India is the first country among major economies where Bond market vigilantes are rising from ashes

Indian govt announced the budget this Monday and the following headlines from Bloomberg is the only one you need to read to visualize the size of budget and extent of market borrowings

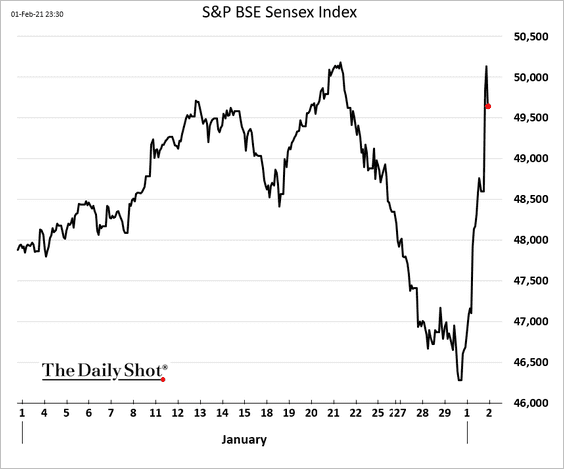

as a result the following reaction from SENSEX was a foregone conclusion

but not so fast

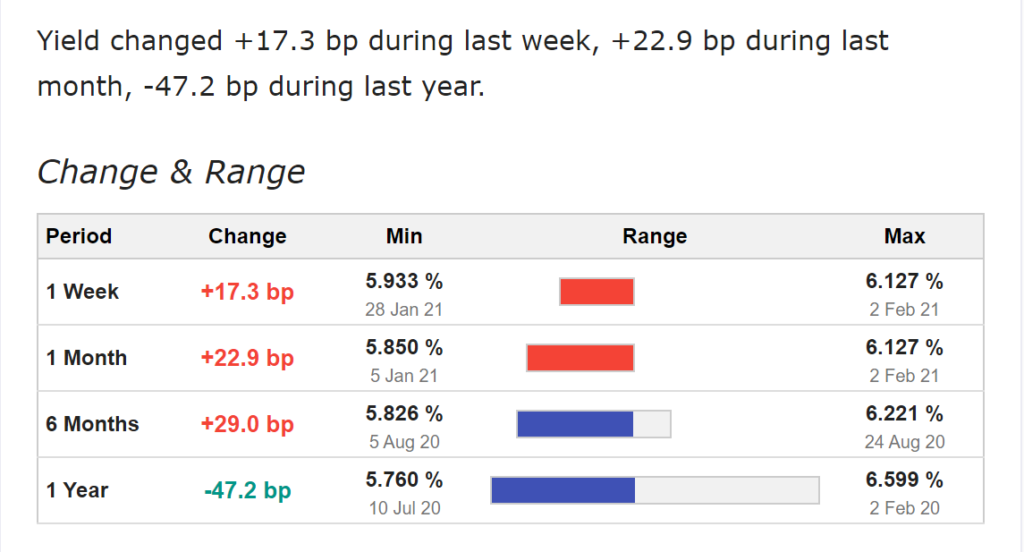

Indian bonds sold off hard with bond market not at all liking the extent of spending and revolting by raising the borrowing cost for govt.

I have often commented in past that till the time bond market oblige… equity markets get a free pass.

Another 30-40 BP increase in Indian 10 year bond yield will start to weigh heavily on equity valuations.

Bond market has spoken, either monetize the deficit and put a lid on bond yields which should be massively bullish for real and financial assets in the short run at the cost of longer run inflation

or

watch rising yields jeopardize government borrowing plans by raising the yields and in turn slowing down the economic momentum even before govt get a chance to kickstart their spending program.

Equity Market will just be the collateral damage