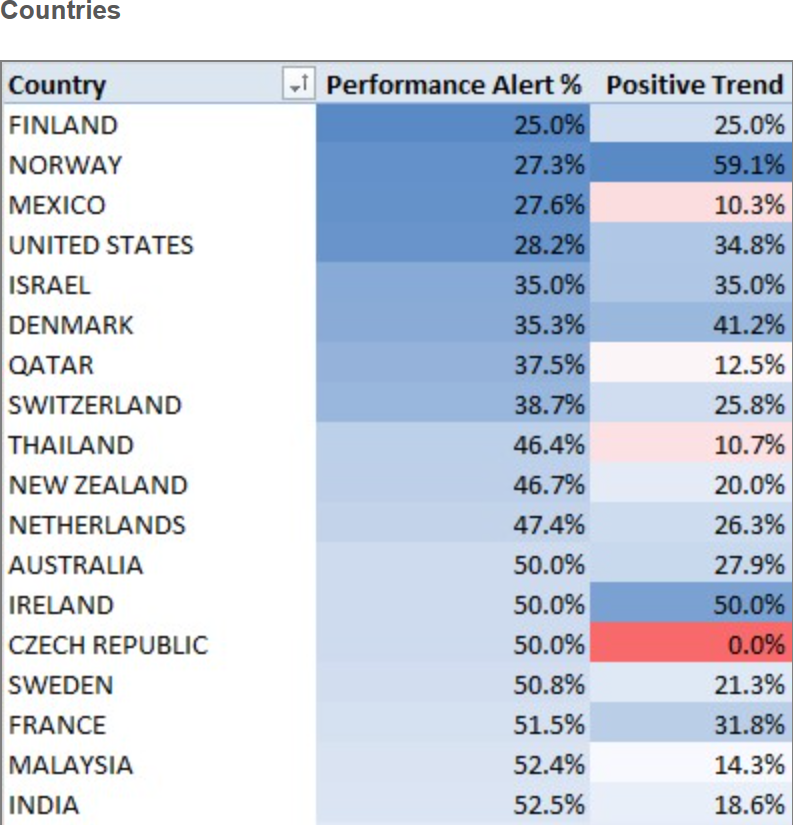

Gavekal Writes in its Knowledge Blog….Chalk it up to strength of the US dollar, trade, policy risk, or whatever, stocks outside of the US are in bad shape. One of the ways we systematically measure the relative attractiveness of a stock in a particular sector, region or country is to calculate the percent of stocks in a group that are currently flashing a red performance alert. A performance alert is activated when a stock has a combination of negative short-term, intermediate-term and long-term trends relative to the global equity market and it is a strong indicator that a particular issue is at risk of further underperformance ( this is the proprietary knowledge). At the same time, they calculate the percent of issues with a positive overall trend, which helps them identify areas of relative strength.

In the US, only about 28% of stocks are flashing a performance alert, which is a relatively modest number. Whereas in case of India 52.5% of all stocks are flashing performance alert with only 18.6% in positive trend

So to sum things up, on the basis of their performance alert measure, US is the only major market without a preponderance of stocks in a risky position. In DM ex US and EM, picking stocks is like walking through a minefield

Read full article on