Why I changed my (Strong) US Dollar view

| “Ideas become part of who we are. People get invested in their ideas, especially if they get invested publicly and identify with their ideas. So, there are many forces against changing your mind. Flip-flopping is a bad word to people. It shouldn’t be. Within sciences, people who give up on an idea and change their mind get good points. It’s a rare quality of a good scientist, but it’s an esteemed one.” -Daniel Kahneman |

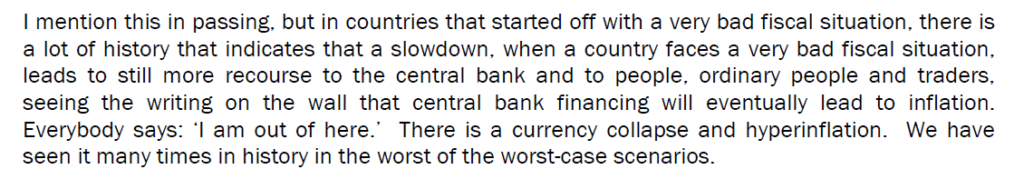

The below quote is by William White, one of the few global policymakers to publicly warn of the GFC ahead of time. Given that US has “a very bad fiscal situation, a key question investor should be asking themselves is what does ‘I am out of here’ look like in the US?

The Fed Gives Up on Inflation

This interesting paragraph from Lance Roberts echo’s my viewpoint –

Last Wednesday the Fed cut rates for the third time this year, which was widely expected by the market.

What was not expected was the following statement.

“I think we would need to see a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns.” – Jerome Powell 10/30/2019

The statement did not receive a lot of attention from the press, but this was the single most important statement from Federal Reserve Chairman Jerome Powell, so far. In fact, I cannot remember a time in the last 30 years when a Fed Chairman has so clearly articulated such a strong desire for more inflation.

Why do I say that? Let’s dissect the bolded words in the quote for further clarification.

- “really significant”– Powell is not only saying that they will allow a significant move up in inflation but going one better by adding the word significant.

- “persistent”– Unlike the prior few Fed Chairman who claimed to be vigilant towards inflation, Powell is clearly telling us that he will not react to inflation that is not only well beyond a “really significant” leap from current levels, but a rate that lasts for a period of time.

- “even consider”– If inflation is not only a significant increase from current levels and stays at such levels for a while, they will only consider raising rates to fight inflation.

I am stunned by the choice of words Powell used to describe the Fed’s view on inflation. I am even more shocked that the markets or media are not making more of it.

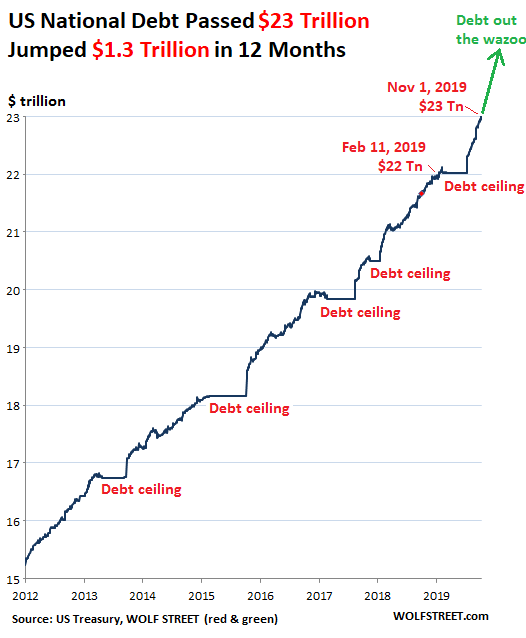

Now, I was looking for a final spike in dollar to 110 on DXY (currently at 98) as world is awash in dollar debt which needs to be rolled over and any dollar spike due to this shortage is bad for risk assets. But then REPO fiasco happened and FED had to support the systemic liquidity by announcing various forms of Repo (which they emphasized should not be called QE) and it led to FED balance sheet expanding by USD 250 Billion in couple of weeks reversing the last six months of Quantitative tightening.

The question which arises is, if US deficit is crowding out the market and FED is stepping in to support the market players with enough liquidity to buy US treasuries then FED is willing to supply unlimited amount of dollars to support the market and effectively fund (indirectly) US 1 trillion dollar deficit.

Now Thankfully Economic 101 taught me

“Increase in supply (of Dollars) with demand remaining constant always leads to lower prices.”

There is one more UNDERAPPRECIATED reason “Why is the market continuing to get FED cuts, liquidity support in the form of Repo operations (restart of QE) in the face of lowest unemployment in last 50 years”?

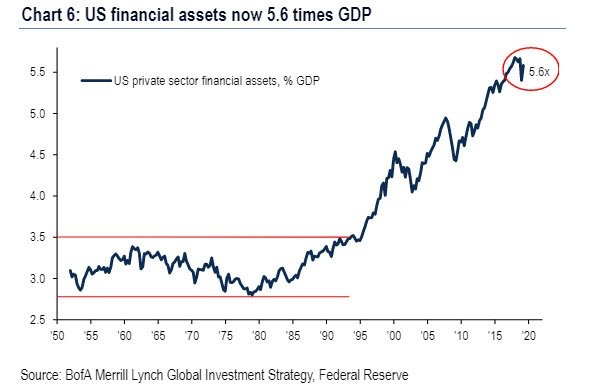

Never in the history of the country has the economy’s prospects been so closely tethered to that of the stock market.

Now Thankfully Economic 101 taught me

“Increase in supply (of Dollars) with demand remaining constant always leads to lower prices.”

There is one more UNDERAPPRECIATED reason “Why is the market continuing to get FED cuts, liquidity support in the form of Repo operations (restart of QE) in the face of lowest unemployment in last 50 years”?

Never in the history of the country has the economy’s prospects been so closely tethered to that of the stock market.

Sadly, financial assets are holding the policy makers hostage. If they allow the self-correcting mechanism to play out, then US will go into depression possibly worse than Great Depression.

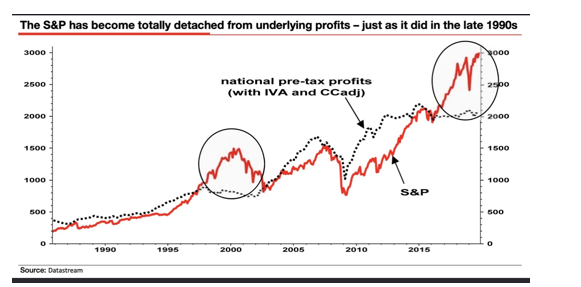

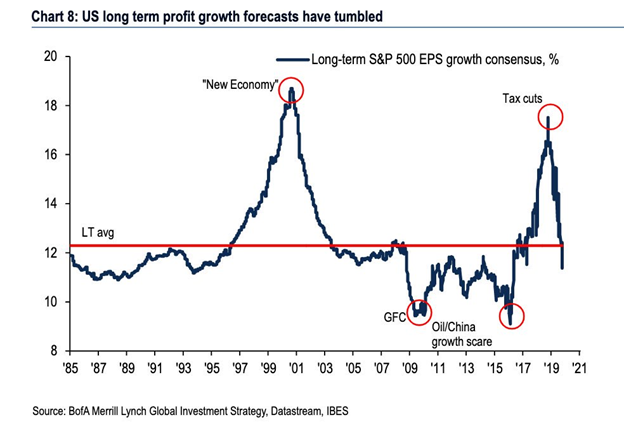

With this kind of Corporate profitability, you would be scratching your head on the strength of the US equity markets.

But Ladies and Gentlemen this is the LIQUIDITY driven market and the FED has just back stopped this market LIQUIDITY.

Remember

“Markets can remain irrational longer than you can remain solvent”

More on the topic

https://econimica.blogspot.com/

Now to a more interesting topic of “GOLD”

My experience has taught me to always analyze supply and demand. Do the math! The supply of negative yielding debt since early 2016 has expanded by 13 times as much as the available gold supply from the world’s mines in dollar terms. In fact, it has grown more than the entire amount of gold that has been mined in the world since the beginning of history! Let that sink in for a moment. Governments created negative yielding liabilities, in less than four years, in more than the amount in dollars of all the gold ever mined in the history of the world. Are you paying attention now?

Looking at it in another way, assume only 1% of the value of negative yielding debt was moved into the world’s gold ETFs, that would be $128 billion of new demand for gold, more than an entire year of newly mined gold supply and more than all the gold currently in those ETF’s. This is a potential supply/demand mismatch worth pondering.

If both sovereign debt and gold have no yield, which one would you rather own? I view gold as a potential superior substitute to those trillions of dollars of negative yielding debt, because gold may not yield anything, but that is more than a negative yield and it has no default risk. The same cannot be said with certainty of any bond in the world especially when every central banker is willing to tolerate higher inflation.

Stated differently

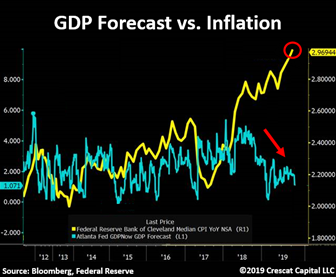

US GDP NOW forecast are now cut to 1% while Median CPI is at 3%

FED just printed $260B in 2 months

3 rate cuts in 3 months

The entire treasury curve now below inflation- CB easing worldwide $13+ Trillion of negative yielding Bonds

Can anyone survey today’s world and feel confident that they fully understand it? Negative interest rates, political unrest, a global crisis in government legitimacy?

I think a lot about what may happen, which means thinking through potential scenarios such as I outline above. I am certainly intrigued about the potential demand for gold as a substitute for negative yielding bonds. It’s hard to say exactly what this would mean for the price of gold, but my best guess is higher.

Emerging Markets

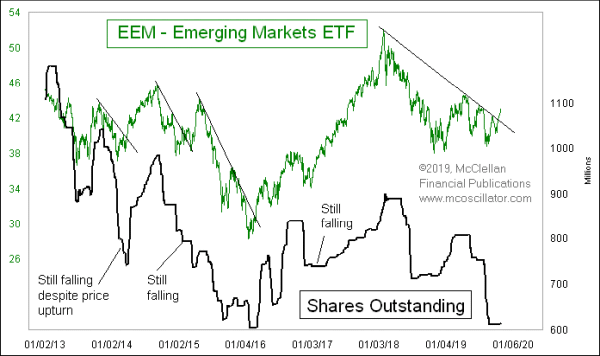

EEM has the fun property that when it disagrees with the SP500, that is usually useful information. When there is a divergence or other disagreement, EEM usually ends up being right about where both are headed.

The hint which EEM gave us recently was in the form of breaking its own declining tops line ahead of the SP500 breaking its downtrend line. It did this same thing coming out of the Dec. 2018 bottom, and in that instance, it had also shown a bullish divergence versus the SP500 by making a higher low…… are EM smelling Dollar depreciation?

One additional reason to expect the new uptrend to continue, is that investors are still not interested in coming back into EEM. Here is a chart showing that fund’s number of shares outstanding.

Market outlook

Fed and other central banks have already cracked open the floodgates of money-printing to provide liquidity to boost markets and/or cap yields. I think dollar index is headed lower to 92-93 levels (currently 98) which will lift all depressed risk assets. Emerging markets, Value stocks, Gold and silver miners and even almost dead Agri commodities.

The most important chart (DXY)….. it is all about DOLLAR

To Summarise

That powerful force of a coming Fed liquidity injection + another Fed cut to sustain the expansion caused a key reversal in the macro landscape where:

- USD topped out and is starting to depreciate easing the GLOBAL DOLLAR SHORTAGE

- Cyclical equities/commodities bottomed and have started to break out higher

- Interest rates bottomed and started pricing out future Fed cuts

- Yield Curves like 2s10s, that had been dormant, beginning to steepen

With that said, and this is just my own opinion, it is just a matter of time before the dam breaks, when the gap between asset inflation and economic growth is no longer tolerated.