Author: Ritesh Jain

Hindesight India Newsletter

India is a Premature Superpower

The Disruption of the Banking sector has already begun

Alex writes…..In the UK, relaxation of rules around banking licensing has seen a flurry of challenger banks spring up, mostly targeting retail banking. These ‘neobanks’ are mostly app-only banks–branchless, digital propositions that offer banking services at far lower costs than your typical bank. Many boast slick apps, allow freezing and unfreezing of cards at the touch of a button and can analyze customer spending in real-time and send budgeting nudges.

The banks are run solely through a smartphone or tablet with no physical branches. Partner firms plug into the apps thus creating a marketplace of services that range from investments and loans to energy and insurance.

And they are thriving, too. Founded five years ago, Britain’s Revolut has amassed nearly two million customers and was recently valued at $1.7 billion during its third round of funding thus making it the first ever digital-only bank to attain unicorn status. That’s nearly half as many accounts as those held by the country’s much bigger TSB Bank Plc.It is also the only British digital bank to operate across Europe so far. Strong growth in countries like France, Germany and Switzerland and the Nordic region helped drive its user base up by 50 percent in the last two months. Expansion plans are also underway in India, Brazil, South Africa and the UAE.

Fintechs tend to thrive in regions with large unbanked populations such as China. For instance in China, Alipay, mobile banking services provider and subsidiary of Alibaba’s Ant Financial, has grown so big that last year it handled more than $8 trillion in transactions–more than MasterCard’s and twice Germany’s GDP. PayTM from India which has just received funding from Warren Buffett is not only disrupting the payment business but getting into direct selling of mutual fund business . The app might also become a major player in the lucrative money market fund (MMF) business like Alipay which commands a bigger share than the country’s leading banks.

Most banks still have high cost structure related to employees and branches inspite of adopting technology.

I think this displacement will accelerate and the day is not far when we will call our banks,

New Technology companies

https://safehaven.com/tech/tech-news/The-Disruption-Of-The-Banking-Sector-Has-Already-Begun.html

Precious Metals and Treasuries getting ripe for a rally

The world’s most feared investor

Paul Singer, the head of hedge fund Elliott Management, has developed a uniquely adversarial, and immensely profitable, way of doing business. He has been called “aggressive, tenacious and litigious to a fault,” and named “The World’s Most Feared Investor.” This is a comprehensive look at what happens when this ruthless activist investor begins to sniff around your company. It’s not so pretty.

“What I came to feel relatively early on in my career is that manual effort was actually not only a driver of value and profitability but an important way to control risk, dig yourself out of holes when you slip into a ravine.”

Developed Economies just doing fine and this is bad news for EM

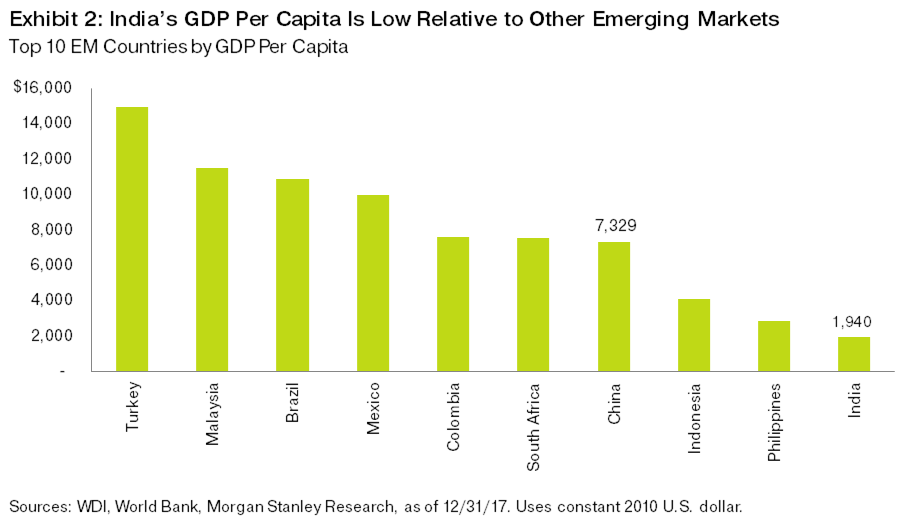

The trend toward emerging markets accounting for a larger share of the global economy has abated.

Last year, excluding China, emerging and developing economies accounted for just 24.6 percent of global output, down from a peak of 26.7 percent in 2013. That helps explain why the Turkey crisis that has roiled emerging markets, has left growth trajectories in developed economies largely unchanged so far, according to Bloomberg Economics.

why we should be more worried about China

Chart of the Day

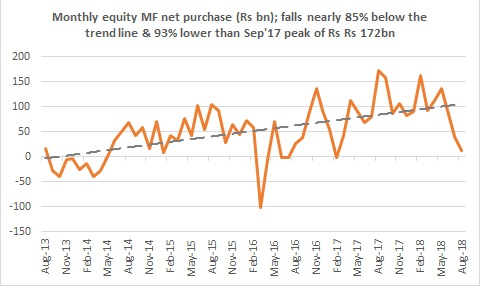

There is just too much excitement about growth of AUM in mutual fund industry and the rosy picture painted about future by extrapolating the data. But as Dhanjay at EMKAY writes and I had written few days back http://worldoutofwhack.com/2018/07/07/interest-in-mutual-fund-declines-to-one-year-low/ Indications from the industries suggest that the flush of money post the demon and GST dislocations, has already reversed…here is an interesting chart (via emkay)

The net purchases of mutual funds into the equity markets has declined to a monthly run rate of Rs 13bn in Aug’18 ( the daily data for aug is extrapolated to get the figures for aug) and actual Rs 40bn in Jul’18. The latest number is

~85% below liner trend since 2013 and 93% lower than the peak of Rs 172bn in Aug’17,nearly a year back. With this the monthly purchases are at pre-demon levels.

…and with this ,also goes a major support for market.

Week in Review

Summary

Wall Street Week…

S&P 500: All-Time High, Nasdaq: All-Time High, Mid Cap 400: All-Time High, Russell 2000: All-Time High

US Vix below 12, barely

US 3 month TBILL yield at 2.09% …. a 10 year high

Most global equity markets higher led by Asia.

Indian Markets all time high in local currency term (in dollar iShares MSCI INDIA is down -1.6% YTD)

Brazil 10-year yield blows out 21 bps and currency flop 5 percent on political concerns.(is this the next turkey)

Argentina peso weakening again but South Africa a bit stronger in sympathy with temporary rebound in Turkish lira, due primarily to closed markets

Nice bounce in metals

Gold up 1.8 percent on the week

Dollar chart looks weak after the blow off gravestone Doji candlestick on August 15, which took the index to 96.984. Nevertheless, 94to hold and the Dixie to trade in a 94-97 range unless U.S. politics gets real UGLY. Not unrealistic, by the way.

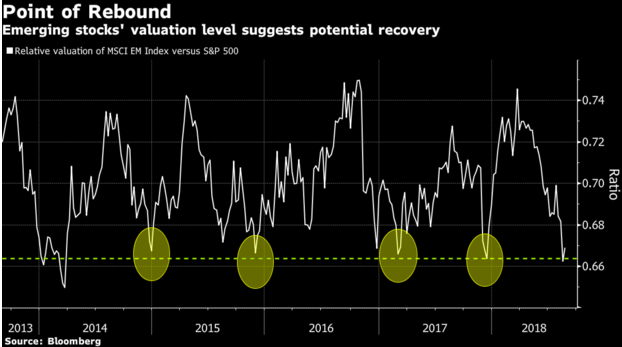

Everyone is looking to buy the emerging market sell-off . EM is oversold and ripe for a decent technical bounce. A fundamental buy is a long way off, however, and the probability a major market disruption is higher than being discounted. The Fed is still tightening the tap on global liquidity.