Time for a new chart

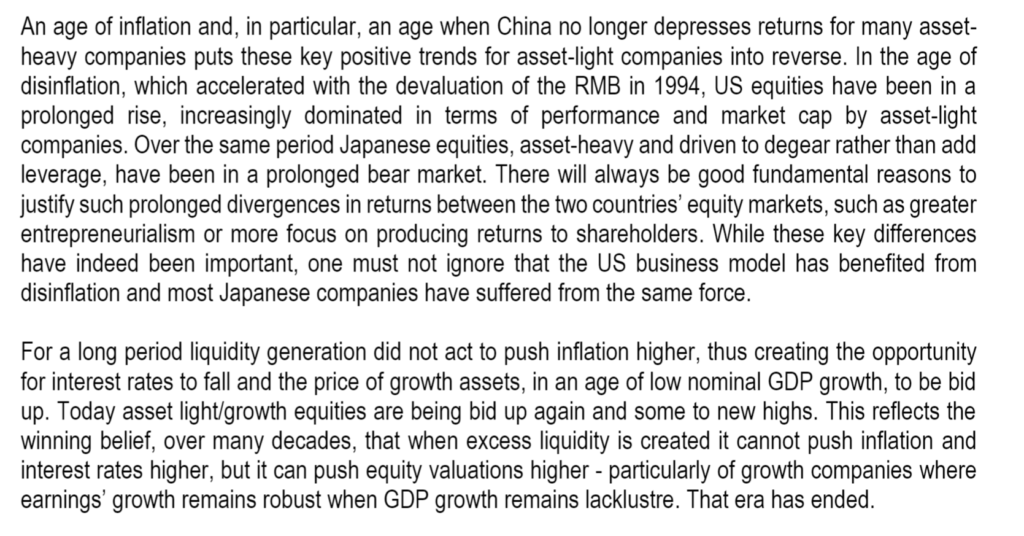

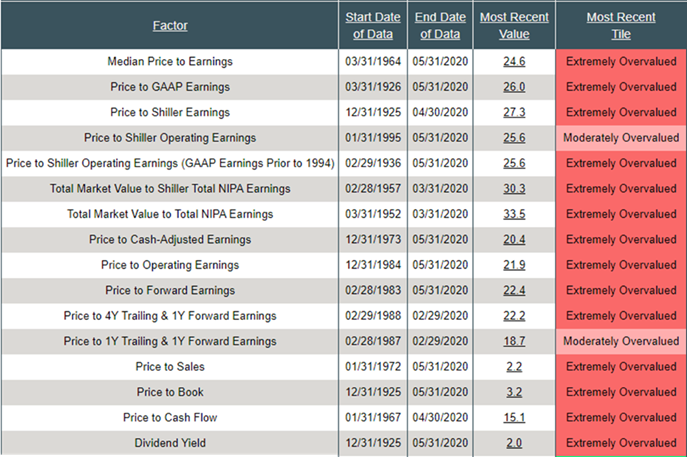

While not exactly a chart but Russell Napier has changed his view and wrote an article titled ” The dawning of age of inflation” . He expects the inflation to cross 4% in developed world by 2021.

A key reason the US middle & working classes have seen stagnant relative real income growth over the past 45 years, in a single chart.

Trade and Tariff barriers are coming back

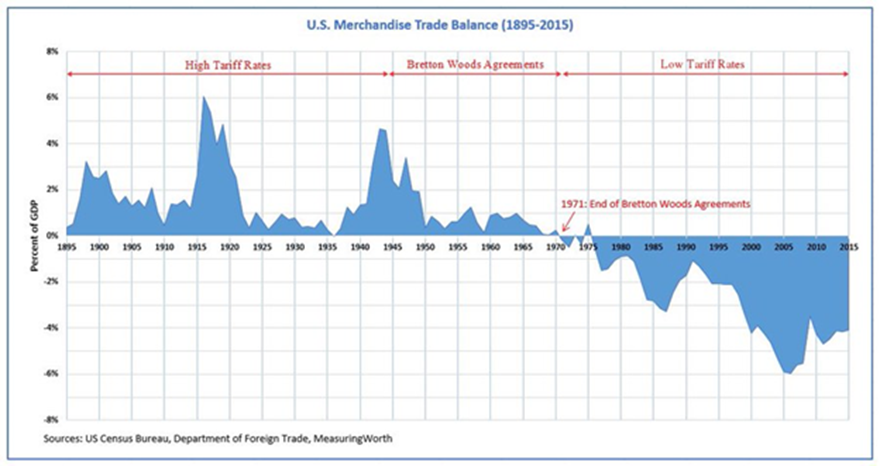

Let’s talk about valuations. Forward price-to-earnings (P/E) sits at 22.4. Median P/E (my favorite indicator, which looks at actual trailing 12-month earnings) sits at 24.6. For comparison purposes, the 52-year average, call it “Fair Value,” is 17.3. That suggests the S&P 500 Index’s fair value is 2,134.06. More than 30% below today’s level of 3,202. And it’s not just price relative to earnings. It’s price-to-sales, price-to-operating earnings, price-to-book. Price-to-everything is expensive. Here’s a look (red is bad):

Hi. I don’t think we can simply use avg PE of last 52 years. Pls correct me if I am wrong. Given the lowest int rates in history, multiples will automatically be higher. I don’t know how much if an increase in multiple is justified by the lower rates, maybe you can help me.

yes you are right and P/E is a function of interest rates, but suffice to say that with interest rates at zero and earning growth stagnant for next couple of years free money cannot goose the P/E perpetually

On interest rates. Lower interest rates mean lower future returns, both in bonds and stocks. If stock valuations climb due to low interest rates on bonds it also lowers future returns on stocks.

So if you are happy with earning nothing on bonds the next 10-20 years, you must also accept you will earn zero total returns on stocks for at least the next 10 years – best case scenario.

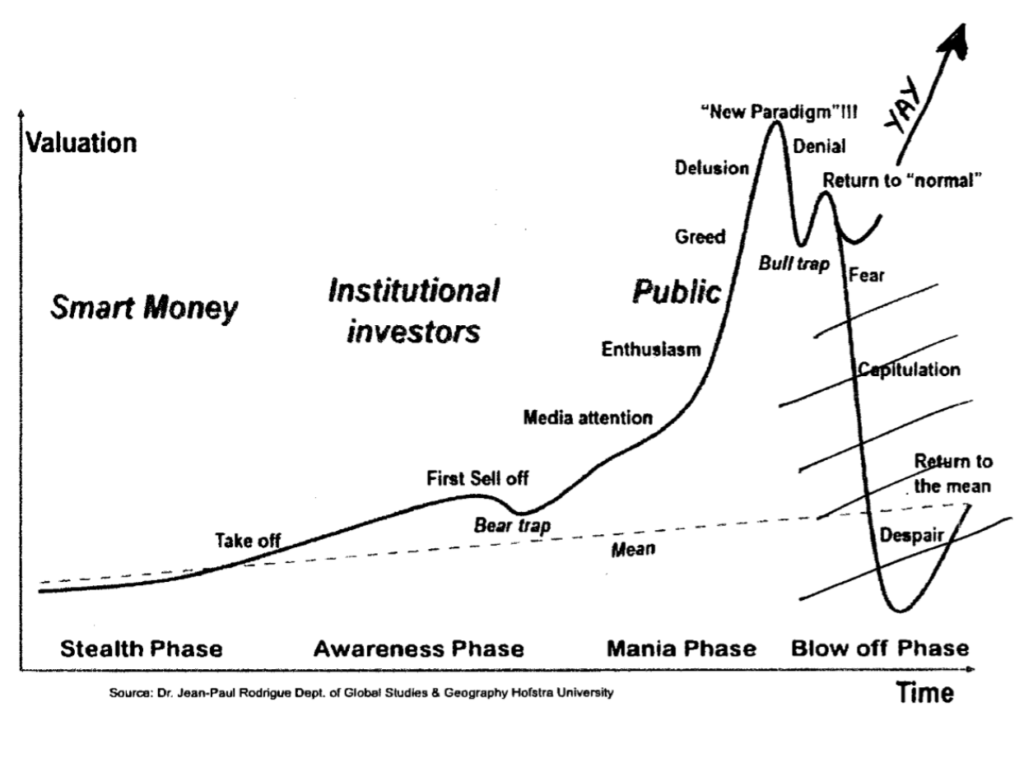

We now have an over-indebted system that can not handle asset prices crashing and the Fed knows it. So $3 trillion in 2 months is just a start. And yes money is being devalued and it will show up soon.

completely agree whenever this euphoria rally will be over unless we have either a war or a natural calamity to rebuild economy we might be looking at a decade of no returns