Federal reserve Bank dusted an old trick to kill two birds with one stone.

Federal Reserve Bank of New York President John Williams said policy makers are “thinking very hard” about targeting specific yields on Treasury securities as a way of ensuring borrowing costs stay at rock-bottom levels beyond keeping the benchmark interest rate near zero.

“Yield-curve control, which has now been used in a few other countries, is I think a tool that can complement -– potentially complement –- forward guidance and our other policy actions,” he said in an interview Wednesday on Bloomberg Television with Michael McKee and Jonathan Ferro. “So this is something that obviously we’re thinking very hard about. We’re analyzing not only what’s happened in other countries but also how that may work in the United States.”

This will not only ensure a lower value of USD and increase the inflation expectation but also lower the DEBT/GDP by inflating away the debt.

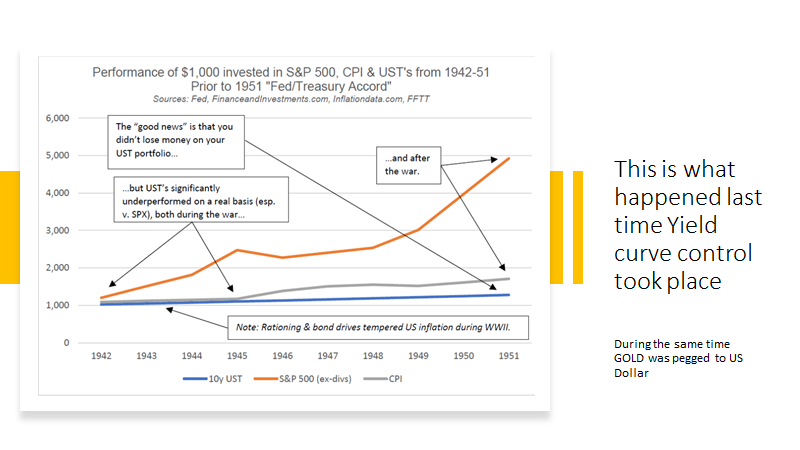

The same remedy was applied by US in aftermath of WW2 nation building.

The default on bond obligation was more nominal than real. With cap on bond yields and increase in spending, the real interest were negative for better part of decade. The smart money went in search of returns and that decade was one of the best period for US equity markets as higher inflation and lower bond yields coupled with war spending led to higher corporate earnings and reduced the over all Debt/GDP of the US economy.

Conclusion

Fed is increasing floating trail balloons about yield control and I believe we might see the post WW2 playbook again which will lead to -3% to -5% real rates in US in next few years. This will be the decade when real assets makes a come back.

Please provide another email id which can be used for a more extensive discussions.

riteshmjn@outlook.com