By Apra Sharma

Capitalist productivity, now 200+ old, is becoming capitalist financialization. Financialization is profit margin growth without labour productivity growth. Financialization is the zero sum game aspect of capitalism, where profit margin growth is both pulled forward from future real growth and pulled away from current economic risk – taking. Financialization is a global phenomenon. In China, it’s transmitted through real estate market. In US, it’s transmitted through stock market.

According to Stephen G. Cecchetti and Enisse Kharroubi of the Bank for International Settlements, the impact of finance on economic growth is very positive in the early stages of development. But beyond a certain point it becomes negative, because the financial sector competes with other sectors for scarce resources.

Financialization is zombiefication of an economy and oligarchification of a society.

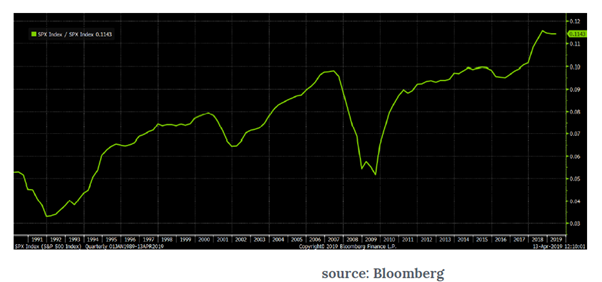

This is a 30-year chart of total S&P 500 earnings divided by total S&P 500 sales. It’s how many pennies of earnings S&P 500 companies get from a dollar of sales, earnings margin, essentially, at a high level of aggregation. So at the lows of 1991, $1 in sales generated a bit more than $0.03 in earnings for the S&P 500. Today in 2019, we are at an all-time high of a bit more than $0.11 in earnings from $1 in sales.

It’s a marvellously steady progression up and to the right, temporarily marred by a recession here and there, but really quite awe-inspiring in its consistency. Yay, capitalism!

It’s a foundational chart because I believe that the WHY of earnings margin growth in the 1990s and early 2000s is fundamentally different than the WHY of earnings margin growth since then.

WHY do we get three times as much in earnings out of a dollar of sales today than we did 30 years ago, and twice as much than we did 10 years ago?

The common knowledge answer is technology!

We can’t exactly say why technology would improve earnings margins and efficiency over the past decade, but we believe it must be technology. Of course it’s technology. Everyone knows that its technology that makes anything in the world more efficient.

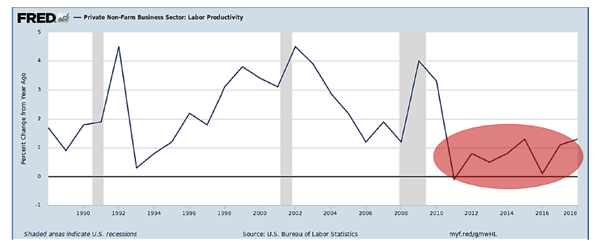

Corporate management was making constant process improvements and technology-based productivity enhancements to squeeze more and more profits out of the same sales dollar. During the 1990s and early 2000s – the so called Great Moderation of the Fed’s Golden Age –we had significant advancements in labour productivity year after year, corporate management was able to drive earnings margins higher. I think the driver of profit margin growth over this period was actual technology.

However, technology and productivity advancements might not be responsible for earnings margin improvements for the past decade.

As Akerlof and Shiller says in Animal Spirits, ‘The United States made the goal clear for itself in Employment Act of 1946: “It is the responsibility of Federal Government…. To use all practicable means… to promote maximum employment, production and purchasing power.”’

Fed was convinced that an easy money policy would lead to corporate management investing more in technology and plant and equipment etc. to drive productivity. Instead, corporate management followed the Zeitgeist.

This is a chart of Labour Productivity growth in the US for the past 30 years. It’s how we generated earnings efficiency and margin growth for the right reasons in the 1990s and early 2000s. It’s how we’ve been reduced to squeezing tax policy and ZIRP-supported balance sheets for earnings efficiency ever since. This chart is the failure of monetary policy for the past decade. This chart is the zombiefication and oligarchification of the US economy.

According to a new report from the International Labour Organization, a United Nations agency, financialization is by far the largest contributor in developed economies. The report estimates that 46 percent of labour’s falling share resulted from financialization, 19 percent from globalization, 10 percent from technological change and 25 percent from institutional factors.

The reason companies aren’t investing more aggressively in plant and equipment and technology is because we have the most accommodative monetary with the easiest money to borrow that corporations have ever seen. No central bank in the developed world is looking to tighten today, and we’re on the cusp of fiscal policies like MMT, or at least trillion dollar deficits forever to accelerate the shift in the modern Zeitgeist towards fiat everything. This is not a mean-reverting phenomenon. This doesn’t get better going forward. It gets worse.

As Ben Hunt says, “I think, as labour is calculated on national incomes and all this is corporate data, in other words the declining share of household income for labour is an effect of financialization, not a cause. If squeezing labour was a cause of profit margin growth, you would see increases in labour productivity. In fact, that’s why productivity number always spikes when recession hits, people get fired.”

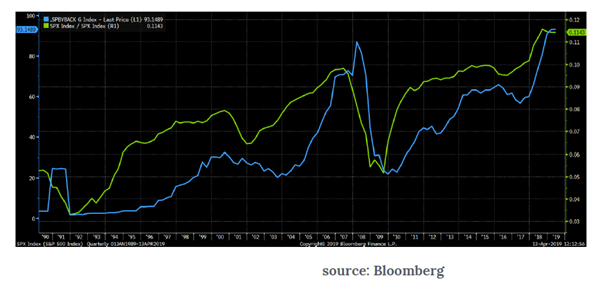

This is a chart of the S&P 500 price-to-earnings ratio in yellow and the price-to-sales ratio in blue.

When we grow profits through productivity growth – when our “supply” of earnings is directly connected to the operations that generate sales – P/E and P/Sales multiples go up and down together. When we extract excess earnings through financialization – when our “supply” of earnings increases for no operational reason connected with sales – the P/E multiple becomes depressed relative to the P/Sales multiple. How many times in the past ten years have you heard that the market is not expensive on a valuation basis? The market narrative of valuation is completely dominated by the vocabulary of earnings, not of sales. Sure, the S&P 500 P/Sales ratio is near an all-time high, but who cares about that? The S&P 500 P/E ratio today is right at 19, neither crazy low nor crazy high and we all care about that. But here’s the thing: Without financialization, my guess is that the S&P 500 P/E ratio today would be 28. Good luck selling that to a value investor, Wall Street.

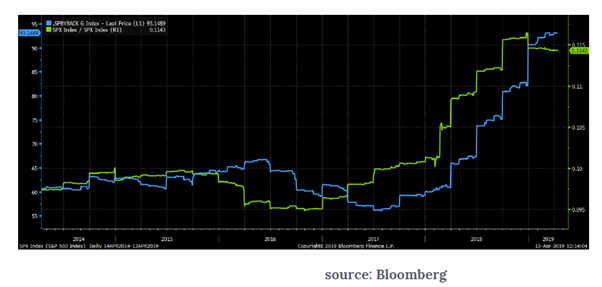

This is a chart of S&P 500 buybacks per share (in blue) imposed over the ratio of S&P 500 earnings-to-sales in green. You’ll see that share buybacks spike afterprofit margins spike. You’ll see that share buybacks spike before and during recessions. When do stock buybacks accelerate dramatically?

In 2006 and 2007, when management is rolling in record profits and profit margins, despite meagre productivity growth.

In 2018 and 2019, when management is rolling in record profits and profit margins, despite meagre productivity growth. This is not an accident. Here’s the past five years so you can see the temporal relationship more clearly.

Stock buybacks are what you do with the excess earnings you’ve made from financialization.

Why? Because stock buybacks are part and parcel of the financialization Zeitgeist. They’re part and parcel of the tax-advantaged issuance of stock to management, which is then converted into tax-advantaged income for management through stock buybacks.

What does Wall Street get out of financialization? A valuation story to sell.

What does management get out of financialization? Stock-based compensation.

What does the Fed get out of financialization? A (very) grateful Wall Street.

What does the White House get out of financialization? Re-election.

What do YOU get out of financialization?

You get to hold up a card that says “Yay, capitalism!”

(reference epsilon theory.. “this is water”)