by Nordea Markets

When a central bank prints money and widens the monetary base for good, it ought to have a negative effect on the currency. If the Fed prints 4-5trn digital USDs through the rest of the year, it would be an increase of close to 20% of GDP. In comparison the ECB expects to print EURs equivalent to around 10% of GDP. Net/net this should be a USD negative story.

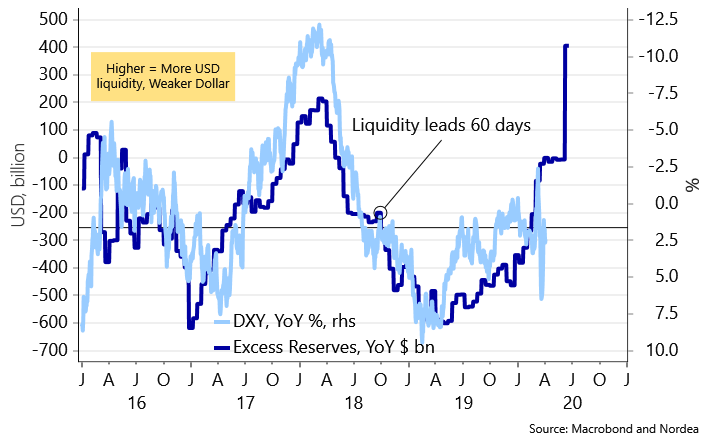

Currently, enough USDs have been printed to lead the DXY index 10% weaker on historical patterns. And this is before accounting for all the money printing that will occur over the coming quarters. The USD probably just needs a green light to weaken from other factors, before this liquidity effect will really kick-in.

Chart 4: Enough USDs have been printed to weaken the dollar by almost 10% now

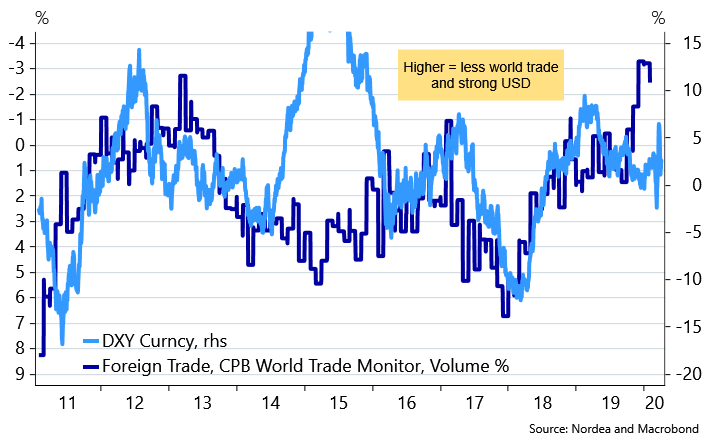

Due to low commodity prices and less global trade, fewer USDs change hands globally and consequently this results in a marked drop in the velocity of USD liquidity, which is one of the reasons why all these liquidity facilities from the Fed are needed. Usually the USD strengthens around 10%, when global trade drops 4-5% as we are currently seeing. Accordingly, the velocity of USD liquidity will not increase again before the global trade rebounds, which is likely a post-lockdown story. Many places are likely to remain locked down for another 4-6 weeks in our view. Once we are out of this mess, the USD could be hammered.

In very prolonged curfew scenarios, the USD will likely remain stronger for longer.

Chart 5: When global trade slows the USD gains, since fewer USDs will float in the global financial system

Should the USD lose its momentum and start a weakening cycle, this would also entail tailwinds for commodities in general. Usually the broad commodity index is a double beta to the DXY index. If the USD weakens 10% then the broad commodity index gains 20%. It is probably not a bad idea to consider adding long broad commodity positions during the second half of 2020.

Chart 6: Commodities usually gain times two, when the USD weakens

A new USD cycle with consequences for asset allocation?

A stronger dollar generally tightens financial conditions outside of the US, which is kind of counterintuitive since that weaker currencies outside of US in principle should lead to a competitive advantage. Some mentionable reasons why a strong USD is bad news for growth are that i) EM countries have borrowed in USD, ii) firms who have borrowed in dollars see debt burdens grow in local currency and iii) the financial sector also empirically becomes less keen to lend out when the USD is strong.

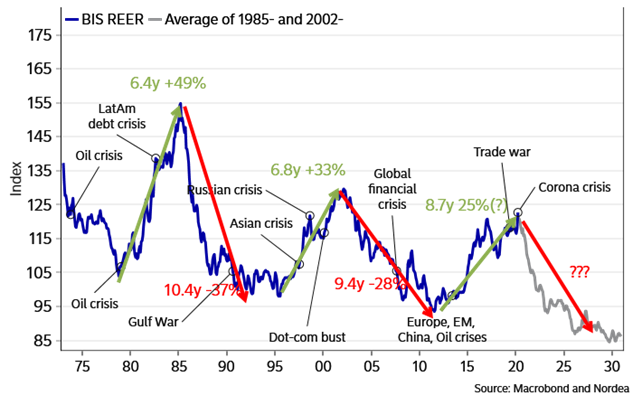

During recessions or times of crisis a strong USD usually builds until a weakening wave takes over. This is exactly what we imagine could happen again this time around. The trade war and corona crisis respectively worked to tighten financial conditions outside of the US alongside the strong USD, and once the crisis is solved it paves the way for a weakening USD trend.

If a new weakening cycle is coming in the USD, it could prove to be lengthy and material. The two most recent USD weakening cycles led the USD BIS REER index approximately 30% on average over a 8-10 year period.

Chart 7: USD cycles from 1970 until today. Usually cycles are lengthy and material

A strong USD usually underpins the return of US equities relative to European or Asian equities, since a strong USD is bad news for financial conditions outside of the US, while the domestically driven US economy usually fares more than OK despite a strong USD.

Hence the direction of the dollar is quite important for asset allocation decisions as a new USD weakening cycle could lead to US underperformance versus rest of the world. During the two periods where the dollar showed a long weakening trend, the S&P500 underperformed the MSCI EAFE index by 15% (1985 to 1995) and 25% (2002 to 2011), while the S&P500 overperformed like crazy during eg the most recent USD bull cycle. We wrote more about in this piece from 2018.

If the USD cycle turns negative, it may make sense to consider underweighting USA already within the next couple of quarters. We don’t necessarily think that a weak USD is right around the corner due to continued curfews, but 6-12 months out we think the tide has turned and structurally it is better to position a little too early than a little too late.

Follow our weekly FX series for continuous esoteric USD liquidity updates.

Chart 8: S&P 500 versus MSCI EAFE (Europe, Australasia and Far-East) and the USD. When the USD is strong US equities outperform and vice versa.