Wolf Richter writes “The only form of stock market leverage that is reported monthly is “margin debt” – the amount individual and institutional investors borrow from their brokers against their portfolios. Margin debt is subject to well-rehearsed margin calls. And apparently, they have kicked off.https://wolfstreet.com/2018/11/21/stock-market-margin-debt-plunges-most-since-lehman-moment/

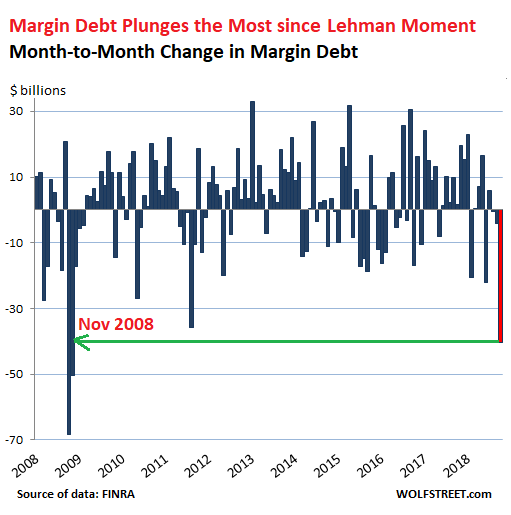

In the ugliest stock-market October anyone can remember, margin debt plunged by $40.5 billion, FINRA (Financial Industry Regulatory Authority) reported this morning – the biggest plunge since November 2008, weeks after Lehman Brothers had filed for bankruptcy:he only form of stock market leverage that is reported monthly is “margin debt” – the amount individual and institutional investors borrow from their brokers against their portfolios. Margin debt is subject to well-rehearsed margin calls. And apparently, they have kicked off.

In the ugliest stock-market October anyone can remember, margin debt plunged by $40.5 billion, FINRA (Financial Industry Regulatory Authority) reported this morning – the biggest plunge since November 2008, weeks after Lehman Brothers had filed for bankruptcy”:

Surging margin debt creates stock-market liquidity out of nothing, and this new liquidity is used to buy more stocks. In this manner, rising margin debt is the great accelerator on the way up

Wolf concludes “October’s plunge in margin debt was just the beginning, a little dimple in the overall chart. Unwinding such a huge pile of margin debt and overall stock-market leverage takes time, years, and they’ll be

interrupted with some brief increases that’ll make everyone feel better for a moment”