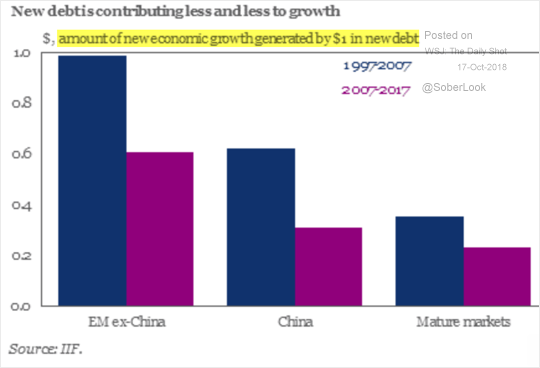

The problem is not debt, it is the productivity of debt and if you see the chart below from IIF things are going in wrong direction. On top of that it is the govt which has accumulated debt as it has expanded its tentacles in different parts of the economy. Now,Government deficits are not saving, but dissaving, reducing the total saving available for investment. The US govt debt/GDP has crossed 100%(India we are still closer to manageable 60%). It is important to note that the projected increase in US federal debt from $21.4 to $28.9 trillion will, all other things being equal, further reduce net national saving from approximately 3% to 2% or possibly even zero. Thus, investment would be forced downward, continuing to erode productivity, unless, of course, consumer saving were to rise. But, if consumer saving were to rise, this would reduce consumer spending and economic growth, undermining the incentive for more investment.This is a recipe for semi-recessionary economic conditions, regardless of monetary mistakes.

Lacy hunt , at Hoisington asset management believes that accumulation of more debt unless accompanied by very high inflation only leads to lower yields….and he concludes” The response by policy makers to this eventuality is a guess, but a higher interest rate policy does not appear to be an option. From the standpoint of an investment firm that started in 1980, when 30-year bond yields were close to 15%, the current 30-year treasury rate at 3% seems ridiculously low. In the near future, at 1.5%, the 3% yield will seem generous”.