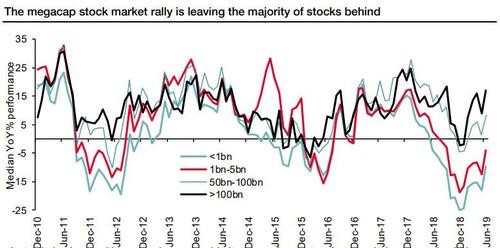

As trade wars threatened to derail global economic growth, major central banks suggested they were ready to provide support in the form of lower rates. Markets rallied early in June as the US Federal Reserve (Fed) President Jerome Powell, said he stood “ready to act” and the official Fed meeting later in the month showed he had plenty of support for that notion, with half of the Federal Open Market Committee (FOMC) members suggesting the most appropriate path forward was for lower US interest rates. Most equity markets closed higher in June, pushing them back into positive territory for 2Q19. Developed markets outperformed emerging markets for the fifth consecutive month. The chart below shows that Mega caps have been a key driver of global markets for the last few years

but, during June, US regulators announced a plan to investigate anti-competitive conduct among large tech companies . Most of this Mega Cap grouping saw their share prices fall by high-single-digits on the news. I think that we need to take this development seriously and believe that we might be ending years of outperformance by FAANG.

It was strange to hear Dovish central bank talk especially from US which is seeing all time high equity markets, loose financial conditions and low Unemployment. Mario Draghi continues to believe in the monetary stimulus as the panacea for stagnating European economy. US 10-year bond yields dropped further, briefly edging below 2% during the month, the first time 10-year rates have breached this level since before US President Donald Trump’s election in November 2016. Interest rate markets are now pricing in expectations for almost three US rate cuts by year-end.

Commodity markets generally were subdued, though falling interest rates helped drive the price of gold up 8% during the month (the highest level it has been since 2013) and agricultural commodities showing some signs of life. The US dollar was weaker against most currencies in June.

Market outlook

I believe that both Equities and Bonds markets globally are headed for a steep reversal but it will not happen unless one of the following conditions are met

- Rise in Junk bond spread

- Resurgence of Inflation

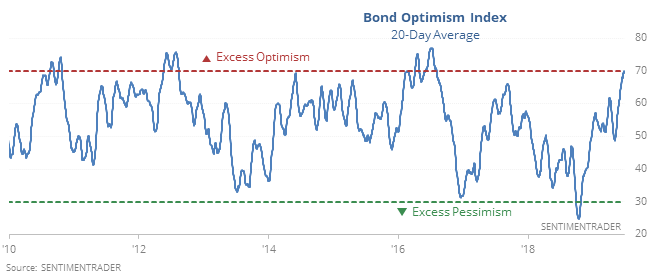

And if I were to pick one asset which is more overvalued between Equities and Bonds, then it is Bonds. USD 12 trillion of Global bonds are now negative yielding and the investor positioning is very optimistic. Infact the bond markets are so overstretched that a 1% rise on global bond yields could wipe out usd 2.4 trillion in market value (Barclays bond fund index).

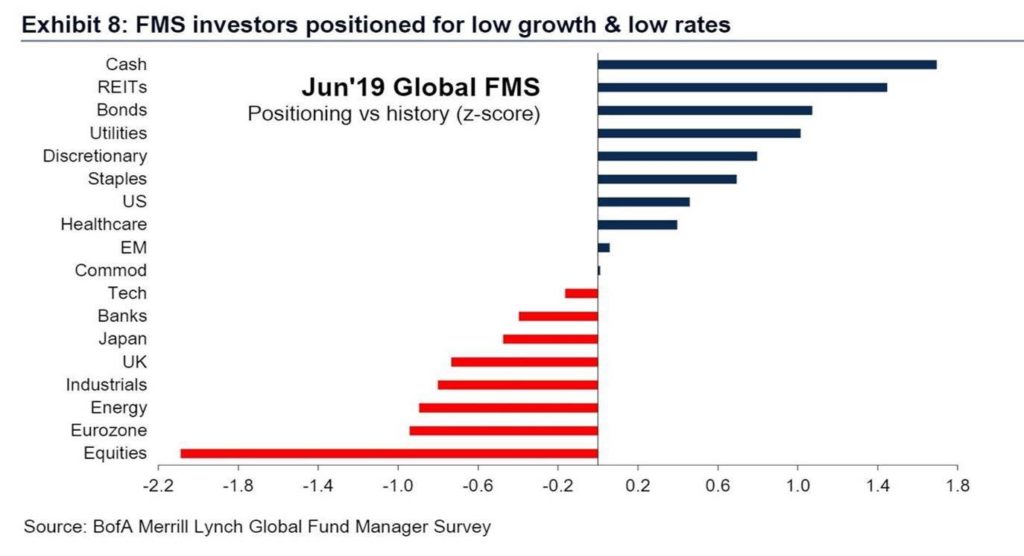

So, Bonds are the canary in the coal mine and I will watch out for volatility in bond markets rising due to any of the factors listed above. Although,We can easily see S&P rising above 3000 in short term as equity market is still defensively positioned as evidenced in this BOFA chart.

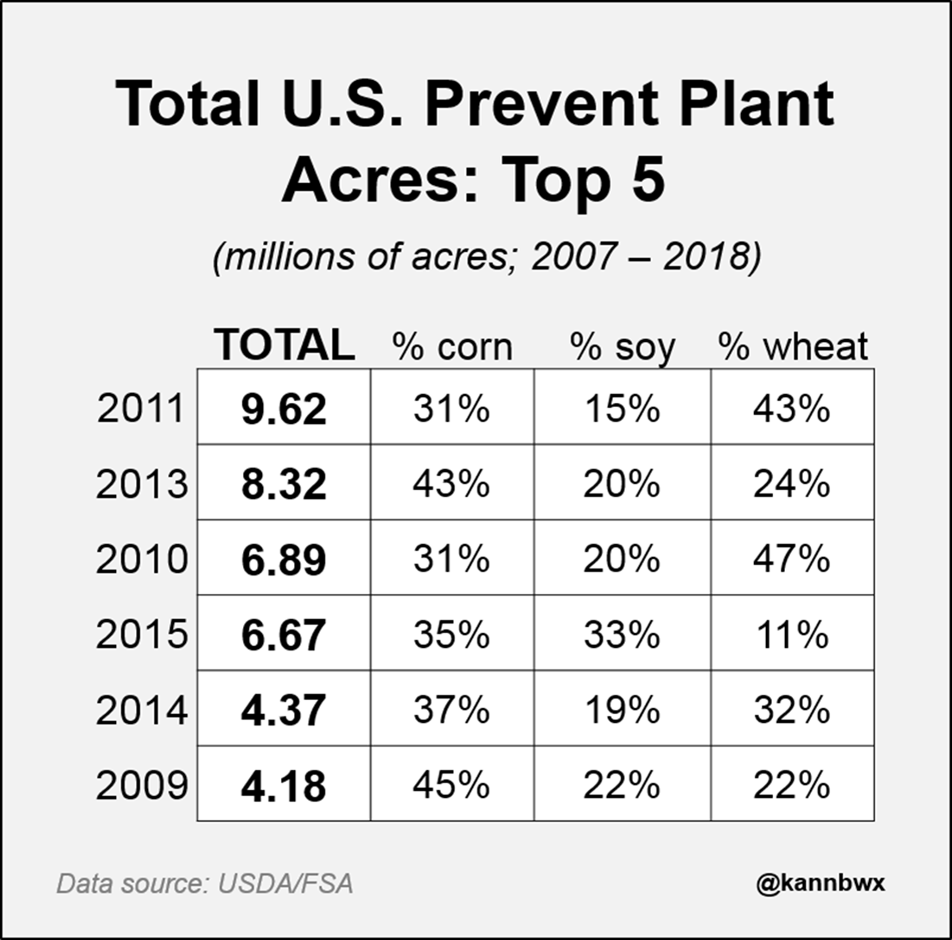

There is now more evidence that we are indeed headed for rise in soft commodities over next few months. Agri commodities have remained subdued for so long time that markets are taking their own time to price in the following planting data out of US and not to mention the continued crop infestation in china, Australia announcing the wheat import tender due to drought and the icing on the cake ” African swine flu” which is killing pig herds across China, Vietnam etc

Conclusion

We are in a feedback loop and with the way it has worked in positive way, it will also work in negative way and unfortunately till then both equities and Bonds are tied to the hip. In the very near term it is blue sky for both equities and fixed income possibly getting ready for another leg up with FED’s help. Beyond that, I think we are headed for STAGFLATIONARY scare over coming months as higher agri commodities prices and tariff increases starts passing through the supply chain. This will in turn create a negative feedback loop with Bond yields rising and then feeding through lower equity prices coupled with higher market volatility. In Nutshell

Euphoria followed by “Brace for Impact”