Anatole Kaletsky writes in “when the world goes to hell”

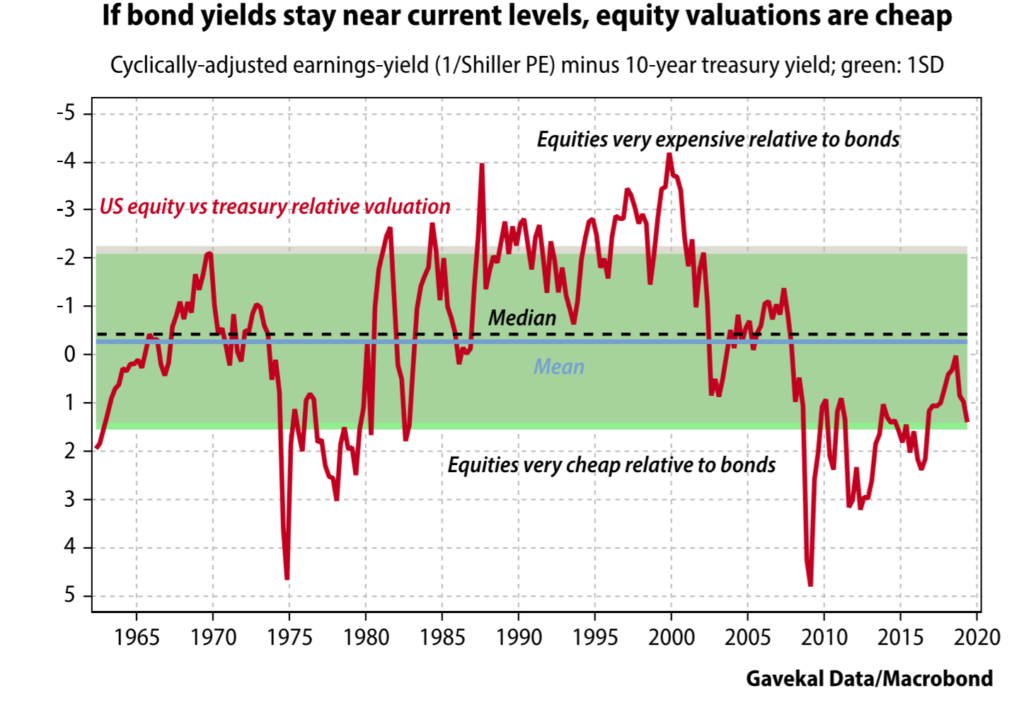

The most convincing reason, “why equity investors should disregard the bond market’s apparently bearish message. Let us suppose that that bond markets really do know more than equity investors or economic forecasters about the economic outlook and that yield curve inversion actually is a reliable indicator of recession. In that case, the Fed and other central banks around the world are certain to keep cutting interest rates, or if their rates are already zero or negative are certain to restart QE. And, even more importantly, both short-term and long-term interest rates are certain to remain near zero for the next ten years or more. In that case, even if the world does experience a recession, the discount rates applied by equity markets to cyclically-adjusted corporate profits, the cap rates assumed by property investors and hurdle rates used by business managements, are bound to keep falling and will eventually end up near zero. In other words, if bond markets are right in predicting a world in which interest rates will stay forever near zero, then US equities on a cyclically adjusted price-earnings ratio of 29—equivalent to an earnings yield of 3.4%—are still quite cheap.