits were cut in half, down 52% on a year-over-year basis. Per Bloomberg, 47% of Evergrande’s debt matures this year. The stock is now down 44% in the last 5 months. We think this could be the canary in the coal mine for China’s debt debacle.

China’s sales of commercialized retail and office buildings are down 13 and 10% for the month of June. Its residential market continues to rise, but historically it tends to follow these other two markets closely. It’s important to note that office buildings are now falling the most since the global financial crisis.

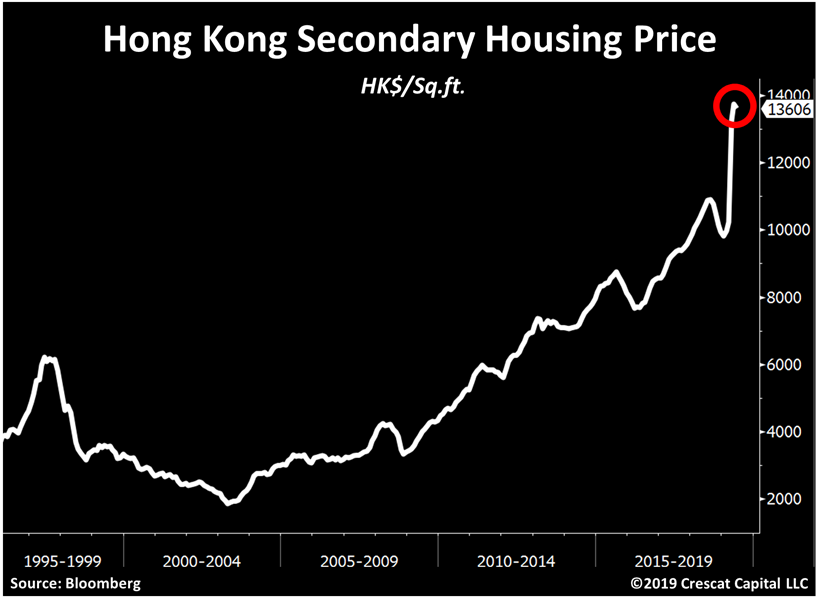

House prices in Hong Kong have risen to absurd levels adding to the country’s banking and currency risks. Its secondary residential market is up 40% this year and now valued at over $1,700 per sq. ft.! In our view, these prices are completely unsustainable. Rising mortgage rates, social unrest, political crisis, and capital flight should all be catalysts for a major economic downturn in Hong Kong.

China’s financial gateway to the world is falling apart. Every Hong Kong bank is breaking down from a major support line. Refer to the sequence of charts in the appendix at the very end of this letter. These charts resemble US banks during the global financial crisis when they broke similar trend lines in early 2008 right before the bigger collapse. Hong Kong’s banks are clearly signaling challenging times ahead. We believe capital is fleeing the financial hub portending a likely de-pegging versus the US dollar.

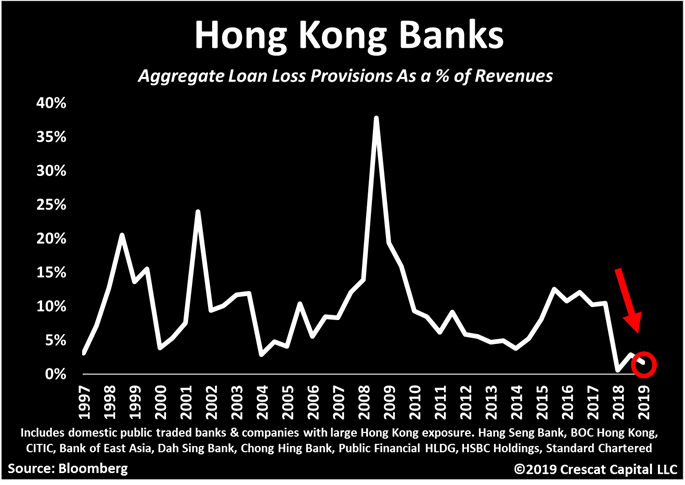

Hong Kong banks are also provisioning only 1.7% of their revenues for loan losses. That’s close to a record low, and even below levels prior to the Asian Crisis. Are HK banks accurately depicting the potential for credit losses? Their historical average is about 12% of revenues.

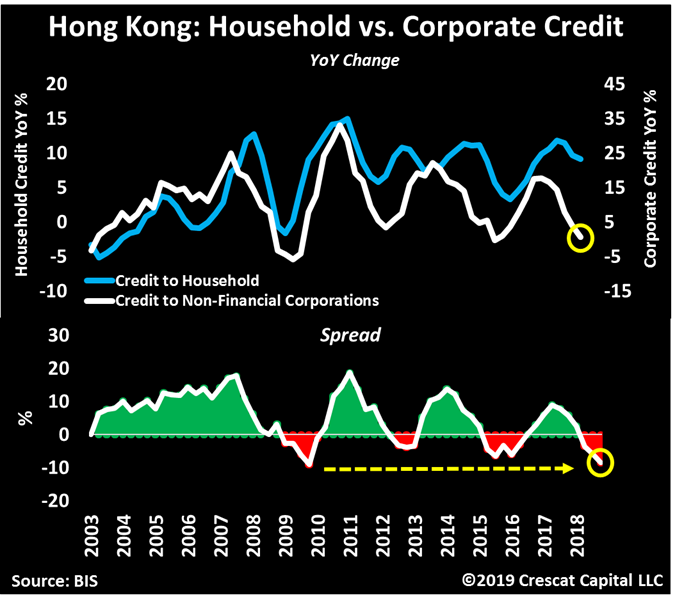

Hong Kong’s corporate and credit growth are also diverging the most since the global financial crisis, another leading indicator of financial stress.

In Conclusion

The truth of asset bubbles and economic weakening matters more than the hope from imminent Fed easing. We believe the global economy along with its many over-valued equity and credit markets are likely to soon head into a severe downturn. The Fed’s polices of near-zero interest rates and quantitative easing since the global financial crisis have created a lack of price discovery in stocks and corporate credit. Investors’ speculative behavior is a natural reaction to cheap money and has played an integral role in inflating these markets. Just as asset prices rise in a positive feedback loop of easy credit, investor speculative behavior, consumer and business spending, so they decline in the opposite self-reinforcing fashion. Such is the natural ebb and flow of the business cycle.