Simple answer….. first gradually and then suddenly

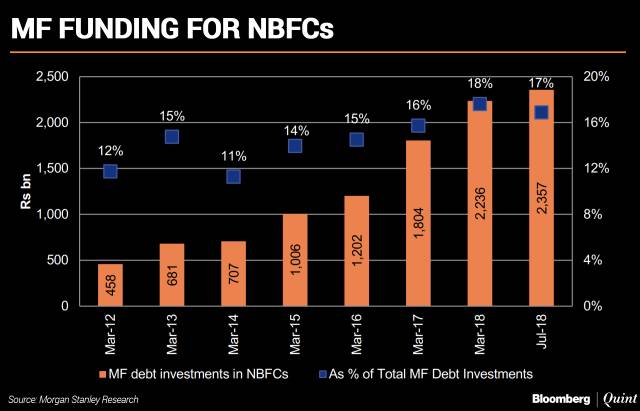

Banks found an easy way to fund credit through consumer funding and lending to NBFC’s. Mutual Fund who couldn’t believe their fortune in wake of demonetization used inflows into their debt schemes to fund NBFC/HFC’s. In fact if SEBI would not have come out with sector wise limits,some MF were happy lending the majority of their unitholders money to this sector.

Interest rate cycle started turning late last year but MF and banks were still having enough short term liquidity to fund Non Bank financiars ,but these lenders started shying away from extending long term funding few months back. NBFC had to alter their funding and accept funding mismatch otherwise cost of borrowing had started rising sharply and this is when the seeds of current problem were sown.

System liquidity has now completely dried and MF are only seeing outflows along with banks who are struggling to attract deposits.

NBFC require funding and long term funding otherwise situation can get out of hand

(only when tide turns you come to know who is swimming naked)

Read More

http://Tighter Liquidity And Lower Trust – The One-Two Punch For India’s NBFCs

Sirji. Link to the detailed article seems to be broken. Please check

my apologies this is the right link