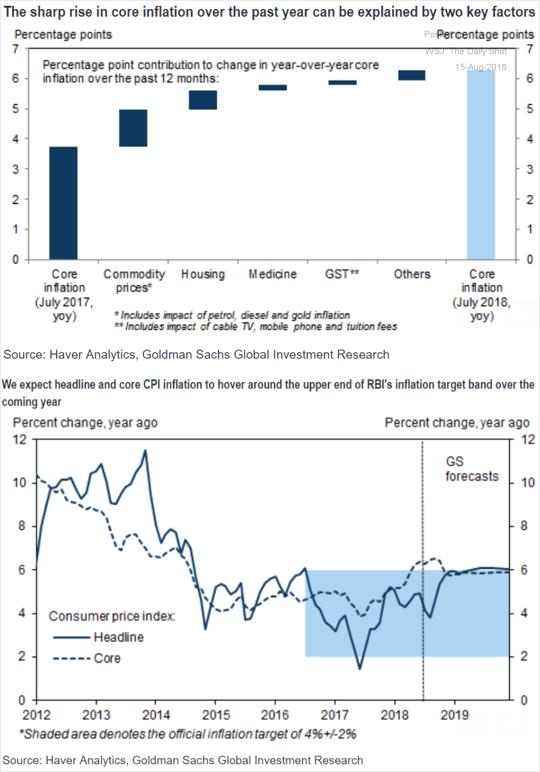

India’s falling household savings rate – a trend accentuated first by demonetisation in November 2016 and then again by shoddy implementation of Goods and Services Tax (GST) last July – could hurt the growth prospects of the economy and also trigger macroeconomic instability if not reversed soon, according to economists.

The country’s falling savings rate confirms the widespread fear that a majority of households are in crisis post-demonetisation, said Arun Kumar, Malcolm S. Adiseshiah Chair Professor, Institute of Social Sciences.

Household saving rates has fallen from 23.6% of GDP in 2011-12 to 16.3% in 2016-17, according to the RBI.Since the household sector is the largest contributor to savings, the overall savings rate declined to about 30% in 2016-17, after staying well above 32% for many years. In 2011-12, the rate was a robust 34.6%.This decline was, in part, due to the shocks from note-ban and GST implementation, according to a recent report by India Ratings and Research.

Household sector was the largest contributor to gross capital formation till 2013-14. Since then private corporations have emerged as the largest contributor.Following demonetisation, household investment shifted from real estate to mutual funds

Is GDP really growing at a robust pace?

Prof Kumar who has an authority on Black Economy in India,also trashed the government’s claim that the economy is growing at a robust pace of over 7%. He expressed fear that the unorganised sector, which contributes as much as 45% of the GDP, has seen a sharp output decline in the wake of demonetisation unlike the organised sector, which continues to grow at a decent pace.“Even if we assume a modest production decline of 10% in the unorganised sector, the GDP growth comes below 1% from 7%,” Kumar said.Production data from the unorganised sector post demonetisation is currently not available.

In absence of data, the government is assuming that the unorganised sector is growing at the same as the organised sector, which may not be true, he said.

The investment rate has also fallen from 38% in 2007-08 to 31% in 2017-18. The economic growth is being driven by the sole engine of consumption which is quite evident from the lending pattern of banks and finance companies.

https://thewire.in/economy/demonetisation-bad-gst-implementation-hurt-indias-household-savings-rate