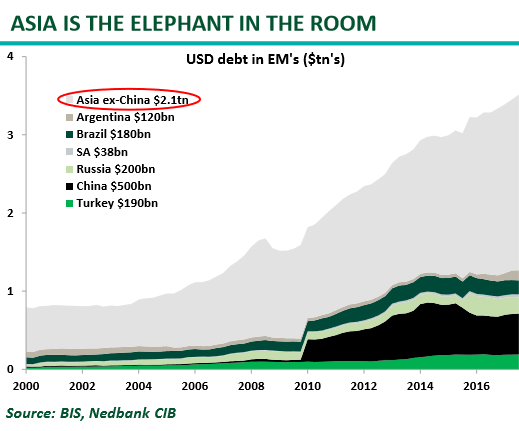

Wolfstreet writes ….Southeast Asia stands out again as in 1997/8, with a large amount of USD denominated debt outstanding,” the write. “The only difference is then Asia had fixed exchange rates and now they are floating! NedBank believe Asia will be the next source of downside systemic risk for financial markets.”

The chart below shows dollar-denominated debt in the EMs, in trillion dollars. This does not include euro-denominated debt which plays a large role in Turkey. The fat gray area represents Asia without China: