Key highlights of the fortnight:

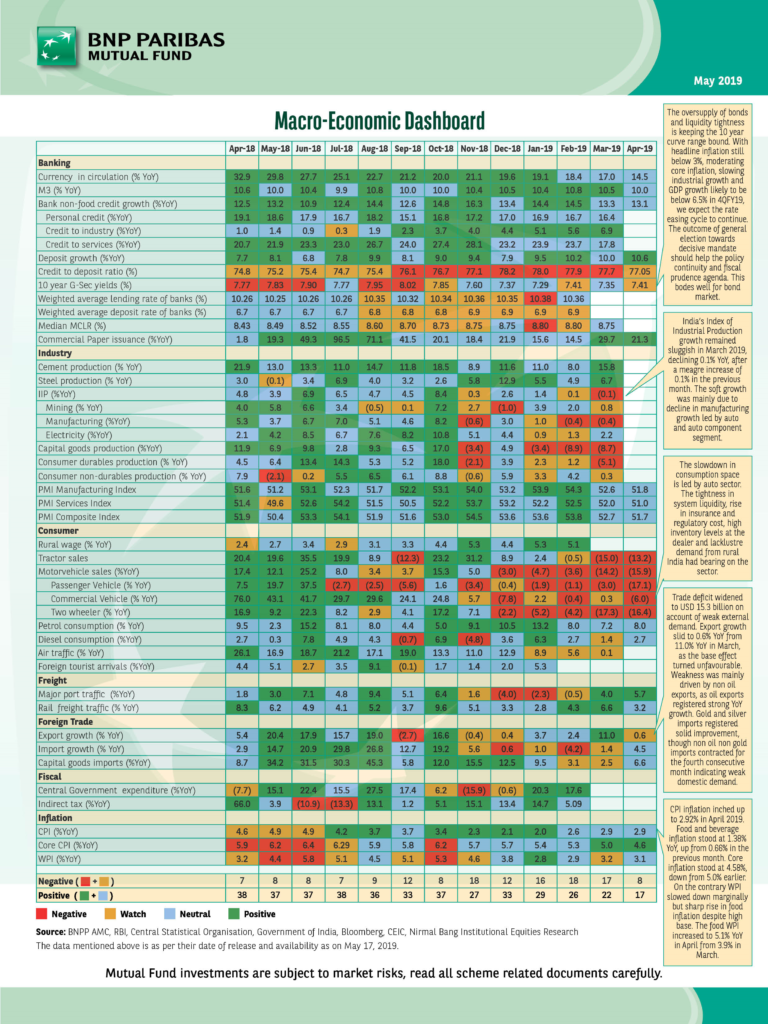

- The oversupply of bonds and liquidity tightness is keeping the 10 year G-sec curve range bound. With headline inflation still below 3%, moderating core inflation, slowing industrial growth and GDP growth likely to be below 6.5% in 4QFY19, we expect the rate easing cycle to continue.

- IIP growth remained sluggish in March 2019, declining 0.1% YoY, after a meagre increase of 0.1% in the previous month. The soft growth was mainly due to decline in manufacturing growth led by auto and auto component segment

- The slowdown in consumption space is led by auto sector which has now percolated down to staples. This is a worrying development

- Trade deficit widened to USD 15.3 billion on account of weak external demand. Export growth slid to 0.6% YoY from 11.0% YoY in March, as the base effect turned unfavourable. Weakness was mainly driven by non-oil exports, as oil exports registered strong YoY growth. Gold and silver imports registered solid improvement, though non-oil non gold imports contracted for the fourth consecutive month indicating weak domestic demand.

- CPI inflation inched up to 2.92% in April 2019. Food and beverage inflation stood at 1.38% YoY, up from 0.66% in the previous month. Core inflation stood at 4.58%, down from 5.0% earlier. On the contrary WPI slowed down marginally but sharp rise in food inflation despite high base. The food WPI increased to 5.1% YoY in April from 3.9% in March.