“There are decades where nothing happens, and there are days (not weeks) where decades happen.” — Vladimir Lenin

$9.7 trillion in value has been erased from global equity markets since the late January peak.

World Equity Markets → Down $9.7 Trillion

Global equities have lost $9.7 trillion in value since peaking in January.

- 1/20/2020: $89.1 trillion

- 2/29/2020: $79.4 trillion

That means global equities have lost -11% from the peak.

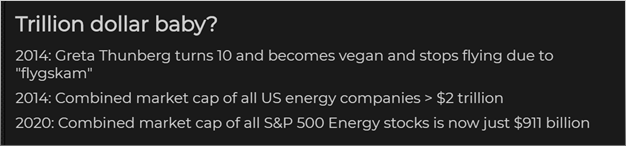

Greta Thunberg alone has chopped off a trillion dollar from Energy companies in last few years with accelerating market cap losses in last one year.

Dollar index is supposed to be a Safe haven during times of crisis, but it has not been able to breach 99 on upside. In fact, the funny thing is, whenever DXY touches 99 there is a global stock market correction.

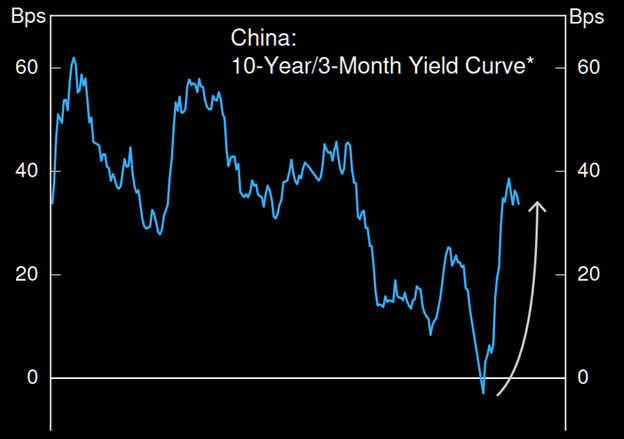

China yield curve steepened sharply in February hinting at a massive reflationary effort by People’s Bank of China.

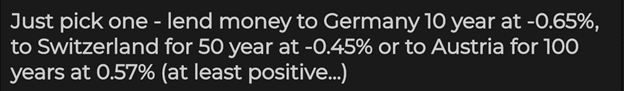

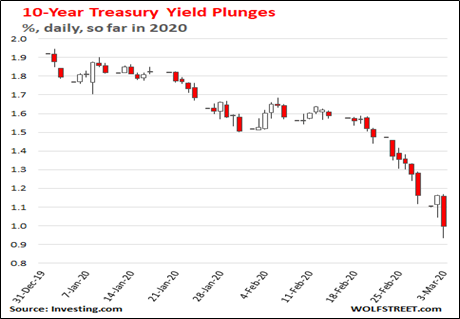

This is the kind of returns expectation you can have in Eurozone countries now. The situation is no different in countries like US where 10-year treasuries are now firmly below 1% yield.

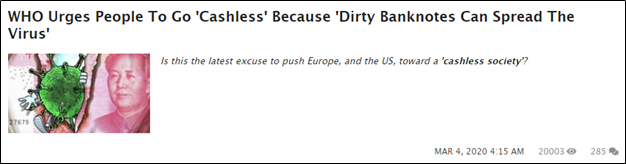

For negative rates to be effective you need to surrender your crumpled currency notes (which are still yielding ZERO not negative like bank deposits) in favor of digital currency. This will be the unintended consequence of Covid19.

So, the question global central bankers who hold $7 trillion in USD currency reserves are asking themselves is “when USD yields are closer to Zero then why not hold some GOLD in your reserves? (both yield nothing but one cannot be devalued).

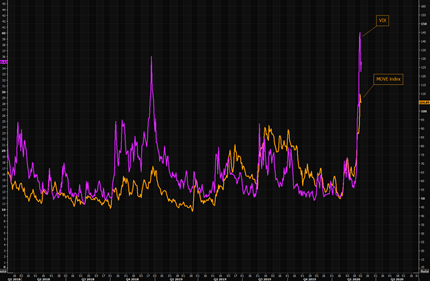

The chart below is of a surge in volatility of not only equities but also bonds. We saw the largest one-week increase in volatility since 1990, when the VIX started getting published.

Market Outlook

We are in new regime as explained by Chris Cole, founder and CEO of Artemis Capital.

Just few days before the global equity sell off began and Fed did a 50 bp emergency rate cut ( to kill the coronavirus, to support the economy, to support the stock markets) , Jerome Powell was pleading with politicians that he does not have any (monetary) tools left to fight the next recession.

In 2008, the bubble was NOT in global sovereign debt. It is NOW. If coronavirus causes a recession, authorities face a choice: Default on sovereign debt or bail it out. Neither option is negative for gold.

This isn’t widely understood yet but understanding of it is growing.