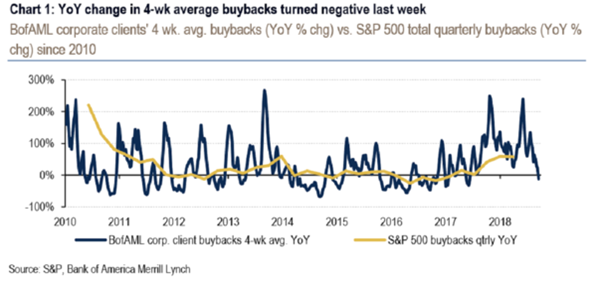

The end of Q1 is almost here and gears are shifting to blend into the buyback blackout period that awaits for us. A slowdown is lurking in ambush and investors who were once dancing in the sparkling highs of S&P500 are now having cold feet. Markets have become so accustomed to Buybacks that a blackout period pose a threat to equity markets in general.

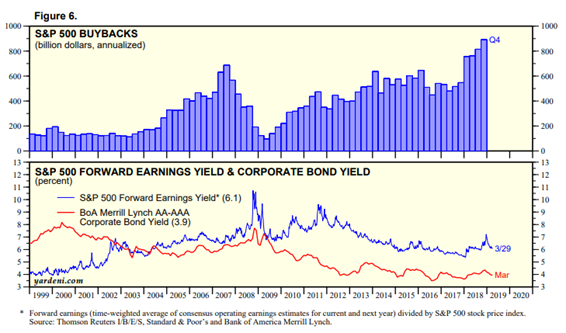

2018 has seen the highest record share repurchases and have rallied 20 percent from its December lows. However, for many investors now is the dreaded time when earnings are announced and companies 5 weeks prior to the reporting and 48 hours after cannot be involved in discrete buyback program punching the demand, as a result of which about 40% of the S&P500 companies will be hit.

The amounts of BBB rated credits is at all time high and those companies are jumping out of the frying pan and into the inferno if they choose to reduce their capex and increase their buybacks which in next recession can seriously challenge their credit ratings

Salt meets wound. To add to this wound, the downward market correction would be incited by the new proposals by senators regarding restricted buyback activity in the corner. Pension fund rebalancing instigating quarter end selling is also nudging investors to go underweight in their positions.