Bond market is showing the challenges Germany face. The bonds from VW, Bayer & Deutsche Bank have plunged because investors have lost confidence in the companies. Bayer suffers from Monsanto takeover, VW from emissions scandal, DB from continuous scandals (holger)

Fear Index Vix jumps by 15% as stock market rout deepens w/ S&P plunges to lowest level since May2017.Daily sentiment Index for equities is at 4 and bond at 93…. extreme not seen for a long time

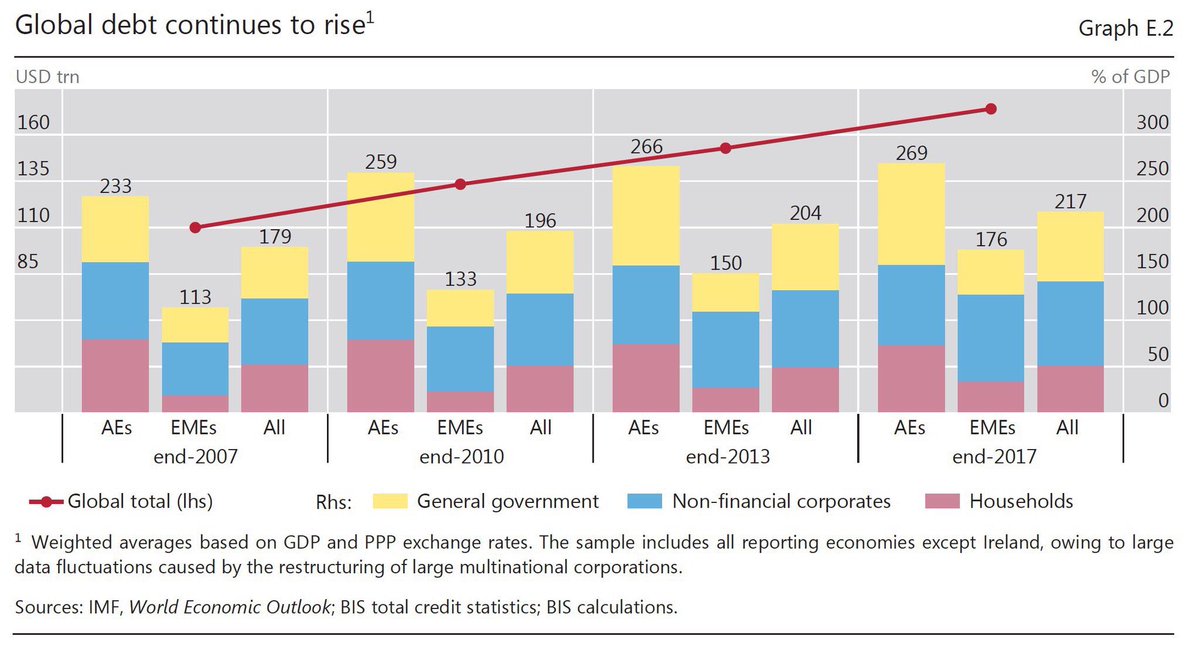

The World Will Pay for Not Dealing With Debt: Inventive policymaking has only made the problem worse, guaranteeing that any eventual restructuring will be all the more painful. US is best placed with almost 50% of their debt held by foreigners. Just Inflate away the debt

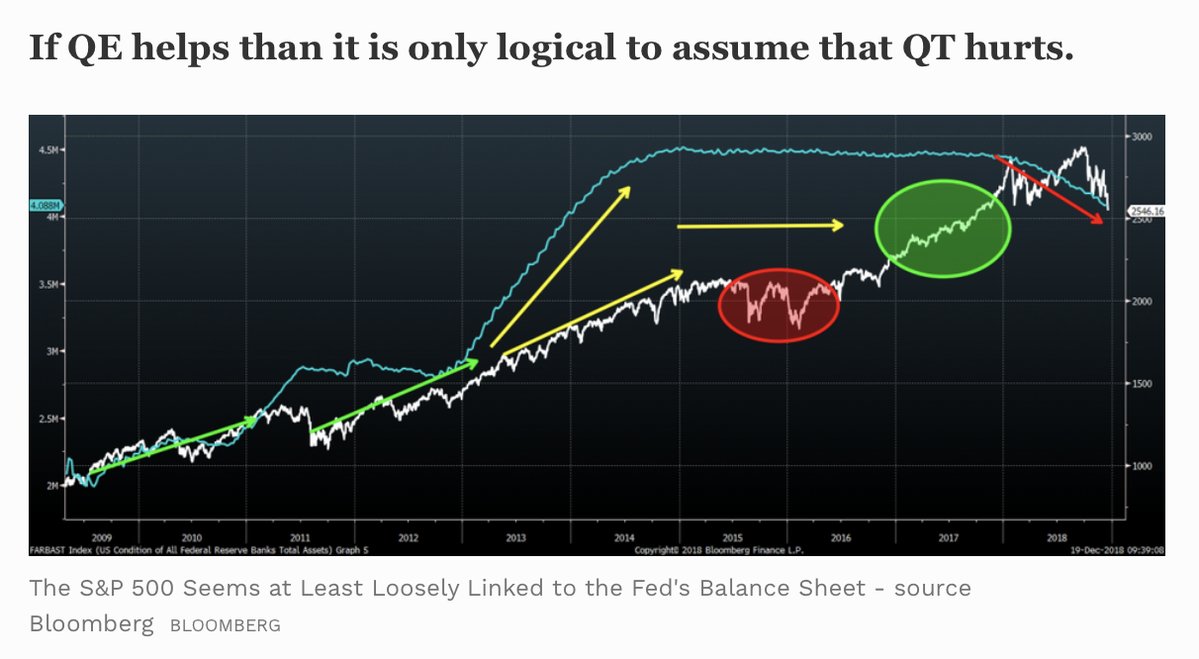

While everyone wants to discuss interest rates, the impact of balance sheet reduction may be more important than hikes and if that isn’t addressed, expect more volatility and stock market problems.

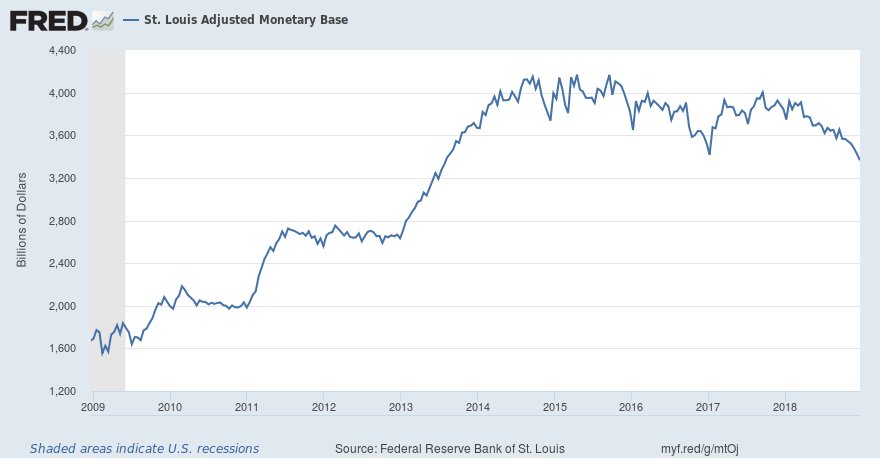

Adjusted monetary base drops by $57 billion over two weeks to $3.365 trillion, the lowest level since July 2013.

LIQUIDITY MATTERS