Russell Napier wrote a piece on the above subject which I have summarized below

Q1 2009 Russell advised holding US equities till inflation reaches 4% .By 2011 , he saw problems in global banking system that would result in anemic credit growth making deflation a likely outcome. Inflation peaked below 4% in 2011 and by early 2015 US was reporting mild deflation.

The journey of inflation from 4% to 0 was not negative for the equities as a whole , it was negative only after inflation declined below 1% and corporate earnings declined.

We are currently in a deflation shock but by 2021 Inflation in developed world will be at or near 4%.

In Q4 2019, the conclusion was made that rising inflation would bode well for European equities, however a deflationary forecast was made. Since Q4 of 2019 we have had deflation shock with more to come causing equity prices and inflation linked bonds to move lower. European markets are pricing in even more low inflation but the forecast is that inflation will be near 4% in Eurozone which leads to a bullish call on European equites.

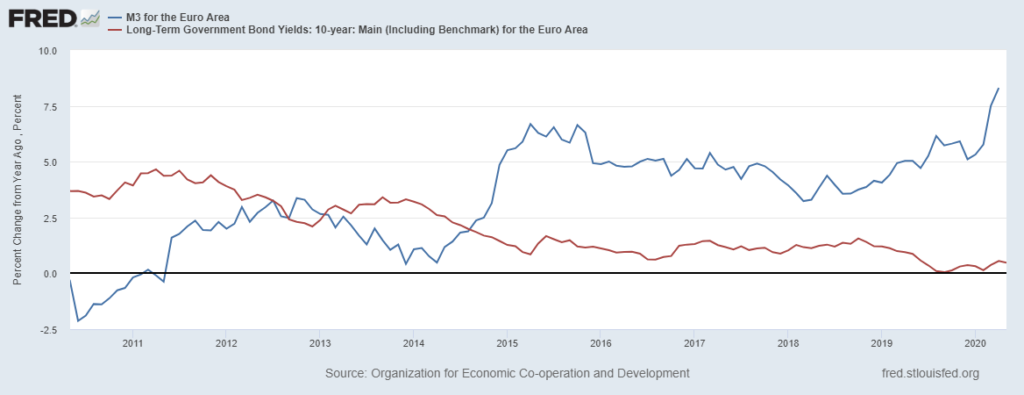

In eurozone bank credit guarantees have not yet fully impacted broad money growth, hence eurozone broad money growth will go higher. Eurozone M3 is already growing at 8.9% YoY and will exceed 2007 peak in after a few months. The other view by analysts is that as emergency programs subside surge in broad money growth will be an aberration and not impact inflation. The forecast is however as politicians use commercial banks balance sheets to launch new initiative backed by loan guarantees, these temporary measures will likely become permanent. Cautious investors would like to confirm the permanence of such schemes however Russell suggests it is time to embrace this new reality before its permanence is confirmed.

Case in point Spanish governments credit guarantee program has extended from $100 to $150 billion already.

The silent revolution as termed by Russell is the permanent shift of power of money creation from central bankers to democratically elected politicians. The incentive structures and mandates of politicians aligns with control of money supply through commercial bank balance sheet control. This means higher long-term interest rates even though near-term outlook is deflation.

The silent revolution will be priced in by the markets much before inflation actually shows its whites.

So current course action is to hold equities as market discounts the silent revolution with a lag. The equites may not rise all the way till inflation reaches 4%. It is highly unlikely governments would accept the accompanying long term interest rates corresponding to 4% inflation. As total debt to gdp ratios in both government and private sectors is at highs even before covid 19. These high debt levels can crush the reflation trade if interest costs rises dramatically, hence yield curve cap will be implemented

At levels of annual inflation above 6% , velocity of money could go out of control and with it ability for inflation to be tamed. Russell assumes governments may not want inflation to spiral above 6% , thereby the long term interest rates could be allowed to rise till 3%. The success of a repression is based on gap between inflation and interest rates. He suggests that even if inflation is allowed to rise as high as 6%, expect aggressive moves to tame it even as long term interest rates reach levels of 2 to 3 %. Allowing interest rates to higher levels too slow a deleveraging or a need of inflation that is too destabilizing.

In a world of rising inflation expectations central bankers will not be able to control long term interest rates. A cap on interest rates would be implemented by forcing savings institutions to buy government debt at targeted yields. Many believe that the combination of capped yields and rising inflation will be positive for equity prices , that will depend on what the saving institutions will have to liquidate to make way for the government debt , which is most likely to be equities. As yields get capped for decades the liquidation can be very prolonged.

Conclusion being that Equities will benefit on road to inflation. Move to cap rates between 2 to 3% can come before inflation reaches 4%. yield curve cap will be implemented by forced purchases of bonds by savings institutions which will have to sell equities to create space for bonds. In nutshell enjoy this equity ride till inflation touched 4%.