As the Long-term debt cycle dynamics become more important as the day passes. This crisis has been one where we have had demand and supply side contraction at the same time. The current scenario signals deflation and may also render previous inflation indices meaningless.

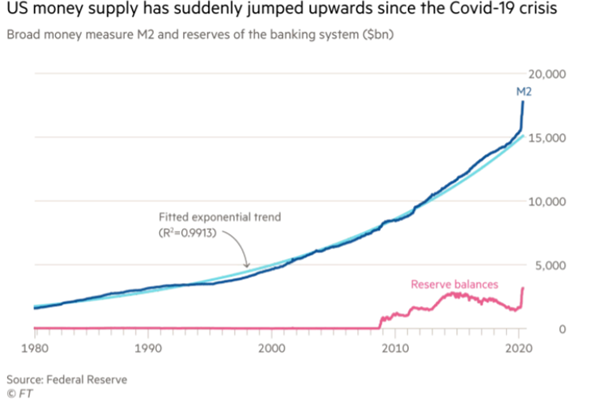

While previous money printing by central bankers had to led to hyper inflation , Current US M2 shows large jumps in growth , so a combination of constrained output along with rapid monetary growth may signal inflation , if velocity of money follows an uptrend. However , just like the last bout of inflation in the 1970s an unexpected surge in inflation might come about as supply chains fray. The supply chains are concentrated and more fragile than ever before, for example the shutting down of one Tyson food plant had affected 4 to 5% of pork supply in the US.

The probability of highly fragile structures failing and leading to inflation cannot be downplayed and deserves a much important role in portfolios. As a trader remarked on CNBC that the bond market almost universally expects deflation which means there will be inflation.

The problem is if we see the worst possible outcome i.e STAGFLATION. The supply chains are going to be reshored, inventory buildup is no more going to be Just In Time but more long term and this will increase the use of working capital. I agree, the demand will take time to recover, but for STAGFLATION, you don’t require high demand but a reduction in supply.

I believe the outcome of COVID will be a STAGFLATION and don’t count on bond markets to tell you that because any signs of INFLATION/STAGFLATION will lead to capping of yield by central bankers.

In the chart above of US 10 year treasuries you can see that yields are now confined to a range. whether by design or market forces will determine the future performance of different assets.