Diana Choyleva at Enodo economics writes “Washington needs to rewrite the economic and financial rules of engagement with Beijing, but now is not the time for it to pursue regime change in China. The West was unscathed by the collapse of the communist bloc because their economies were distinctly separate. By contrast, China’s integration into global supply chains is deep enough to suggest the US has no interest in pushing Beijing so hard as to risk an economic collapse. From a short-term perspective, China also holds the key to the resolution of the North Korean conflict, even though Kim Jong-un is far from China’s friend.

From Beijing’s point of view, the transformation of its economy and military has further to go before it feels fully confident of standing up to America. So, the top leadership needs to buy time, while not sacrificing its long-term goals. Over the past few years China has started to rein in financial risks, rebalance growth towards consumer spending and focus on moving up the value-added chain. Beijing is far from changing its fundamental economic model, but it is working towards its understanding of achieving economic self-sufficiency and technological supremacy.”

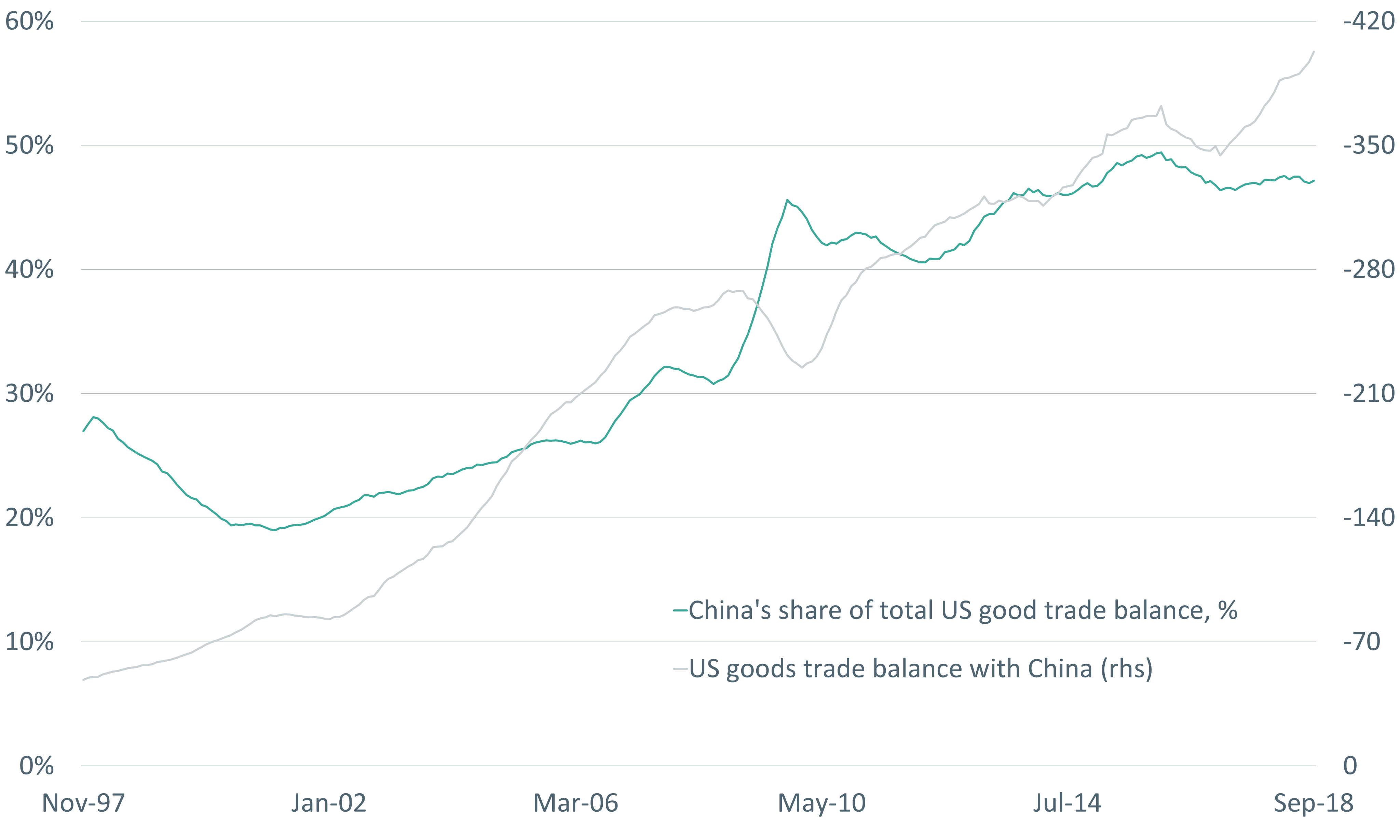

China would be willing to ramp up imports and to run an overall trade deficit

Powell has smartly passed the buck to Trump and now eyes are on Trump to make some compromise at G-20 failing which markets might reverse their recent gains. The next selloff then cannot be blamed on FED and Powell will be free of any more tongue lashing from the President

In this context, Buenos Aires could well bring some short-term respite to struggling global equity markets.

But the long-term investor would be better off selling into any upturn, as the trade war is set to morph into a tech war – though hopefully not into an actual war over Taiwan.

A fleshed-out deal is neither expected nor it going to be announced in Buenos Aires. After all, the two sides have just about started talking again. Moreover, America is still putting significant pressure on Beijing, as was evident when Mike Pence rounded on China in Xi’s presence at the APEC summit in Papua New Guinea. Trump’s reaffirmation of his intention to raise tariffs on Chinese imports to 25% in January is also part of his administration’s scare tactics.

Hence, for the Sino-US negotiations to advance, Washington must offer Xi a respite from the pressure.

It is difficult to anticipate what concessions Beijing is ready to make and whether they will be enough to allow the two sides to move on, but here is our list. We are cautiously optimistic that we will see some progress along these lines.

Diana concludes “Argentina is the home of the tango. Trump and Xi would be the last to hit the dance floor, so it’s best not to get carried away. But we do expect some sort of progress to keep the world’s most crucial bilateral relationship from veering completely off the rails.”

full report ( subscription required)