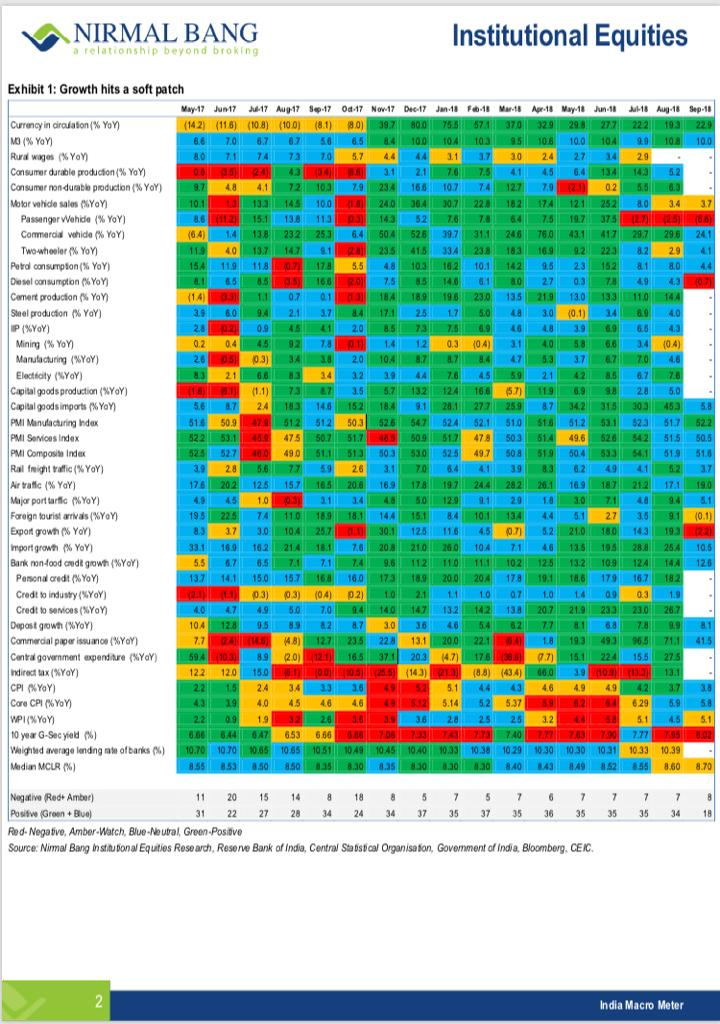

Nirmal Bang writes….Early data for September 2018 indicates that 69.23% of indicators are in positive territory. This is sharply down from 82.9% in August 2018, and the lowest since October 2017 when only 57% of indicators were in positive territory. However, GDP growth in 2QFY19 may still be around the 7.5% mark aided by robust performance in the previous two months. Rural wages are sluggish, while prices of agricultural commodities remain muted. Nevertheless, we expect some support from government spending in an election year. Domestic demand has also hit an air pocket with passenger vehicle sales witnessing a declining trend, while two- wheeler sales have also slowed. The manufacturing sector’s recovery continues to hold up for now, but some slowdown seems inevitable. The Nikkei manufacturing PMI stood at 52.2 in September 2018, slightly better than 51.7 in the previous month. However, capital goods production and capital goods imports are slowing, although still firmly entrenched in positive territory. Exports declined 2.2% YoY in September 2018 on the back of a high base. Yet, export-oriented sectors such as textiles, engineering and pharmaceuticals are reaping some of the benefits of a weak Indian rupee or INR and still robust global demand. It remains to be seen, how long global demand will sustain. Service sector indicators, though largely robust, are also witnessing some soft patches. The Nikkei manufacturing PMI slipped to 51.5 in September 2018 from 50.5 in the previous month. Meanwhile, lending rates are rising, and the pace of increase has accelerated even as inflation continued to undershoot. So far, real interest rates have been trending down, but if inflation continues to be muted and lending rates rise, bank credit growth could also slip, and the slowdown may be protracted. Commercial paper issuance slowed in September 2018, but still up 41.5%YoY.