By Neppolian

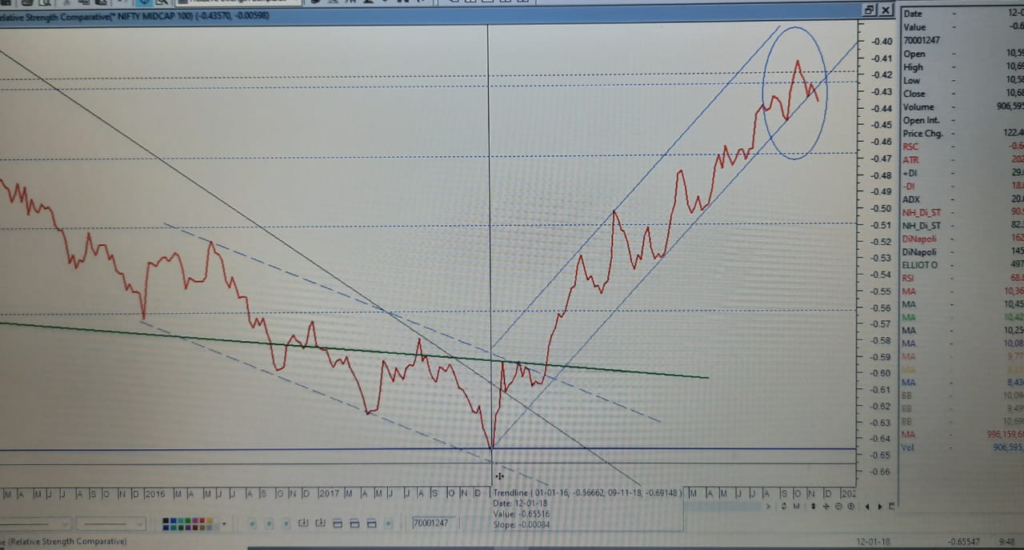

The ratio line of large cap (Nifty) versus midcaps (Nifty Midcap Index).

For the first time in almost two years, the ratio is shifting in favour of midcaps. Generally, such a shift would imply, emergence of risk on attitude, rally getting broadbased. The midcap underperformance may be ending too, leading to stock specific activity from the mid cap side of the market.

Historically, a late surge in midcaps is also indicative of the final move in the preexisting general bullish trend.

The chart presented above is a weekly…hence request to review it by the end of this week.

My View

I wrote in this month market review http://worldoutofwhack.com/2019/11/04/global-market-commentary-and-outlook/

why I changed my dollar index view from positive to negative and falling dollar is generally associated with rising Emerging Markets and precious metals. It is possible that we see action in beaten down mid and small cap index vs the large cap index