Excerpt from IMF report

Highlights:

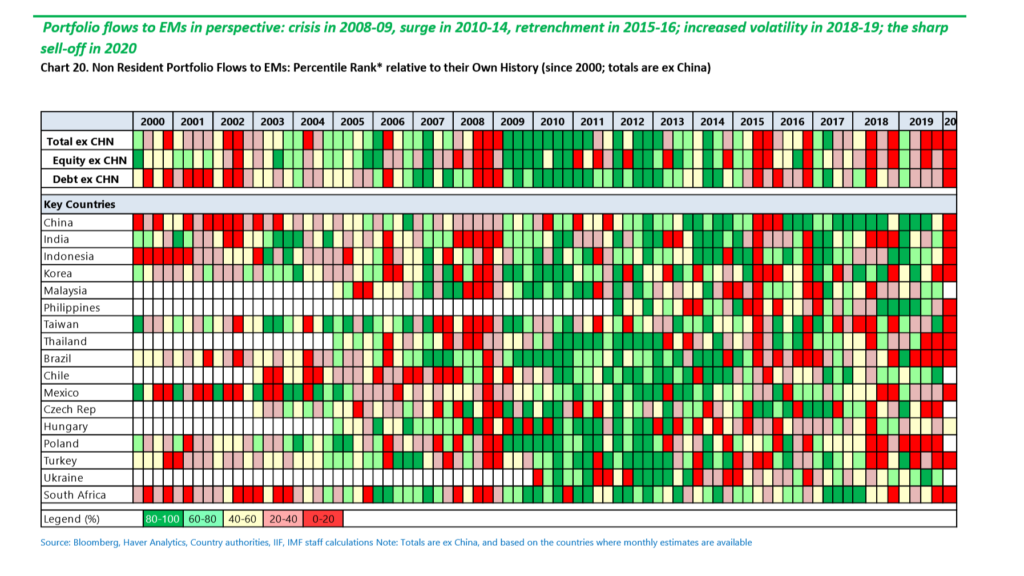

• Emerging markets (EMs) have experienced unprecedented portfolio outflows in Q1:2020. The COVID-19 pandemic, the oil price collapse and a sharp deterioration of the economic outlook have fueled a precipitous pullback of nonresident portfolio flows. EMs have seen $96bn of outflows since 21st Jan, equivalent to 0.4% GDP of EMs, making this sell-off episode the largest reversal since the GFC . The speed of reversal is also particularly notable, posing challenges for countries with large external financing needs. Outflows have been initially concentrated in Asian equities but have since accelerated across most countries and extended to bond funds (hard currency funds in particular), making this episode the most broad-based since GFC . Within different investor categories, available data indicates that retail-oriented funds have faced large outflows .

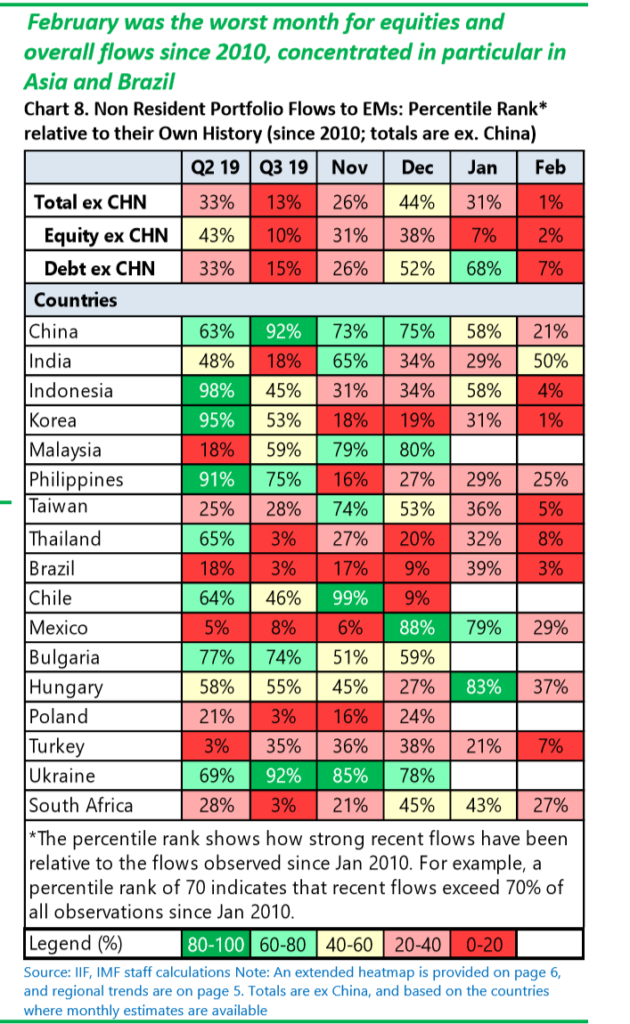

• Within the EM bond funds, active funds have experienced most of the outflows ($38bn in March), while passive funds have seen more modest pressures so far ($10bn). The recent pickup in outflows from passive funds may also reflect the action by benchmark-driven investors (BDI) due to a series of sovereign rating downgrades by global agencies in March. In particular, South Africa has been downgraded to junk status by Moody’s. Analysts expect BDI-driven outflows to range between $3-5bn, noting that the economy has already seen $3bn debt outflows year to date, on top of $6.2bn in the last two years. Mexico has been downgraded to BBB rating by S&P. Analysts are now focused on Moody’s rating (currently at A3 with a negative outlook) and the potential for Pemex to become a sub-investment-grade credit. As discussed in the GFSR, BDIs have grown significantly in last few years and are increasingly more sensitive to external shocks. Portfolio flows, which had been highly volatile in 2019 due to trade-related uncertainties, had started to recover late last year through January for most countries, before coming to a sudden stop in February – making it the worst month since 2010.

• Looking at the broader EM capital flows (ex. China), the latest available balance-of-payments data show a decline in both inward and outward FDI and bank flows in the second half of 2019 (Charts 9 and 10). FDI to EMs (ex China) moderated to about 2 percent of GDP in Q4, from about 2.3 percent in the four preceding quarters and 2.5 percent in the last 10 years – reflecting EM growth downgrades and business uncertainty. The aggregate current account surplus of EMs (ex. China) has eroded over the last three quarters, though net capital flows have been supported by a steady decline in resident outflows . Reserve accumulation trends have diverged across economies, with Latam countries coming under pressure (Brazil and Colombia continued to intervene through March), while India and Russia built up reserves through 2019 .

• Net capital flows to China had started on a strong note in 2019 but have moderated over the last few quarters. The flows have been driven by a sharp rise in resident outward investment in the second half of 2019. Non-resident portfolio flows have been relatively stable, with inflows associated with China’s inclusion in global benchmark indices (IMF blog) partly offset by outflows related to trade uncertainty and EM-wide pressures . PBOC has shifted from buying reserves in Q1 to selling reserves through 2019.