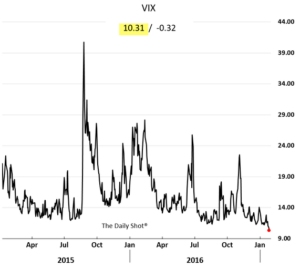

The chart below is oil volatility index. Low volatility is a precondition for breakout of volatility

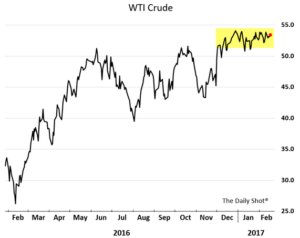

One more chart showing narrow range

so how is the market positioned?

Highest long speculative position in oil in quite some time.

Highest short speculative position in US treasuries.Everybody is positioned for “REFLATION” trade and short treasuries

And everybody is short equity volatility (VIX) and hence Long Equities. From Trump is bad for equity markets to full on Trumpflation with rub on effect on our equities markets… how sentiment changes

So to summarise Market participants are unanimously long crude oil, long equities, short US treasuries and bonds in general,short VIX ( absolutely no fear)

when Everybody is on one side it require a little nudge and the boat just tilts ……..that is the law of nature.

Sir,

This is so very apparent. Something has to give in….and soon….I have, covered some part of this anamoly in my year report as well. Thanks.

Thanks Neppolian and i have read your report. very well explained with cycle the only place where i have a little bit of disconnect is that a year ending with 7 cannot go out without some kind of firework.so the call for 2018-19 is on track but not before a big drawdown in market

Sir,

Point taken. I guess the area of probing will be the band between 9000-9200 Nifty……and 2400-2450 SP500……till the trend remains under these numbers…..one can count on a correction.

Thanks i am also watching these numbers with keen interest . can you tell me what kind of correction are you looking at ? i remember our discussion where u said around 8000 as bottom (it exactly bottomed out last time around those levels) and i was of the view that for markets to touch 12000 by late 2018 the correction has to be more deep like 7300 types. unless you move the pendulum of market big way on one side it will not move up big on other side? will wait for your comment thanks

Very good information. Lucky me I ran across your site by accident (stumbleupon). I have book-marked it for later!