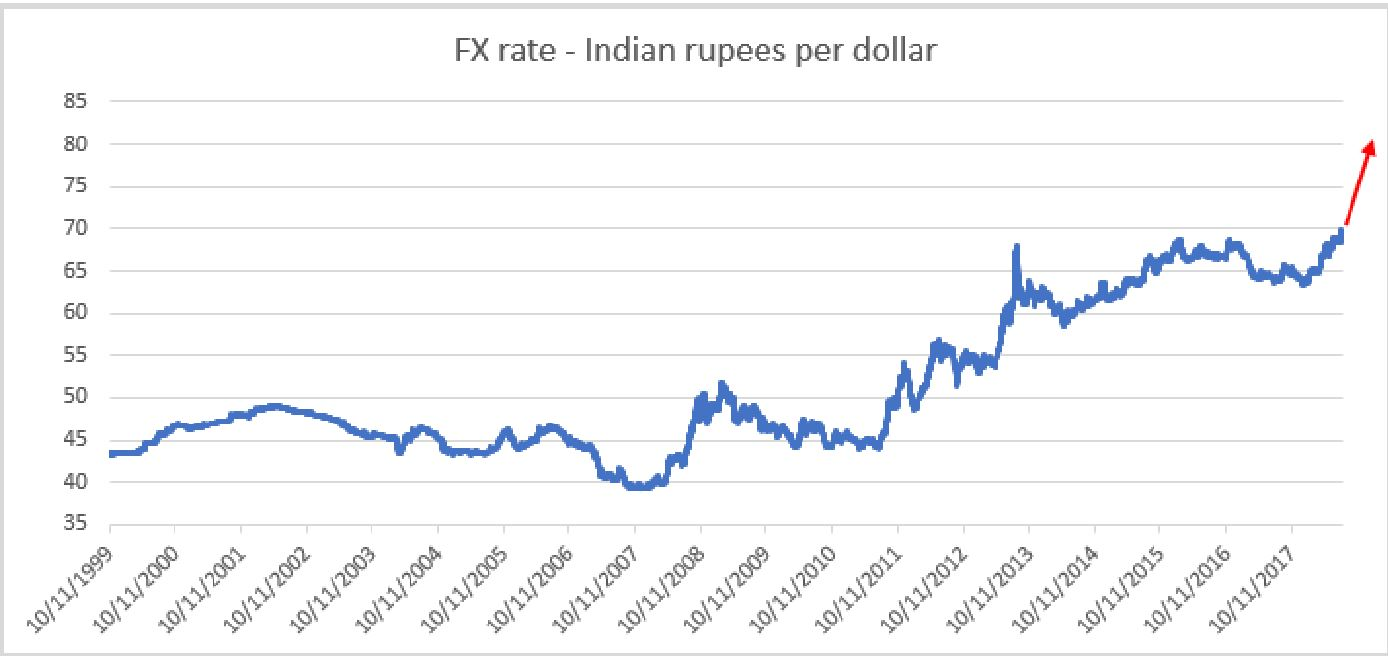

A senior finance ministry official said India would not be concerned if the rupee fell to 80 against the dollar after hitting an all-time low of 70.1 on Tuesday, as long as other currencies also depreciated. This would appear to be the sanctioning of a further 15% fall. The currency has fallen 8% this year, pushing up the prices of imports. Subhash Chandra Garg, economic affairs secretary at the finance ministry, said that the Reserve Bank of India had already spent about USD23bn defending the currency, and that further intervention may not help as the fall was due to external factors.

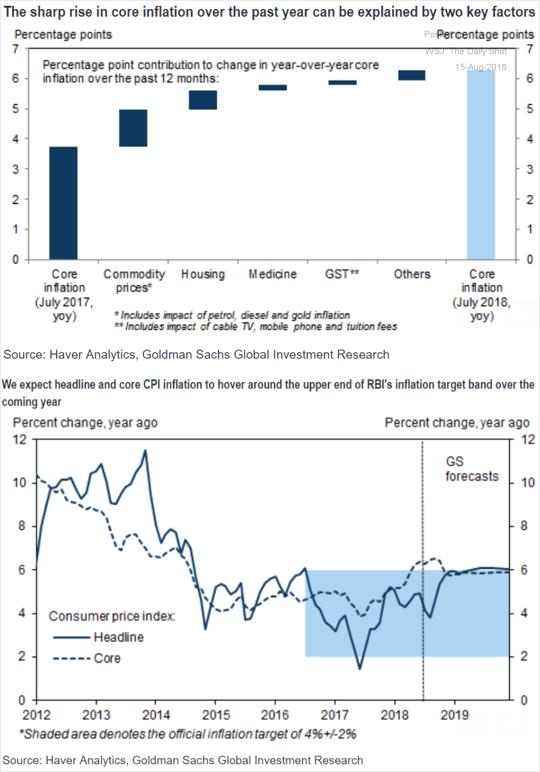

The problem of currency depreciation is magnified by a sticky and rising core inflation prompting Goldman Sachs to highlight the challenges faced by RBI.

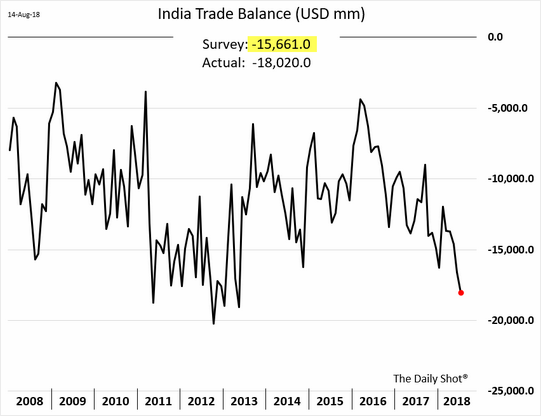

Compunding the issue is India’s trade deficit which hit a multi-year high as imports rise and exports stagnate.

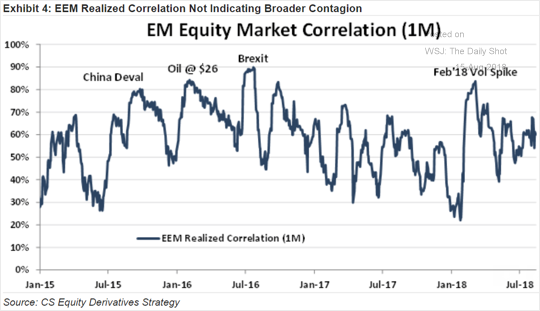

So inspite of all the above mentioned issues of Rising inflation and trade deficit the question is why is Indian market resilient unlike last time in FEB/MAR when admitedly our macros have worsen?

The Emerging Market sell off seen till now is actually contained among few economies and the correlation among EM markets is actually down. That roughly means the selling this time is not from ETF but by active managers who are selling based on fundamentals.

Will this selloff spread to other markets is a million dollar question. I believe it will spread to other EM including India simply to cover losses of other markets and reducing the risk thereby pressurising the Indian Currency.RBI then ,will be left with no choice but to raise the rates more than required which in turn will a negative impact on both Household consumption and domestic growth .