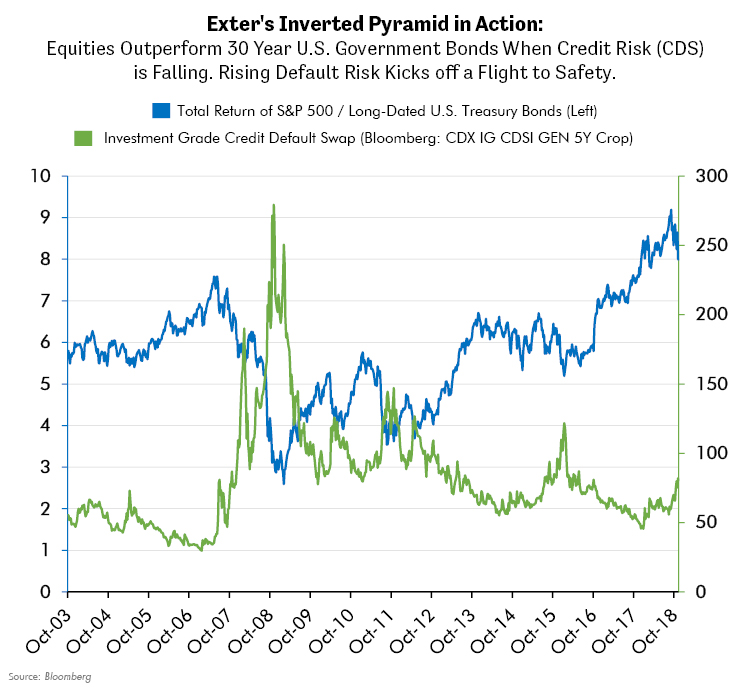

Lewis Johnson writes …. there are three key indicators we have generally found trustworthy to gauge real-time risk appetite. These provide insight into where we are in the cycle. These three market-based, forward looking indicators are 1.) credit default swaps (CDS,) 2.) interest rate expectations, and 3.) the relative performance of gold.

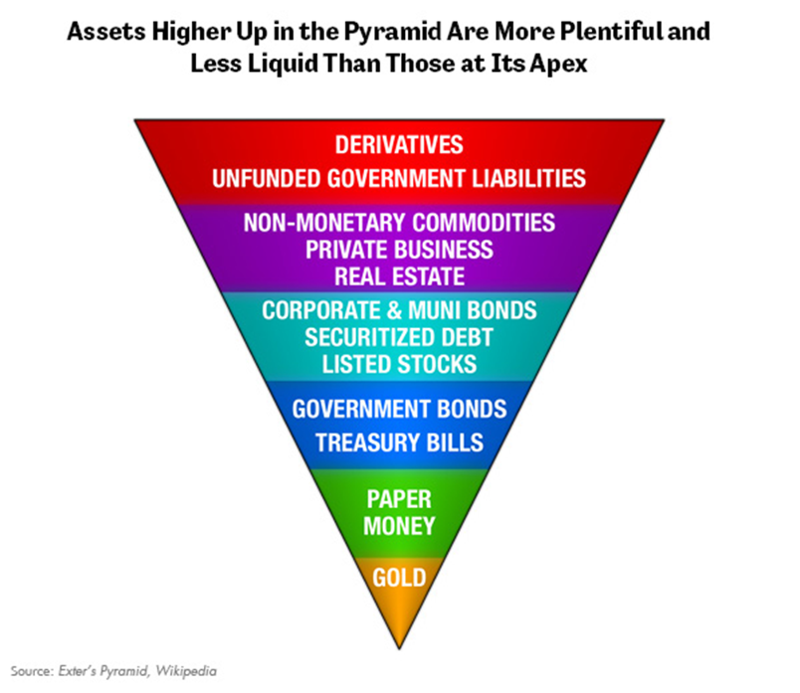

We believe the graph above is strongly suggestive of a deeper truth: that rising CDS can mark the beginning of a turn in risk taking appetite. We believe that this relationship of credit leading equities is causal. The job of CDS is to hedge default risk in bonds. Since bonds are a senior claim to equities in a company’s capital structure, rising problems (rising CDS) in the senior tranche (bonds) should mathematically suggest that problems in the junior tranche (equities) may follow. The credit markets are larger than equity markets and provide the needed flow of financing for commerce to thrive. If confidence in credit is falling – the perception of risk is rising. This could lead to a rising cost of debt and less accommodative debt financing, both of which can lower the fuel that finances a company’s growth.

Read More

https://blog.capitalwealthadvisors.com/trends-tail-risks/skate-where-puck-is-going