As the year draws to a close, most financial market players like to project themselves forward and attempt to figure out what challenges, or surprises, the upcoming year may have in store. The aim of this piece is to do precisely the opposite: instead of looking forward, I propose to look backwards at the important changes of the past year. Some changes (especially the first couple) may seem obvious. Yet they are important enough to warrant a mention. Other important shifts in 2020 may have gone unnoticed (even if highlighted in our research!) and could end up casting a long shadow.

A dramatic shift in Western economies’ fiscal policies

In 2020, Western governments spent money like never before and promised to continue doing the same through 2021. Thus, for Keynesians, these are exciting times. And more broadly, too, for as my friend Jawad Mian recently wrote in his Stray Reflections piece:

“America’s response to the coronavirus pandemic revealed something true, says Astra Taylor, co-founder of Debt Collective, a debtors’ union fighting to cancel debts. “So many policies that our elected officials have long told us were impossible and impractical were eminently possible and practical all along.” Evictions are avoidable; there’s shelter for the homeless in government buildings; water and electricity need not be cut off for late payments; paid sick leave can be statutory for everyone; missing a mortgage payment shouldn’t result in foreclosure; and debtors can be granted relief. Political action is possible; it needs will. Multi-trillion-dollar programs were mobilized quickly in this emergency, and it will be near-impossible to put that spending genie back in the bottle…”.

The fiscal spending genie is indeed out of the bottle and there is no political will in the West to stop it from “working its magic”. Governments will thus keep spending other people’s money until they run out of it. With the “other people” being the central banks. Now importantly, in a recent must-read piece, my colleague Tan Kai Xian showed how, for all intents and purposes, US store shelves, along with procurement centers, are empty (which, on anecdotal evidence, feels broadly right as stores seem to be missing many items). And half-way across the world, my other colleague Dan Wang basically confirmed the same thing when talking to Chinese manufacturers. The Covid-linked disruption to supply chains has meant that in many industries, Chinese manufacturers are struggling to keep up with orders from Western clients. This may help explain China’s soaring export numbers, despite the renminbi having been strong.

Needless to say, empty shelves and stretched supply chains are not the typical backdrop for a recession. But even if we lack the “typical backdrop”, it seems pretty clear that policymakers can be relied upon to deliver the “typical recession answer”—namely print more money and expand budget deficits.

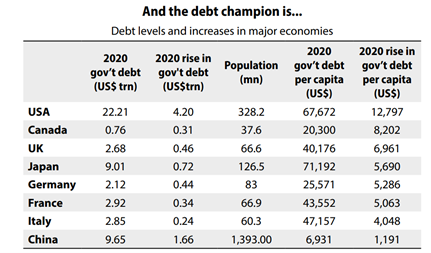

So what next? Runaway fiscal spending will keep most Western currencies under pressure, especially the US dollar since the US economy has seen the biggest rise in debt.

Initially, the weaker dollar will be reflationary for the rest of the world and generally welcomed with glee. At some point (given dislocated supply chains, maybe sooner than later), the weaker currencies will start to trigger higher inflation. Central banks with falling currencies will then face the choice of either letting their domestic currencies continue to bear the brunt of the above spending (and gradually sink into irrelevance), or choose to defend their currencies and trigger a bond market and broader asset price meltdown.

Interestingly, US inflation expectations are already rebounding (see left-hand chart below). So will the Federal Reserve be forced to reveal its hand earlier than most expect?

Embracing MMT (the magic money tree)

As the world ground to a halt in March, the Fed injected more than US$3trn into the US treasury market in a few weeks. For the first time, it also started directly buying US corporate bonds. Confronting these unprecedented actions, the obvious questions for investors is whether the Fed was aiming to (i) stop US growth from collapsing, (ii) stop the US equity market from collapsing, or (iii) stop the US bond market from collapsing.

Now granted, the answer is likely to be yes to all of the above. But if so, this marks a key difference from past cycles when, in a crisis, the government bond market would be strong and could be counted on to reduce portfolio volatility. In fact, for 40 years treasuries were the “anti-fragile” asset of choice. Then in mid-March they stopped doing the job that was expected of them (see right-hand chart below). In response, the Fed stepped in with unprecedented firepower.

All of which brings me to this interesting quote from Randal Quarles, the Fed Vice Chair for financial supervision:

“It may be that there is a simple macro fact that the treasury market being so much larger than it was even a few years ago… that the sheer volume there may have outpaced the ability of the private market infrastructure to support stress of any sort there… There is thus an open question about whether there will be an indefinite need for the Fed to participate as a purchaser to support market functioning.”

Of course, one could launch an interesting philosophical debate on whether a market that needs constant government intervention to function is really a market. I will spare readers that detour and instead conclude that current monetary policy means that the US bond market (along with its European and Japanese equivalents) survives due to the good grace and generosity of central banks. Which brings me to a fairly obvious conclusion: either central banks decide to remain generous, and bond returns should broadly flatline (as since early April 2020). Or alternatively, one day, central banks will decide that they now need to support their currencies instead of supporting their bond markets. In this scenario, bond markets will implode. In short, following the massive intervention of central banks, government bonds all across the Western world have now become “return-free” risks.

China blasts its own policy path

As the rest of the world becomes more Chinese (stay-at-home orders, smartphone tracking of individuals, church services closed and commercial banks forced to lend to firms on noncommercial terms), China’s response to the Covid crisis has been far less expansionary than its reaction to either the 2003 Sars outbreak, the 2008 global crisis and its own 2015 equity bubble burst. China’s response to the Covid crisis not only goes against the current of its own recent history, but also against the trend of all major Western countries.

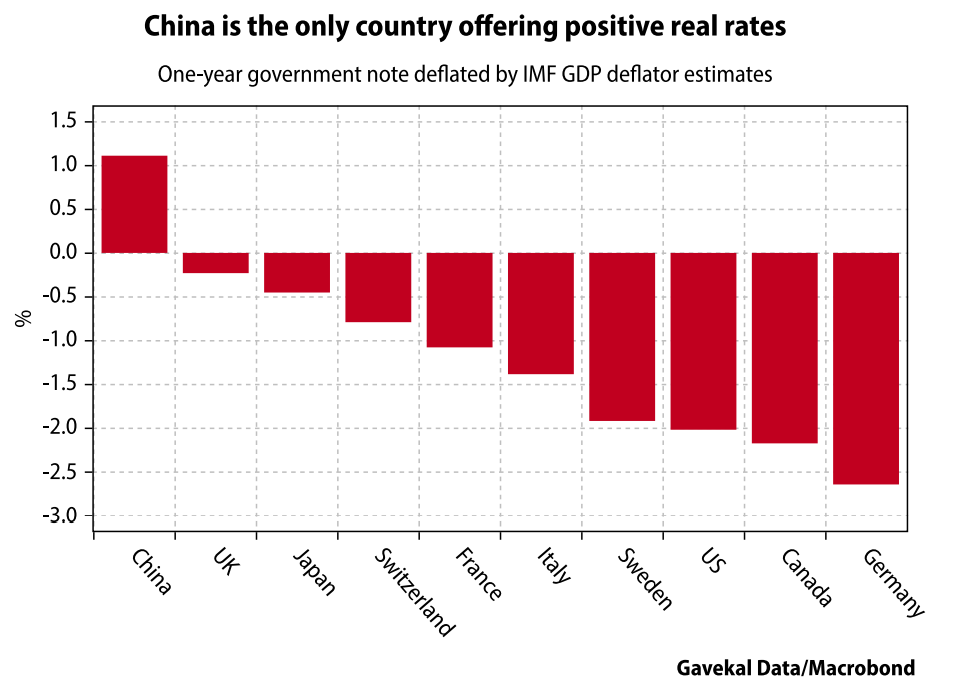

Throughout the year, we have updated readers on the reasons behind this important policy paradigm shift, whose obvious immediate consequence is that China is now alone among major economies in offering global investors positive real interest rates.

Just as water flows downhill, capital tends to flow to where it is best rewarded. Foreign investors are buying more Chinese government bonds, with their ownership share of the market doubling from 1.5% to almost 3% in the last 18 months.

These inflows have helped push the renminbi higher. For this unfolding trend to stop (lest we forget, in financial markets, all too often, the trend is a friend), one of the following will likely have to occur:

- A fall in Chinese real bond yields: This could follow a big leg down in global growth, which would trigger gains in Chinese bonds, or a sharp rise in Chinese inflation (unlikely given the strength of the renminbi).

- A rise in Western real yields: This seems a low-odds scenario, with real yields more likely to fall further as year-on-year inflation comparisons in the upcoming spring and summer point to rising prices.

- A tightening of capital controls in China: For now, things are going the other way, with China realizing that it needs to dramatically, and rapidly, reduce the dependency of its economy on the US dollar.

- Imposition of capital controls by Western economies: Facing the Sophie’s Choice of having to sacrifice either their currency or their bond market, could Western policymakers chose instead to impose capital controls on their populations? After the events of 2020, who is to say what is inconceivable, and what is not.

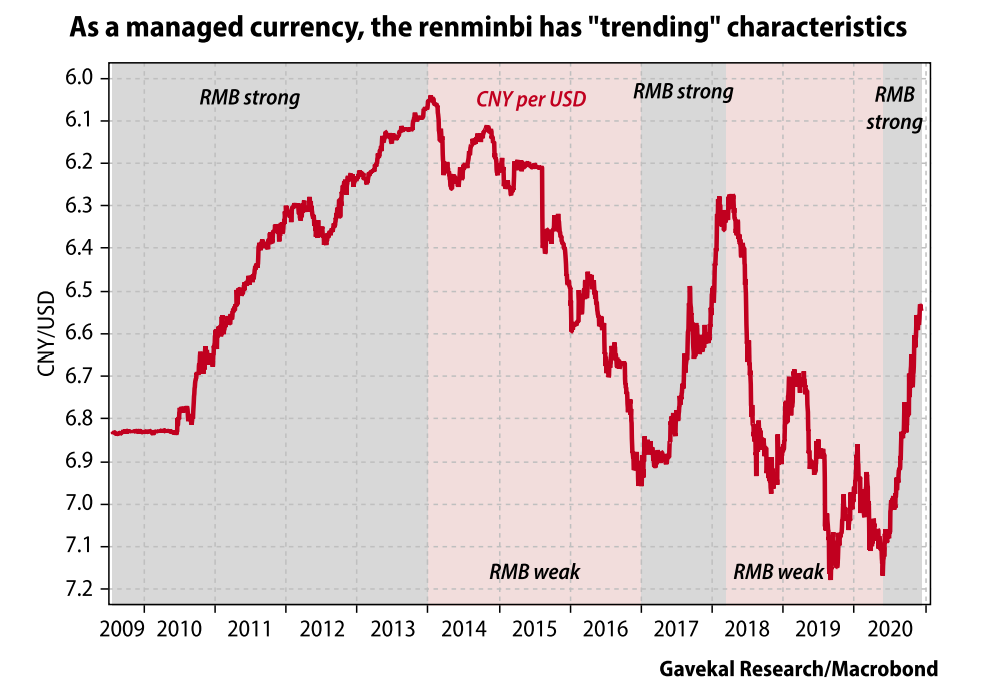

A change in renminbi policy?

The renminbi is still a managed currency and, as such, has strong “trending” characteristics (see chart below). Another interesting feature is that it tends to “flat-line” when the outlook is uncertain. For example, after the 2008 US mortgage crisis—and until the world was clearly back on its feet by the summer of 2010—the exchange rate was fairly steady against the US dollar at around CNY6.82. A similar thing happened in the spring and summer of 2015 around the time that Shanghai’s equity market bubble burst (the renminbi flat-lined at around CNY6.2 to the US dollar). Yet, in the past six months, against an uncertain backdrop, the renminbi has registered its best six-month rebound on record.

This sharp rally raises the question: are we seeing an important change in the Chinese and global macro landscape? And if so, what are the investment implications.

A stop to Ricardian growth?

The thesis of Gavekal’s first book back in 2005 was that the ability to measure everything in real time meant successful companies would outsource all parts of their business processes in which they did not have the highest possible returns on invested capital. We used the term “platform company” to describe the firms of the future that focused mostly on design and/or sales, while outsourcing capital and labor intensive production to others. In such a world, supply chains would become ever more stretched across the globe.

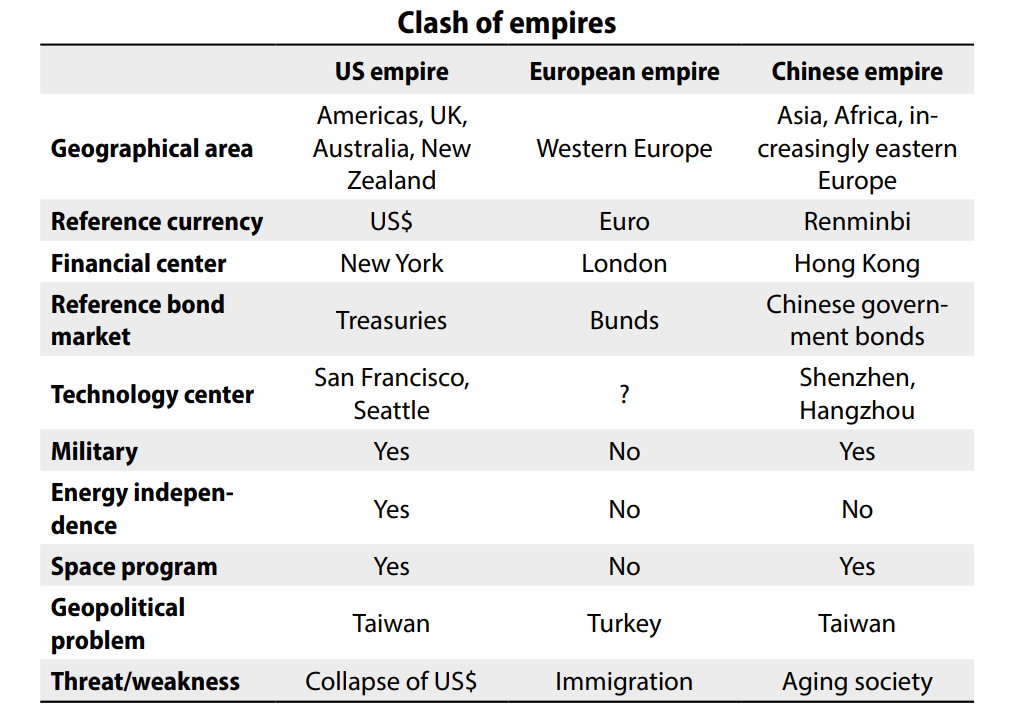

The publication of Clash of Empires at the start of last year marked a bookend to that period. No longer would supply chains be stretched across the globe. Instead, the world would break into three separate economic zones, each with their own currency of reference (US dollar, euro and renminbi), financial capital (New York, London, Hong Kong), bond market (treasuries, bunds, Chinese government bonds) and their own supply chains.

But this breakdown would present challenges.

- For Europe, it is the lack of an army, space program or serious tech center. Also, after Brexit, its financial center will be outside its immediate borders.

- For the globally-integrated tech world, the problem is that the US has identified this as a key battlefield for confronting China.

But this tech war is now having broader consequences. In one of the best pieces we published this past year, Dan Wang makes the following point.

“Chinese companies shudder at the thought of suffering the same fate as Huawei, which at a stroke found that it could not procure many of the components it needed to make its products. That has shown Chinese companies in all industries that reliance on US supply is a potential risk… Because the US government has introduced the possibility that supplies might be cut off at any time, Chinese firms are starting to look more at US competitors, in China as well as the rest of Asia. One sales manager at a US chemicals company confessed anxiety about this trend, as the high quality of its products is no longer a guarantee that customers won’t switch to another vendor.”

To put this another way, for 20 years, every company’s procurement process was driven by the price-to-quality ratio: could a potential supplier produce an adequate product at a low enough price point. That was then. Today, after actions against Huawei, ZTE, Semiconductor Manufacturing International Corporation, the equation, at least in China (the world’s second largest economy) has changed. Above all else, what now matters most is the security of the supply and the price-to-quality ratio has slipped down the list of priorities.

This represents a paradigm shift as “Ricardian optimization” is no longer the be-all and end-all. A world that worries more about safety than low prices is one that will likely deliver lower productivity, and higher prices.

Taiwan as the new geostrategic fault line

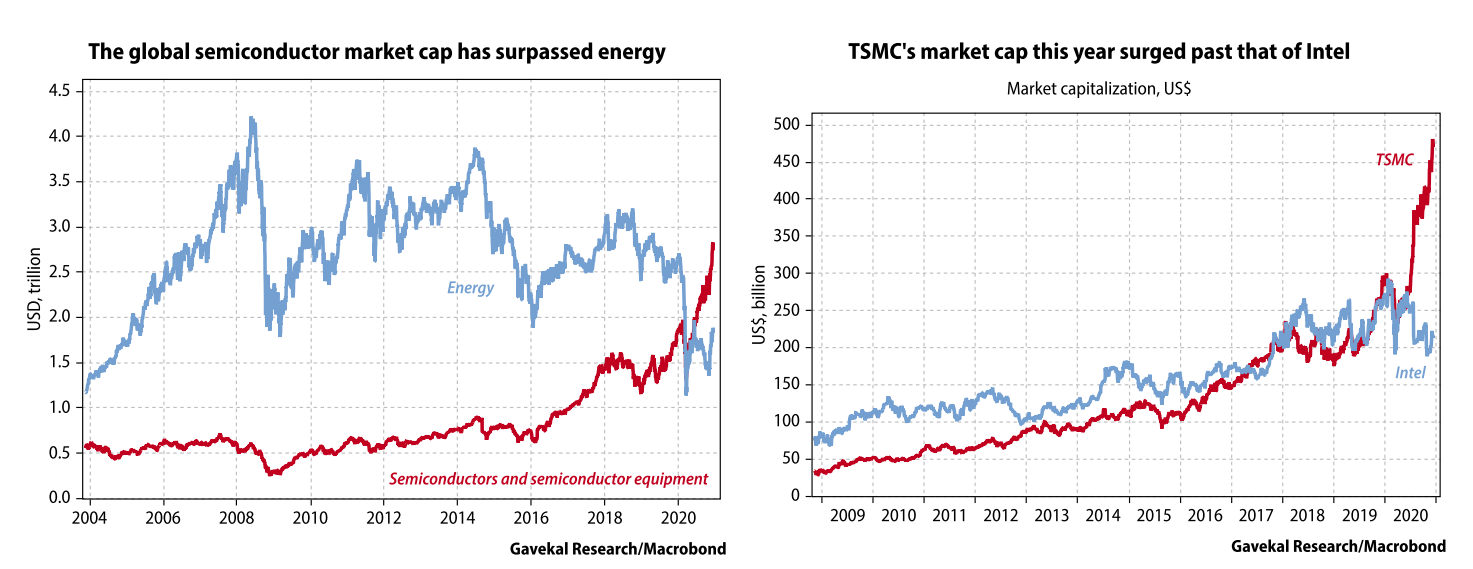

Staying with the idea that semiconductors are the key battlefield in the unfolding US-China “cold war”, the past year saw two important events:

- The global market capitalization of the semiconductor sector soared past that of the energy sector (see left-hand chart below). The market’s message was that chips are the commodity of the future while barrels of oil are the commodity of the past (whether the market is right on this is another debate).

- A more important development came in July when Intel—the US firm that once ruled global semiconductor manufacturing—said it could not mass produce 7nm chips until 2023, some 18 months later than its guidance. Then just weeks later, Taiwan Semiconductor Manufacturing Corporation, which is already producing 7nm chips, confirmed that it will begin mass producing 3nm chips in 2022. In a nutshell, this means that the once-dominant Intel has lost its technological edge over TSMC, and is unlikely to regain it before 2025 at the earliest—if ever. Unsurprisingly, the market quickly adjusted to this new tech reality: the TSMC market cap more than doubled while the Intel market cap fell by more than a quarter (see right-hand chart below).

So to recap, the US has chosen to make semiconductors the battlefield in the unfolding Chinese Cold War at a moment when the US is losing its semiconductor manufacturing leadership, and to Taiwan, of all places!

This is a problem, as Taiwan has long been a source of potential instability in the US-China relationship. Even when the two countries sort of got along, and Taiwan produced plastic toys and bicycles, the disputed island state was a sore point in the relationship. Fast forward to today and the US and China no longer get along, while Taiwan is instrumental in producing the world’s most economically important commodity. The “passing of the baton” from Intel to TSMC could not have come at a worse time for the US!

In response the US is likely to sell Taiwan more weapons—which will infuriate Beijing and sour an already strained relationship. TSMC is being arm-twisted to move its wafer fabrication plants to the US and pressure is being applied to South Korea (the other key semiconductor producer) to pick a side between the US and China (interestingly, Seoul may decide that discretion is the better part of valor and move to become neutral—an Asian Switzerland of sorts).

Meanwhile, the first order of business for Beijing will be to continue investing in its domestic semiconductor industry in a bid to close the technology gap. Dan Wang and Matt Forney of Gavekal Fathom China have researched this in detail over the past year and published numerous papers on this topic. There are few reasons to think that the trend won’t accelerate since the ability to produce semiconductors domestically is no longer a business decision for China, but a national security one.

China’s second order of business will be to keep on investing in its military. There are solid historical correlations between strong military and a strong tech sector. The US has the world’s biggest defense budget and the largest tech sector. China has the second largest military and the second largest tech sector. Japan for years boasted the highest defense spending in Asia and is a credible tech player, as are Israel, South Korea and Taiwan, which are small countries that punch far above their weight in terms of military spending. In contrast, countries that used to spend on their military but no longer do, like France and the UK, have seen their tech sectors shrivel, with the eclipse of once proud national tech champions like Bull, Alcatel and Marconi.

The third order of business for China will be to ratchet up bellicose crossstraits rhetoric. The impact will be that both firms and individuals think twice about investing more in Taiwan, and may even reassess their dependence on components made in the island (i.e. the point above on supply chain security).

At the very least, these developments mean that a generation of geopolitical analysts who have spent their careers assessing every tiny shift in the greater Persian Gulf region will have to refocus on the Taiwan Strait instead. If only because each time the US cranks up the pressures on semiconductors, or its propping up of the Taiwanese military, China will likely respond by sending its ships through the Taiwan Straits and rattling its various sabers.

The financial front and the Hong Kong takeover

The other battlefront in the US-China Cold War is access to capital. In fact, the past year saw the following chain of events unfold: the US threatened China with an embargo of semiconductors that hold any US intellectual property (most semiconductors); China responded by launching naval maneuvers around Taiwan; the US reacted, saying that if China pushes too far, Chinese companies will be cut off from US capital markets or, worse, that Chinese banks will find themselves cut off from the US dollar system. This year also saw China respond by taking over Hong Kong.

The challenge for US policymakers is that kicking China off the dollar system would likely spur a global bust worse than the 2008 Lehman Brothers crisis. First, it would trigger a collapse in global trade (at a time when inventories are low). Second, many big US firms (Apple, Walmart, General Motors) rely on China for both production and final sales. And third because US corporates have invested over US$600bn in Chinese plants, property and equipment. Thus, kicking China off the US dollar system sounds like a hollow threat. It is one thing to kick off Iran, Venezuela or Sudan, all countries that, in the broader scheme of things, are roughly irrelevant to US corporations. To kick off China would be to invite an economic shock without precedent.

Still, because US policymakers have put such a course of action on the table, their Chinese counterparts must take it seriously. Hence the need to take control of the Hong Kong situation. After all, if Chinese firms are to lose access to US capital markets, Hong Kong can now present itself as the default choice to such orphans. Hence the need to internationalize the renminbi and present it as a credible alternative to the US dollar for trade settlement and reserve accumulation in Asia and across emerging economies more broadly.

Now, convincing China’s trade partners to drop the US dollar and embrace the renminbi is a tall order. And perhaps the best way to explain why is to return to the old Gavekal analogy of reserve currencies being akin to computer operating systems.

At Gavekal, we use Microsoft for two main reasons. First, most of our clients use it—and naturally, we want to be able to swap files with them. Second, because everyone else uses Microsoft, any new team member will be proficient in Word, Excel, PowerPoint and other products in the Microsoft suite. Thus, any new Gavekal hire is able to hit the ground running without a need for IT training. Hence, for Gavekal to switch from Microsoft to another operating system, the new system would have to be much more than marginally better; it would need to be so good that all our clients, and all our potential employees, would be compelled to make the switch in short order as well.

The parallels with the US dollar are obvious, as it is the Microsoft of the trading and reserve currency world. Everyone uses the dollar because everyone else uses the dollar. For any currency to replace it, the new currency would need to be not just marginally better, but many miles better. Today, nothing comes close, including the renminbi. Consequently, the US dollar remains the cornerstone of the global financial architecture.

In recent decades, Apple (and to a lesser extent Google) eroded Microsoft’s dominance in operating systems. Apple did so initially by focusing on niche markets. If you visit an architect’s studio or a web design firm, all the computers are likely to be Apple. But as Apple focused on capturing niches, it pretty much abandoned the big corporate IT system spend to Microsoft, which is why, back in 2005-06 Apple traded at eight times earnings. But then Apple blindsided Microsoft by launching the iPhone and creating a parallel operating system (iOS and apps) that did not need corporate IT departments’ backing to thrive. Instead, with iOS, Apple went straight to the consumer.

Why revisit this territory? Because if the US dollar is the Microsoft of global currencies, there is little doubt that in recent years China has tried to position the renminbi as its Apple. First, China tried to capture “niche” markets that were at best peripheral to the incumbent currency behemoth: financing intra-Asian trade, funding commodity imports into China, and financing infrastructure projects in places like Myanmar, Sri Lanka and Pakistan where, historically, infrastructure projects have struggled to attract funding. But owning niche markets only gets you so far.

So, let’s accept that the US dollar has too many advantages, like dominance of the SWIFT system, for the renminbi to challenge the US currency at its own game. Yet if we further assume that Xi Jinping is serious about establishing the renminbi as Asia’s main trade and reserve currency, China doesn’t have much of a choice: it must follow Apple’s example and build a parallel operating system that doesn’t try to compete with the US dollar on its own turf.

Which brings me to the drive shown by the People’s Bank of China to launch a digital renminbi and the clear attempt by the Chinese Communist Party to place fintech behemoths firmly under its control. Coincidences? Like Apple before them, the Alipays and Wepays of this world want to establish a new, parallel operating system that helps Chinese consumers (and increasingly consumers in other emerging economies) with payments and cash transfers that bypass SWIFT (and so US control). A digital renminbi will only boost this attempt further.

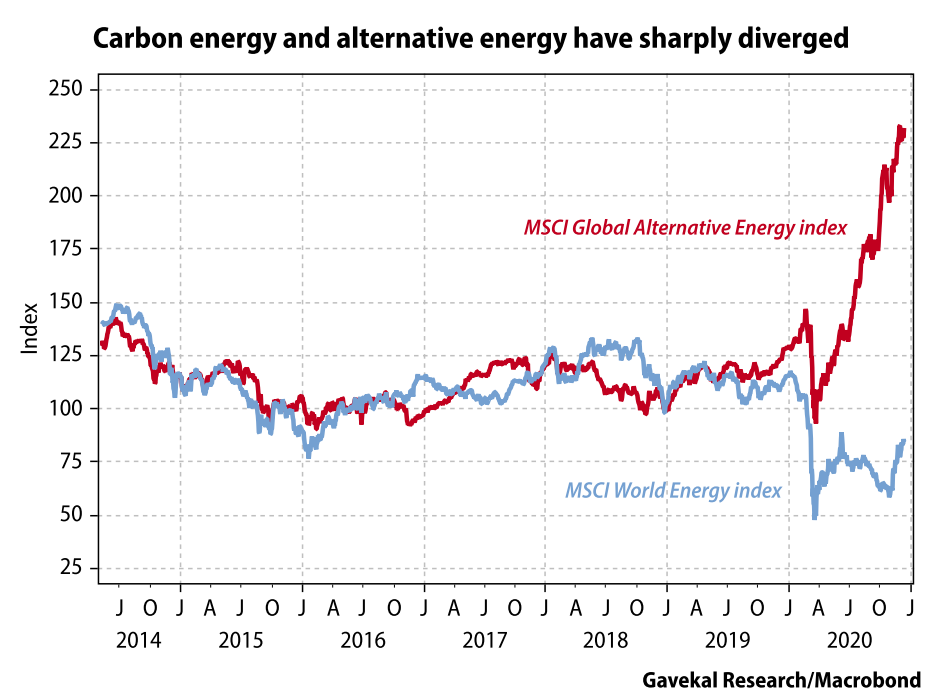

A rapidly shifting energy landscape

If a picture is worth a thousand words, few will be as space saving as the one below to describe energy investors’ year. Carbon energy companies and alternative energy companies produce the same thing: energy. The key difference is to be found in the way they do it. The former make it in dirty and reprehensible ways (or so the general consensus seems to go), while the latter produce it in the most virtuous manner (forget the needs for copper, lithium, cobalt, etc). This key difference is apparently enough to drive an unprecedented divergence in stock market performance between the two groups over the past nine months.

Another explanation for the performance divergence between green energy and carbon energy is linked to future government spending. As reviewed in Desperately Seeking Anti-Fragility (Part I), in a world in which government bonds are not the anti-fragile buffer of choice, investors face a bind. And the growth of green tech has appeared as a possible solution, with the following simple logic: the weaker economic growth is, the lower interest rates will be and the more Western governments will spend money to re-ignite activity. And spending billions on initiatives to stop climate change is an easy way to get money out the door, while also looking righteous. Better still, if green investments look like duds, governments can always increase regulation (no more carbon-driven cars) to ensure that money spent on green tech is not wasted, even if the result is a collapse in the broader economy’s productivity. After all, if growth ends up being weak because of new green regulations, interest rates will stay low, which then helps finance the next round of green investments. And if these investments underperform, governments can increase regulations to make sure that these investments appear wise, even at the cost of lower economic growth. Wash, rinse, repeat.

This impeccable logic has helped green tech become the new anti-fragile asset of choice, perhaps even replacing government bonds. But then, this likely means that green tech will, in the future, suffer a parallel fate to that of government bonds. For example, if interest rates across Western economies start to rise, will capital come out of the frothy green-tech space and return to the known shelter of bonds with yields (as opposed to the current shelter of bonds with no yields)? Or worse yet: what if governments find themselves in a situation where running multi-trillion deficits is no longer an option? Would green tech spending be the first sacrifice made?

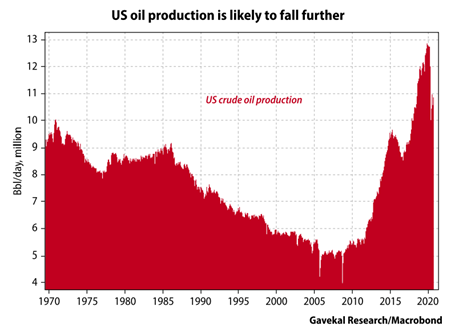

For now, the rise of green-tech to anti-fragile status has helped contribute to the greatest ever underperformance by the energy sector of any broad S&P GSCI grouping. And following this underperformance, energy companies have little choice but to sharply reduce their footprint. Traditional energy firms are no longer rewarded by the market for delivering growth. The only thing they can do is return capital. To take a couple of examples:

- Chevron recently unveiled a capital spending budget of US$14bn-16bn a year through 2025. It represents a -27% cut from the midpoint of the company’s prior forecasts and is half what it spent in 2014.

- ExxonMobil said that its capital spending will fall to US$16-19bn next year, and US$20-25bn from 2022 to 2025. Those figures represent a -46% and -31% decline, respectively, from the previous capex guidance.

These are the capital spending plans of North America’s two largest oil companies. The picture gets darker as smaller companies are considered. The prevailing theme across the oil and gas sector is of sector consolidation, mergers and outright bankruptcies. Hence, it seems fairly clear that US oil production, which has already started to shrink, is set to fall further. This will have negative consequences for the US trade balance, and thus for the value of the US currency.

From a north-south European divide to a west-east divide

The Covid pandemic hit Italy early, and particularly hard. And as Austria and France, and then the rest of Europe closed their borders to Italy, it looked for a few weeks as if the Covid crisis might be the straw that broke the back of the eurozone camel (it is said that a camel is a horse designed by a committee and what is the euro if not a currency designed by a committee?). Still, snatching an apparent victory from the jaws of defeat, Europe seemed to embrace a common fiscal solution to match its common monetary policy. This promise of a fiscal backbone and the hope that Europe’s north-south economic divide might be seriously addressed helped push aside fears of the euro’s survival. In turn, this planted the seed for the common currency to mount an impressive rebound over the past six months.

Still, even as the north-south split appears to fade away into the background, a new division has emerged in Brussels. This time the split is more of a west-east cleavage and has less to do with economic divergences than different cultural outlooks. At the risk of over-simplifying, Hungary, Poland, the Czech Republic and Slovakia (known as the Visegrád group, but also the old Austro-Hungarian empire!) do not want to change their immigration policies to suit Brussels while also typically having different approaches to “family/personal matters” (the Visegrád countries are usually against homosexual marriage, sometimes against abortion and oppose notions of gender fluidity).

At first glance, such fights may appear rather unimportant for investors. After all, the Visegrád countries have kept their own currencies and so are not subject to direct euro break-up risk. Their financial markets are also fairly small (not many global investors are in Hungarian bonds or Slovakian equities) and finally, cultural issues seldom have clear investment impacts. Still, notwithstanding last week’s EU summit fudge over a Brussels threat to sanction countries deemed to have breached the “rule of law”, these eastern countries, if pushed, could still upend the great fiscal compromise on which so much of the euro’s rebound rests.

But perhaps most importantly, the growing tensions between west and east in Europe further remind us that Europe, with its bastard political structures, remains an uncertain place for foreign investors to deploy capital. For Europe remains just one bad electoral result away (perhaps France in 2022 or Italy in 2023) from the whole edifice coming down.

Japan’s quiet bull market

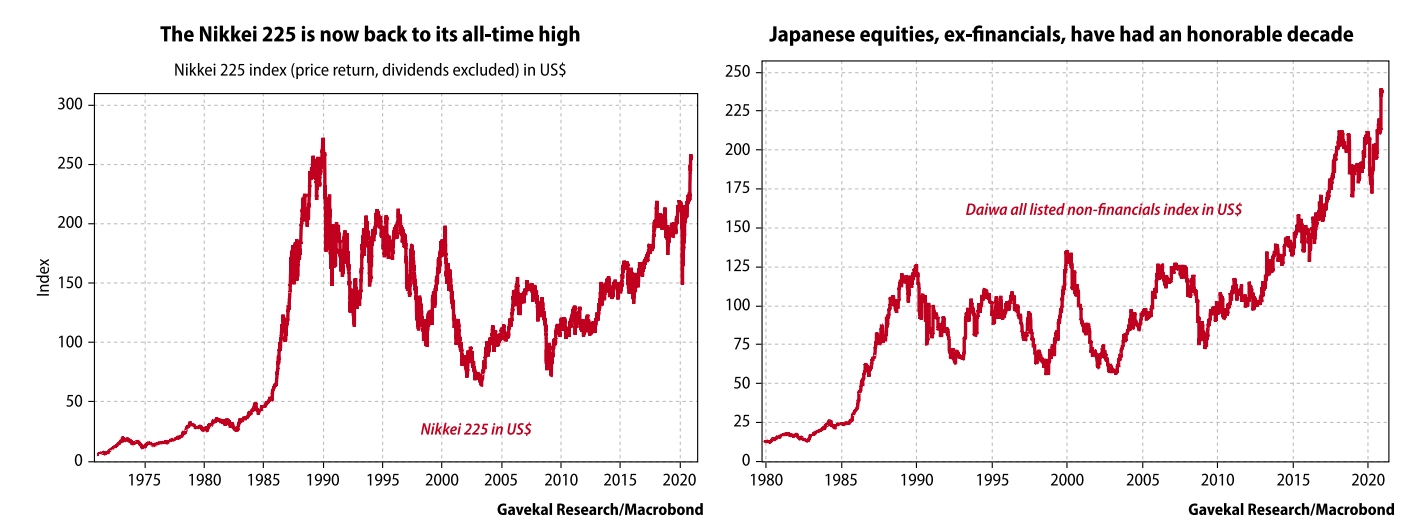

This year will mark the point when the patient foreign investor who got sucked in to the Japanese hype of the 1989 bull market finally broke even (in US dollar terms) and the Nikkei 225 got back to its all-time high (the left-hand chart below does not include dividends).

In fact, for all the Japan-bashing out there (in fairness, most foreign investors have stopped railing against Japan and now simply ignore the place), Japanese equity markets have had a very honorable past decade. This is especially true when one strips out financials.

The above charts may bring comfort to Western policymakers now set on a path (unprecedented budget deficits funded through massive expansions in central bank balance sheets) trailblazed by Japan after its epic real estate and stock market bubbles of the late 1980s burst. Time will tell whether Japan’s experiment gets replicated elsewhere, or remains an anomaly in the annals of economic experiments. Indeed, as Kenneth Rogoff and Carmen Reinhart reviewed in their book This Time It’s Different, when massive expansions in budget deficits led to increases in government debt beyond the 100% of GDP (arbitrary) mark, and were funded with big rises in monetary aggregates, then in almost every case that country experienced either a currency collapse and a surge in inflation, or a debt default. Every country, except for Japan.

One reason that Japan proved to be such an anomaly is that, when its crisis hit, oddly it was one of the world’s most efficient export producers (with world class companies like Toyota, Sony and Nintendo) and probably one of the world’s most inefficient developed economies in its domestic market. Anyone who traveled to Japan in the late 1980s, or even through the 1990s, will have memories of US$10 apples in grocery stores, US$300 cab rides, US$500 pairs of Nike shoes or US$1000 a head dinners at Tokyo restaurants. All this when dollars were worth a good bit more than they are today!

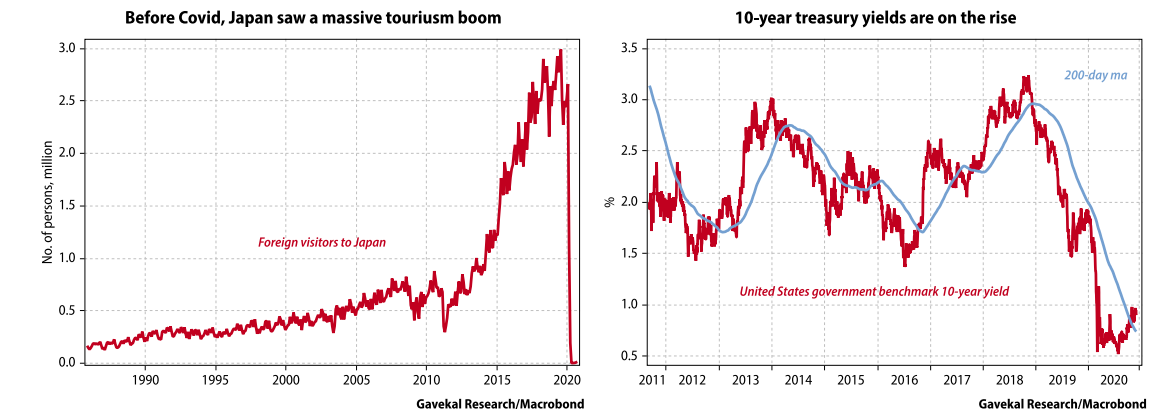

Fast forward to today and all these “excess prices” have, through a three decade long deflationary process, been squeezed out of a Japanese economy that now looks and feels far more “normal” than its predecessor. Going out for the evening in Tokyo no longer entails taking out a second mortgage. If anything crystallizes the fact that the cost structure in Japan has now normalized, it must be the tourism boom of recent years (until Covid obviously stopped foreign arrivals dead in their tracks, see left-hand chart below).

But while big rises in budget deficits, funded with central bank printing, ended up having little impact on domestic Japanese prices that were being compressed by the squeezing out of inefficiencies, will the same thing happen across Europe or the US? Suffice to say that no-one today is paying US$10 an apple in the supermarkets of Chicago, Los Angeles, Paris, or Berlin. Instead, the inefficiencies to be squeezed out are few and far between. And perhaps more worryingly, instead of being squeezed out, inefficiencies are set to increase if, as described above, the security of supply now trumps price, or quality, as the determining factor for capital allocation and procurement decisions.

Meanwhile, Japan may well continue to thrive, quietly and unbeknown to most investors, in such an environment.

A last one, for the road….

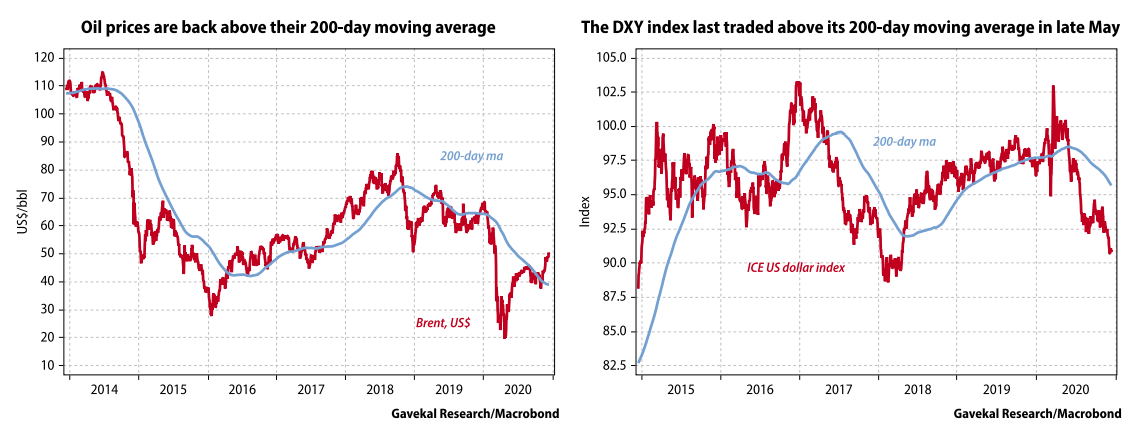

When 2019 started, 10-year treasury yields were falling (and trading below their 200-day moving average), oil prices were falling (and trading below their 200-day moving average) and the US dollar was rising (and trading above its 200-day moving average). Fast forward two years, and we have witnessed a reversal in all three of these key price trends.

I would argue that these key price reversals are linked to the above 10 developments. But whether this is right, or not, may be not be that relevant. What matters is that bond yields, energy prices and the US dollar are now moving in the opposite direction to the one investors grew used to in recent years. The times, they are a-changin’ but have portfolios?