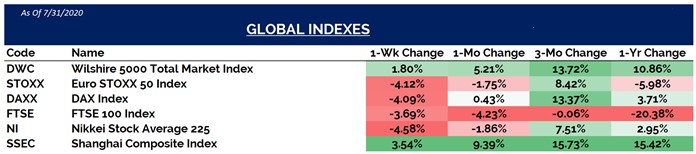

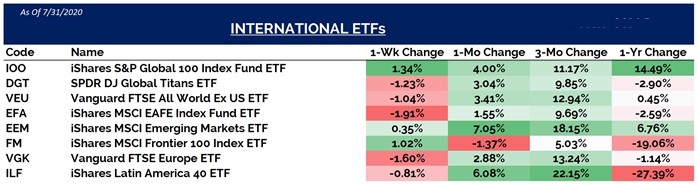

The Global Stock Market rally continued through July with the exception of Japan. The EU agreed to a 1.82 Trillion Budget of which 750 billion Euros is Coronavirus Aid, 390 billion Euros is grants & 360 billion euros is loans. Meanwhile US stimulus negotiations seem to yet to result in any deal.

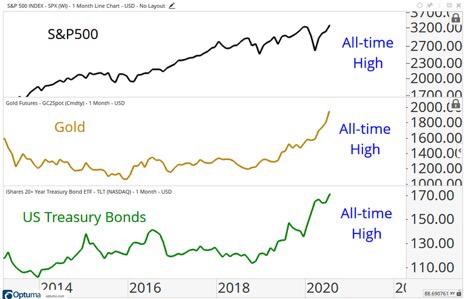

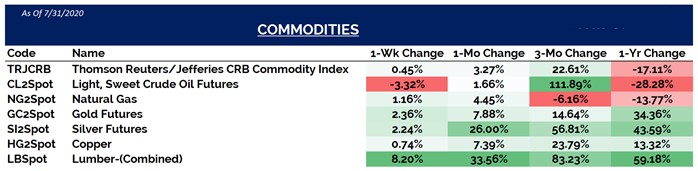

All of this talk of stimulus and investors realizing the gravy train has just begun has led to gold rallying to $2000 an ounce. With more and more trading houses coming out with even more bullish forecasts for gold. The out performer however was Silver which went up 25% in July beating Gold which 9.63%.

We also got to see the impact of lockdowns on the economy. US Q2 GDP declined by a whole 32.9% which is now being considered the worst drop in history with the previous one being in mid-1921.

The Eurozone was no different with the economy contracting by 12.1% in Q2 2020 which is the lowest since 1995. Thus, the impact of lockdowns on GDP become clearer.

Overall S&P Global Ratings forecasts a decline in Global GDP of 3.8%. This is obviously a moving target because of uncertainty related to future coronavirus lockdowns.

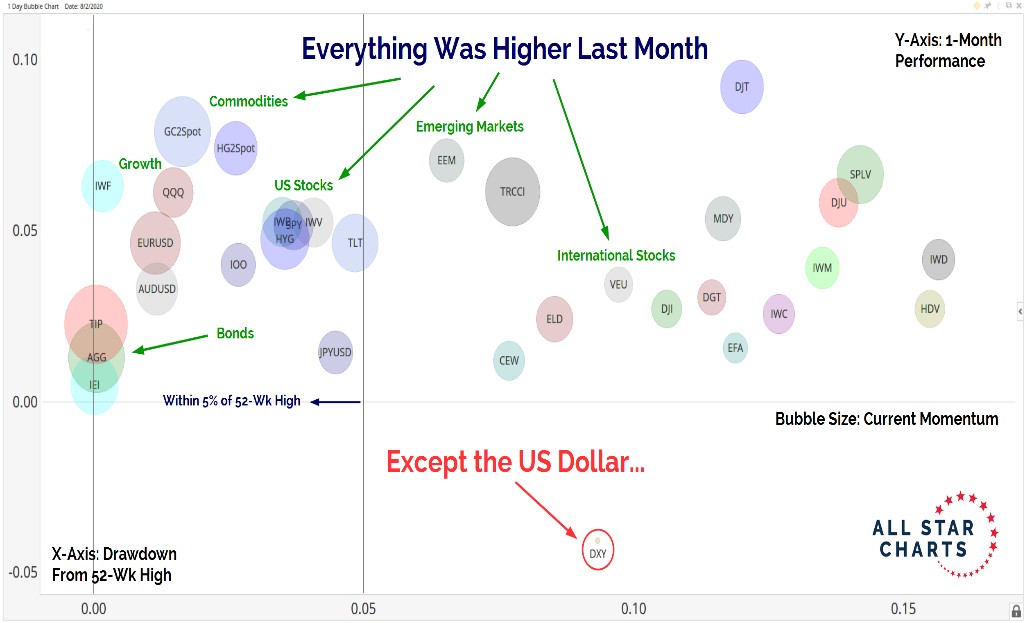

The main story of the month is undoubtedly the US dollar Index reaching a low of 92.55 before recovering to 93.35 levels. This is the biggest 1 month drop (-4.15%) in the index in a decade, meanwhile euro rose by 11% from its may levels with its best monthly performance in a decade. This can be the start of the dollar deprecation cycle and thereby lead to rotation of liquidity flows into value from growth and Emerging markets equities from developed world.

Monthly Market Indices

US Reserve Currency status at Risk, as gold surges: Goldman Sachs

As governments are debasing their currencies and real interest rates are reaching all-time lows, gold has had a record-breaking rally.

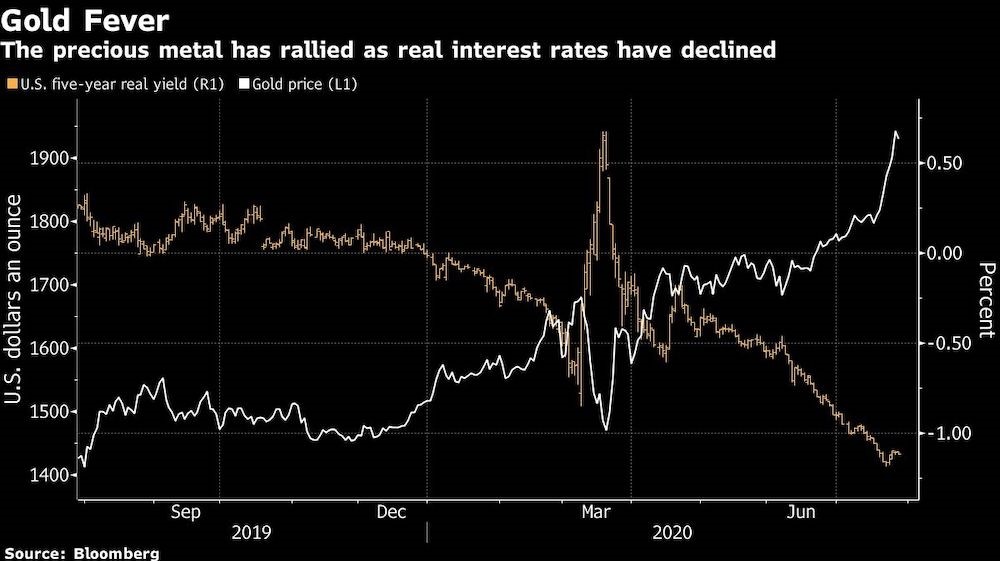

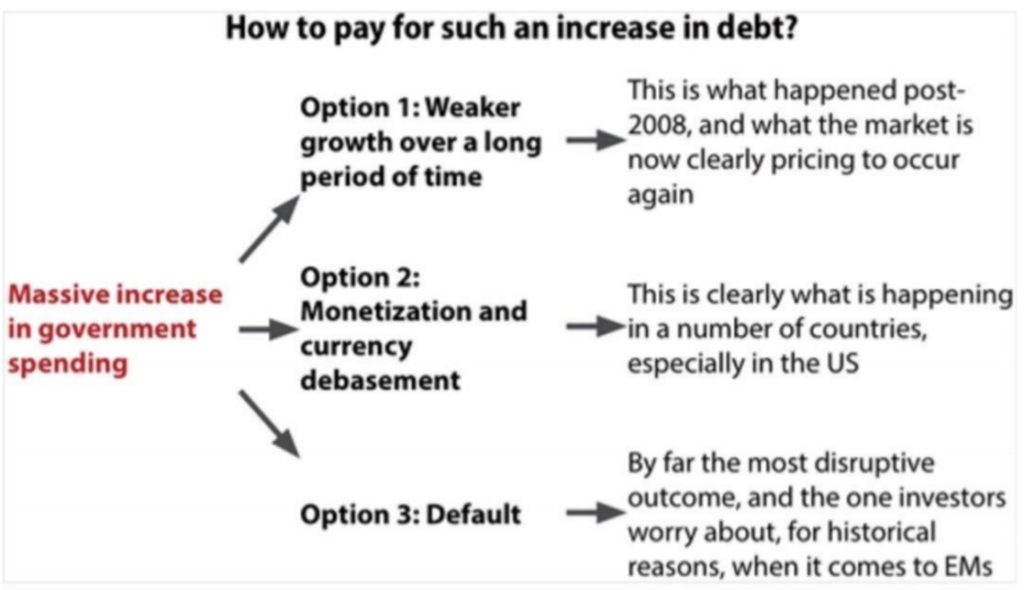

Goldman Sachs commodity strategist Jeffrey Currie, wrote that “real concerns around the longevity of the US dollar as a reserve currency have started to emerge. “The argument is along the same lines that US Debt to GDP ratio has exceeded 80% which may lead to government, federal reserve allowing inflation to accelerate. Its because inflation allows central banks and governments to reduce accumulated debt burden.

As time progresses and the market realizes the amount of debt racked on by governments worldwide and the unsustainability of it, people will flee even more to asset classes which they consider as stores of wealth.

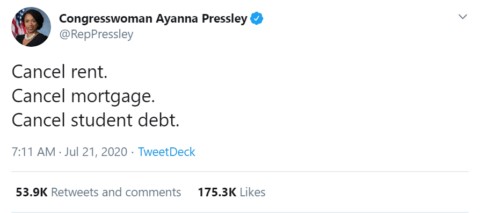

With populism on the rise and a future MMT implementation in the works where politicians take control of the money supply. All roads line up to one thing which is inflation and as productivity levels decline due to structural reasons and fail to recover, we might be staring at stagflation. The geopolitical tensions between US and China are rising, with escalatory moves ,de-dollarization to accelerate which is positive for gold.

The unrest breaking out in many states inside the US is also causing an increase in uncertainty. We have high unemployment rate along with lower median wages and low labor participation rate in an election year, the combination just add to the list of issues.

All of these coupled with plunge in real yields are very bullish for precious metals and real assets. We believe that the rally of gold and silver is in the initial phases and has so much more to go in coming years. Just like 1942-51 we expect real yields to reach -3 to -4% in coming years keeping relentless bid under yellow metal which is nothing but a perpetual Zero coupon bond.

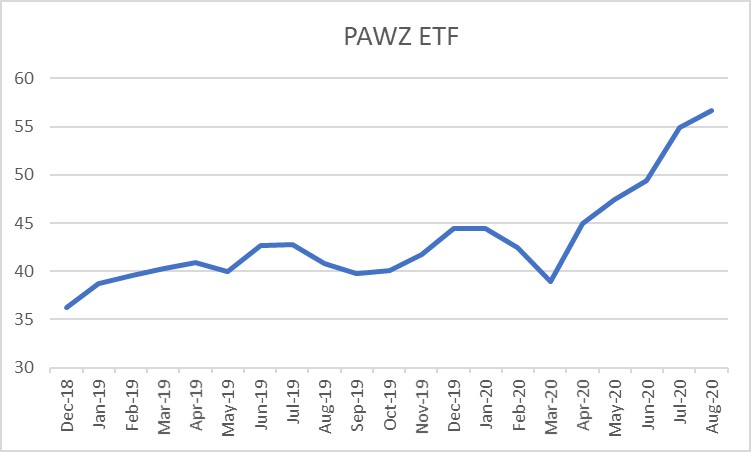

No Pause for Gains in PAWZ

The Proshares Petcare ETF(PAWZ) hit an all time high with a YTD gain of 20%. It is the first and only dedicated pet care and retail ETF.

Almost 67% of families in US have pets and the trend has been accelerated by the pandemic as more families and seniors are looking to pets as a companion. From 2013 to 2018 even while annual incomes increased by 23% pet spending increased by 50%. With Global Pet industry sales forecasted to grow even further PAWZ is good bet to capitalize on this trend.

Are we heading towards Inflation ?

As the federal reserve and congress push efforts to stimulate the economy, M2 growth has reached 23% on YoY basis.

While this is in response to the pandemic, higher money supply growth has been linked to inflation. However, there is an even broader trend of shift of money creation away from central bankers. As pointed out by Morgan Stanley chief U.S. equity strategist Mike Wilson -The “Fed may not be in control of Money Supply growth which means they won’t have control of inflation either, if it gets going,”.

Now we previously had Quantitative easing by the central banks, but it only led to increase in Debt to GDP and did not lead to growth in real GDP as the money did not circulate in the economy.

The power is now shifting from central bankers to governments. Where they are now taking on Contingent Liability and offering to bail out any default on principal which is leading to circulation of money by commercial banks . These bank credit guarantees solve the problem of quantitative easing by directly lending to the real sector.

This mechanism is the real money magic tree and politicians will not relinquish this power. The incentives of the politicians are linked to getting elected and not to any macroeconomic stability related variables like inflation.So, for elected politicians, credit guarantees is a cheap way of funding an economic recovery and green projects.

All these changing trends are already being reflected in assets like gold, silver and cryptocurrencies along with inflation expectations which are increasing rapidly.

Capitalism turning into socialism

Even Mr. Russel Napier, an avowed deflationist for the previous decades has changed his stance. He outlines that “Politicians have gained control of money supply and they will not give up this instrument anytime in near future”. Napier says” In his view, we are at the beginning of a new era of financial repression, in which politicians will make sure that inflation rates remain consistently above government bond yields for years. This is the only way to reduce the crushing levels of debt.”